Another day another $15,000.

Another day another $15,000.

That's right, yesterday's long play on Gasoline Futures (/RB) that were already up $15,000 from Monday's call, gained another $15,000 yesterday. Not bad for two day's work, right? We only made $10,000 more though as we cut back to 6 contracts at $1.32 – as we didn't want to be too greedy but, as you can see on the chart – they kept on going higher and higher – all the way to $1.34 before finally pulling back.

NOW you missed it – I can't heartily recommend this as a new trade the way I did yesterday and Monday but we do have a Live Trading Webinar today at 1pm (EST) and I'm sure we'll find something fun to trade there. Another good call from Monday's post was Barrick Gold (ABX), which blasted higer yesterday as George Soros followed us in, buying 1.8M shares, about 1.5% of the company. Monday's Oil (USO) trade idea is also blasting higher, made even more significant as it's doing so against a strong Dollar.

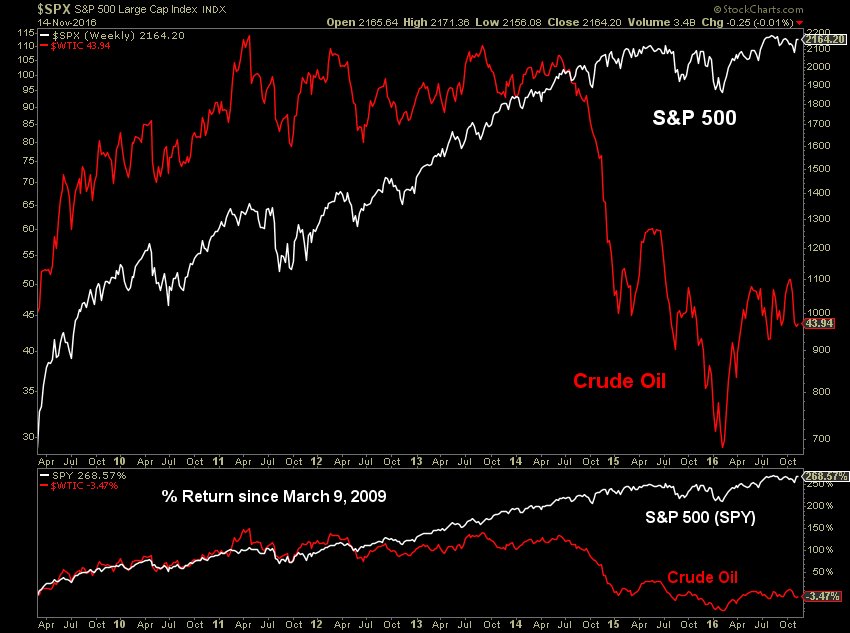

Oil led the rally yesterday and the S&P seems to have lost its oil dependence way back in May though a bad inventory report today is likely to spark a sell-off that will pull the index down from the 2,180 line and the /ES Futures are testing our shorting line at 2,170 (short below, tight stops above) along with Dow (/YM) 18,900, Nasdaq (/NQ) 4,760, Russell (/TF) 1,295 (raised from Monday's 1,290) and especially the Nikkei (/NKD), now 17,900 and a really fun short (and see Monday for our Nikkei Index (EWJ) play.

Oil led the rally yesterday and the S&P seems to have lost its oil dependence way back in May though a bad inventory report today is likely to spark a sell-off that will pull the index down from the 2,180 line and the /ES Futures are testing our shorting line at 2,170 (short below, tight stops above) along with Dow (/YM) 18,900, Nasdaq (/NQ) 4,760, Russell (/TF) 1,295 (raised from Monday's 1,290) and especially the Nikkei (/NKD), now 17,900 and a really fun short (and see Monday for our Nikkei Index (EWJ) play.

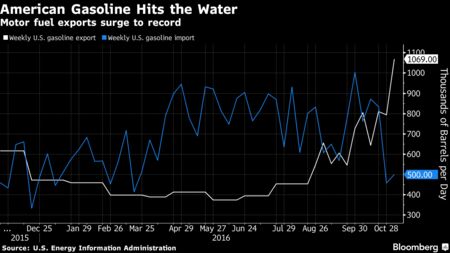

Today's EIA inventory report at 10:30 is going to be critical and we are still long 6 contracts in the Futures (see above) but expecting a possible pullback. Waterborne gasoline exports surged after Colonial Pipeline Co., the main system that moves Gulf Coast gasoline to the Eastern Seaboard, shut for six days following an Oct 31 explosion. The outage backed up almost 8Mb of gasoline that would normally flow to states in the Southeast and along the Atlantic coast.

U.S. gasoline exports reached 1.07Mb/d in the week ended Nov 4, the first time the figure has topped 1Mb/d in U.S. Energy Information Administration data going back to 2010. ClipperData LLC, which tracks crude and products globally, also counted exports above 1Mb/d after the Colonial blast. We don't know which way the inventories will net out – which is why we cut back a bit on our longs but we still feel the upcoming holiday will give us a lift towards $1.45.

U.S. gasoline exports reached 1.07Mb/d in the week ended Nov 4, the first time the figure has topped 1Mb/d in U.S. Energy Information Administration data going back to 2010. ClipperData LLC, which tracks crude and products globally, also counted exports above 1Mb/d after the Colonial blast. We don't know which way the inventories will net out – which is why we cut back a bit on our longs but we still feel the upcoming holiday will give us a lift towards $1.45.

