Don't you just love oil trading?

Don't you just love oil trading?

After making $4,000 in less than a day on our Live Trading Webinar Idea on Wednesday (replay available here) we took advantage of the last day's trading the November contracts over at the NYMEX to short Oil Futures (/CL) one final time. As I said to our readers in yesterday's morning post:

Today is rollover day to the December contracts so anything can happen though, of course, we'll short below $51 or $51.50 if we get there on a bounce, using those lines as stops and, of course, we still have our longer-term Oil ETF (USO) puts. We can only hope that, by making contract spoofing more expensive for the pumpers, we can do just a little to curb the practice at the NYMEX – God only knows the GOP Congress has done nothing to stop this madness, which robs Americans of Billions of Dollars at the pumps each year.

Remember, I can only tell you what is going to happen in the markets and how to make money by trading it – the rest is up to you!

Another trade we left up to you was our call to short the S&P (also from our Webinar) Futures (/ES) at 2,140 and those gives us a nice ride down to 2,130, which was also good for $500 per contract and that's nice money to take home into the weekend so we're not being greedy if it stops us out (over our weak bounce line at 2,134 – also see yesterday's post), though we will short oil again as it struggles to take back $51 this morning though, now we're early in the December contract cycle, so there's less downward pressure, so it's a much riskier bet (so very tight stops above).

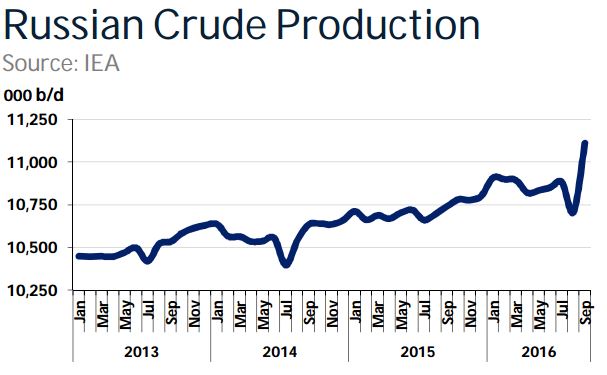

Also, in favor of the oil bull, OPEC is having another meeting this weekend (as noted in our Webinar, they are now having streams of meetings to talk up the price of oil) and Now Russia's Oil Minister is saying that, with Russian output now over 11Mb/d (a post-Soviet record), they are still willing to discuss production cutbacks. As with all the OPEC nations – Russia is producing oil full-tilt now so they can cut back to a sustainable amount later – smart!

Also, in favor of the oil bull, OPEC is having another meeting this weekend (as noted in our Webinar, they are now having streams of meetings to talk up the price of oil) and Now Russia's Oil Minister is saying that, with Russian output now over 11Mb/d (a post-Soviet record), they are still willing to discuss production cutbacks. As with all the OPEC nations – Russia is producing oil full-tilt now so they can cut back to a sustainable amount later – smart!

"The near term fundamentals in the oil market have turned positive. Demand is stabilizing, OPEC production has peaked (and will fall if cuts are implemented), and global inventory declines imply that the market is more balanced than many believe," Bernstein analyst Neil Beveridge says.

And no, this does not make my case for low oil prices and we only expected a dip into early November and THEN we plan to be BULLISH on oil into Thanksgiving with a target of $55-60 by July. So when we're talking about taking the quick short money and running – we mean it! Obviously, there will be no actual deal this weekend and, until they REALLY have an agreement and until they REALLY start cutting back production – the glut continues.

And no, this does not make my case for low oil prices and we only expected a dip into early November and THEN we plan to be BULLISH on oil into Thanksgiving with a target of $55-60 by July. So when we're talking about taking the quick short money and running – we mean it! Obviously, there will be no actual deal this weekend and, until they REALLY have an agreement and until they REALLY start cutting back production – the glut continues.

Because, really, what is OPEC's plan? To cut 1Mb/d in supply? We have 147M more barrels of oil in storage than we had 2 years ago so it would take 6 months of these cuts just to get the US supply down to a "normal" level – and that's assuming no one outside of OPEC decides to produce a little more as prices rise (and assumes OPEC members don't cheat). And the US isn't the only country with a storage glut.

In reality, OPEC is a non-factor for the US oil market anyway. Yes, they supply 31Mb to the World but, to America, they supply just over 2Mbd so even a 10% production cut (they are proposing 3%) would just be a rounding error in our weekly inventories.

In reality, OPEC is a non-factor for the US oil market anyway. Yes, they supply 31Mb to the World but, to America, they supply just over 2Mbd so even a 10% production cut (they are proposing 3%) would just be a rounding error in our weekly inventories.

So why then, does the price of oil in the US fly up and down whenever there's a rumor of on OPEC production cut? MANIPULATION – plain and simple. OPEC noise gives the manipulators cover so, if an investigation ever does occur (good luck!), they will be able to say they were legitimately hedging based on news at the time – even if the news is meaningless. Sadly, they can't regulate how dumb your trading is and regulations don't assume that you WANT to lose money trading – which is what oil pumpers do, losing millions so that their masters, who sell you the oil at the pump, to heat your home and elsewhere, can make Billions.

It's criminal, it's organized, it's a racket – it's racketeering! Racketeering is the act of offering a dishonest service (fake NYMEX trading) to solve a problem (fluctuating oil prices) that would not otherwise exist if it wasn't for the actions of the racketeer (traders). The problem is that there is SOME legitimate trading and SOME legitimate price fluctuations but, when 96% of the orders are FAKE – I think it makes a pretty good case to call the Untouchables.

Pulling back to the macro scene, earnings have been mixed so far but it's early innings in late October (yet still the World Series hasn't started yet?) so we'll have to wait for more data there but, while we're waiting, the economic data we're getting from other countries is not so hot. In fact, just this morning, Canada (who IS our biggest oil supplier) had a rising CPI (1.3) and falling retail sales (-0.1%). When I say "STAG" you say "FLATION": STAG – FLATION, STAG – FLATION, STAG – FLATION!!!! Look it up folks, it's the biggest trend – and it's not good!

Gluskin Sheff's David Rosenberg thinks that with monetary options exhausted it will take a fiscal boost in the Trillions of Dollars to kickstart the economy. These issues were discussed in an extended interview with Real Vision TV, where the chief economist and strategist at Gluskin Sheff proposed some radical policies to engineer the growth needed in nominal income.

His ideas, some of which can be seen here in a clip of the interview, include helicopter money attached to a $2 trillion perpetual bond, massive infrastructure spending and measures to tackle the $1 trillion student debt load that has seriously hamstrung the economy. Sounds like he's a Bernie supporter!

Even as I write this, the sell-off in the market continues – we'll see what sticks into the weekend.

Have a good one,

– Phil