Down 30% in a day?

Down 30% in a day?

That's right, Fitbit (FIT) just fell from $12 to $9, dropping $1Bn in market cap overnight as they missed revenues ($503.8M) by $3.13M (0.6%%) and guide their Q4 projections 25% lower than expectations. This isn't about FIT in particular, they are just the most recent disappointment this earnings season – this is about how a well-followed company, with 21 analysts on their case, who had an AVERAGE price target of $20.88, can fall from $30 to below $10 (66.6%) in a single year.

This is more an indictment of a market that is unrealistically priced than it is of just FIT. I keep telling our Members not to mess around with companies that have dot-com level valuations of 100x or more of their earnings and FIT isn't even one of those, they will probably end up earning just under 0.80 for each of those now $9 shares – the reaction is simply an indication of how hollow the support is for any of these stocks – now that the smart money base has been removed – leaving only the sheeple and their tendency to stampede in overvalued positions that will SHOCK them at earnings.

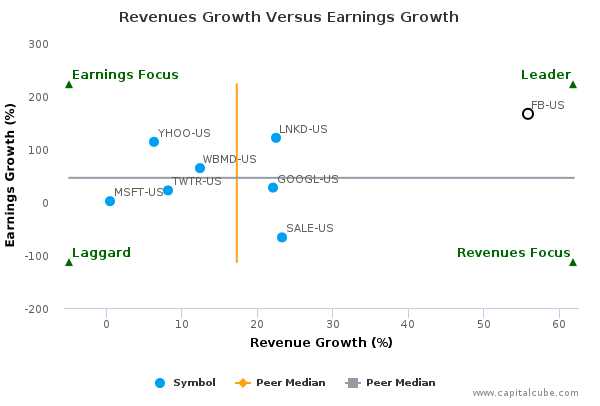

FIT's particular miss is due to a manufacturing issue that is already being fixed, the reaction is an over-reaction but only NOW, -66.6% after the year started, is FIT trading at a realistic price. Facebook (FB) is down nearly 5% at the open, despite putting up $7Bn in Revenues, which is up 55% from last year and $2.4Bn in Earnings, which is up 166% from last year. On the bottom line, FB made 0.82 per $127 share ($121 now) so call it about $4 for the year and that's a p/e in the 30s which is RIDICULUS – even with that kind of growth.

FIT's particular miss is due to a manufacturing issue that is already being fixed, the reaction is an over-reaction but only NOW, -66.6% after the year started, is FIT trading at a realistic price. Facebook (FB) is down nearly 5% at the open, despite putting up $7Bn in Revenues, which is up 55% from last year and $2.4Bn in Earnings, which is up 166% from last year. On the bottom line, FB made 0.82 per $127 share ($121 now) so call it about $4 for the year and that's a p/e in the 30s which is RIDICULUS – even with that kind of growth.

This is exactly what happens when you reach the top of a rally and you have consistently refused to invest in fundamentally secure companies (ones that return at least 5% of your investment annually) – unless they are growing at incredible rates, the slightest misstep can spook your fellow investors because the value investors (smart money) have long ago pulled their support and it's just you dreamers propping up the prices – until someone finally wakes up.

Knowing that things are way overvalued, we emphasized an Ultra-Short Nasdaq ETF (SQQQ) hedge in yesterday's Live Trading Webinar (replay available here). We also have a nice winner having gone long on Gasoline Futures (/RB) at $1.45 and it's already over $146 this morning and we're up $500 per contract. The long trade idea we gave you for Natural Gas (/NG) in yesterday's morning post gave us a quick $500 per contract gain at $2.85 and we're back below $2.80 again and we'll like it long again when it crosses over.

See, we don't mind making money on the same thing over and over again!

By the way, the Cubs won the World Series last night – it's certainly a sign of the Apocalypse. In 1907, the year before the Cubs last won, the market had a terrible crash! On the bright side, it was the year the Wright Brothers invented the airplane too and the first Model T rolled off the assembly line that same month.

Overall, our indexes are still flashing danger signs but we're not likely to move much until tomorrow's Non-Farm Payroll Report (8:30). The Bank of England sent a signal there will be no more rate cuts this year as they are becoming concerned about the inflation everyone but the Fed seems to think is obvious. This move will strengthen the Pound and keep the Dollar near the 97 line pending word from the ECB, who don't meet again until Dec 8th.

Overall, our indexes are still flashing danger signs but we're not likely to move much until tomorrow's Non-Farm Payroll Report (8:30). The Bank of England sent a signal there will be no more rate cuts this year as they are becoming concerned about the inflation everyone but the Fed seems to think is obvious. This move will strengthen the Pound and keep the Dollar near the 97 line pending word from the ECB, who don't meet again until Dec 8th.

I still love CASH!!! ahead of next Tuesday's election but it is CRAZY not to also have hedges against your long positions in this very volatile market. We should have a small bounce as the S&P has fallen 2.5% in the last 7 sessions (all down – the most in a row since 2011) and anything lower than this (2,100) is DOOM!!! A weak bounce would be a 0.5% gain (about 10 points) and a strong bounce would be a 1% gain (21 points) – anything less than that by tomorrow is going to be very scary into the weekend.

We're still expecting at least a 5% correction and we're halfway there but could easily be 10% and much more than that if Tuesday's results are also an upset!

Speaking of a divided nation, the Consumer Comfort Index hit 44.6 this week, up from 43.9 but, interestingly, Democrats are at 53.1 and Republicans are at 39. Make of that what you will – I have to pretend politics don't affect the economy and have no predictive factor towards the markets in order to get published on certain web sites – only our Members get my actual opinion and predictions based on ALL the facts – you can join them here.