Meanwhile, our economy is still in the grips of stagflation with today's PPI report at 0, vs 0.3% expected by leading economorons, who clearly do not live on this planet (wise choice, given recent election results) and core PPI was DOWN 0.2% vs up 0.2% so that's what, a 200% miss? Yet still the Fed will use their predictions to determine their outlook on the economy because who blindly trusts the work of inept academics more than other inept academics?

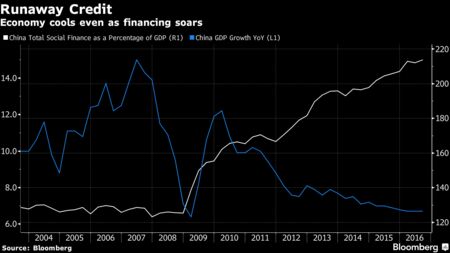

This is not something Japan wants to hear but it is something we want to hear as we've made short bets on Japan (again, back to Monday). China is no picnic either with their banks' loan to deposit ratios now topping 80% indicating China’s entire deposit base is used up and any loss of confidence from savers can severely destabilize the banking system.

Even more so than the US, China has been running a debt-fueled economy with a 100% increase in debt since the 2009 crisis meaning that, in the past 7 years, 15% of the 7% growth has come from debt financing. Yes, that's not a typo, China is borrowing $2 for every $1 of GDP growth – how long can this really last?

Even more so than the US, China has been running a debt-fueled economy with a 100% increase in debt since the 2009 crisis meaning that, in the past 7 years, 15% of the 7% growth has come from debt financing. Yes, that's not a typo, China is borrowing $2 for every $1 of GDP growth – how long can this really last?

China, meanwhile has fixed they Yuan rate at 6.85 to the Dollar, the lowest it's ever been, which is an interesting move since someone (we can't talk about political stuff so let's pretend it was Winnie the Pooh) called China a currency manipulator and if that bear ever gets his hands on some honey – it could become a very stick situation when all the forest creatures convene in January. Hey, don't knock the allegory – it really fits – it even comes with a manically depressed donkey who thinks everything sucks now!

What does suck (and I talked about this on Monday's Nasdaq Show) is the very scary lack of breadth to this rally. As we noted yesterday, the S&P volume is dropping and in all the indexes – it's a very small band of stocks taking the indexes higher (dressing the windows) while the smart money if running for the exits in fear that the big orange pooh bear is going to screw everything up.

Sadly for Pooh and all his followers, their home is being deforested and global warming is making all of the enchanted woods uninhabitable. 2016 is going to end up being the hottest year on record, beating the record that was set in 2014 which was broken in 2015 and now 16 and so on and so on until we are all dead. According to the World Meteorological Organization:

“In parts of Arctic Russia, temperatures were 6°C to 7°C above the long-term average. Many other Arctic and sub-Arctic regions in Russia, Alaska and northwest Canada were at least 3°C above average. We are used to measuring temperature records in fractions of a degree, and so this is different.”

Fortunately, Myron Ebell is heading up the EPA and he is going to stop this potentially species-ending catastrophe by letting everyone know that Global Warming is a hoax and he leads President Pooh's anti-science team, whose goal it is to dismantle the EPA and let the free market decide if we need clean air or safe drinking water – or a habitable planet. Paying for these "luxuries" shouldn't be forced on our citizens – especially our rich citizens and that's true as my tax bill is much higher than the bill for my bottled water deliveries or changing the filters on my home purifier.

It should be people's choice whether they want those things or not and Myron says "Even if climate change is real, there will be benefits… Instead of 20 below zero in January in Saskatoon, it might be only 10 below. And I don’t think too many people would complain if winters in Minneapolis became more like winters in Kansas City.” Yes, he really said that and so many other insane things that will doom us all now that he's in power.

That's why we're long on Coffee (JO) – it's a very climate-sensitive crop and we're on the way to much lower production yields and many years of disruptions from unpredictable climate events. We've had a long play on JO in our Options Opportunity Portfolio since Sept 1st, when JO was at $22 (and we are long the /KC futures as well) and, as a new trade, I like:

- Selling 5 Starbucks (SBUX) 2019 $45 puts for $4 ($2,000)

- Buying 10 Coffee (JO) June $22 calls for $3.40 ($3,400)

- Selling 10 Coffee (JO) June $26 calls for $1.70 ($1,700)

That's a net credit of $300 on a $4,000 spread that is just under $2,000 in the money to start. If global warming is not a hoax, this trade should make a gain of $4,300 on cash which is a 1,433% return in 7 months, averaging 200% a month back on your initial credit balance – that will pay for a lot of lattes!

The worst case is coffee gets cheaper and the trade goes worthless but that should be good for SBUX and, even if SBUX goes lower, you would be in a net $44.70, which is 20% below the current price. So, it's an ideal inflation and temperature hedge for a coffee achiever and we'll probably do a spread much larger than that in our STP as we can take, for example, a $1,200 credit and get a $17,200 upside.

May as well fiddle while Rome burns, right?