You really can fool some of the people all of the time!

You really can fool some of the people all of the time!

As wisely noted by the great George Bush II, there are some people you can count on to be fools and those people have put their money into oil over and over and over again since September on the same idiotic news that OPEC will cut production from 33Mb/d to 31.5Mb/d. Since that time, the OPEC members have INCREASED production to over 34Mb/d and the plan is to cut back to the more sustainable 31.5Mb/d and claim victory (and we are long oil in our Options Opportunity Portfolio, expecting it to work out for them).

This morning, Iran's oil minister said Russia will be on board with a 1.4Mb cut (total) and that will bring them down to 32.5Mb/d, which is 1Mb/d HIGHER than what they said in September but what difference do facts make in post-election America? Just last night, the American Petroleum Institute (API) reported a weekly 2.3M barrel surplus of Oil (/CL) at Cushing, OK along with a 3.36Mb surplus in Gasoline (/RB) and a 2.24Mb surplus of Distillates – and that's after a holiday weekend, when demand was supposed to pick up.

As you can see from this chart of our oil inventories, we are already nearly at full capacity, more than 10% over the top of the range that was set last year and, if EIA confirms the API build at 10:30, $50 oil will be a nice shorting spot because the US alone has a 50Mb surplus vs last year so – even if OPEC where our only supplier, it would take months just to work off our own massive surplus – and that's assuming US producers don't rush in to fill any production gap OPEC leaves on the table.

As you can see from this chart of our oil inventories, we are already nearly at full capacity, more than 10% over the top of the range that was set last year and, if EIA confirms the API build at 10:30, $50 oil will be a nice shorting spot because the US alone has a 50Mb surplus vs last year so – even if OPEC where our only supplier, it would take months just to work off our own massive surplus – and that's assuming US producers don't rush in to fill any production gap OPEC leaves on the table.

Aside from OPEC, it's a big data day on the last day of the month and we expect all hands to be on deck to prop up the markets and close November at those all-time highs so your friendly neighborhood bankster has some nice-looking charts that they will be able to use to pressure you to make "tax-advantaged" moves by 12/31 "before you miss out."

That's right, they only have to fool some of the people some of the time to make Billions of Dollars in fees and, as Wells Fargo (WFC) proved, these banks will stop at NOTHING, not even what weak regulation we do have in place (to be removed very shortly, too), in order to part you from your money. Hell, WFC didn't even need your permission OR your signature – they could just forge that for you, right?

Don't worry though, Wells Fargo was punished for ripping off millions of customers.

Don't worry though, Wells Fargo was punished for ripping off millions of customers.

See? Fooled you again! Nothing happened to WFC, they're fine and I just opened an account with my 16 year-old daughter and I was truly dumbfounded at the hard-sell tactics they were using on an underage girl to open up additional accounts and sign up for "overdraft protection," which is essentially just another way to charge you insane fees and interest.

Wait, we were going to talk about today's data, not the disgusting habits of Banksters, right? So we already had Mortgage Applications and they were down 9.4% with refinances down 16% as rates ticked up and made refinancing unattractive. That, of course, is being ignored by the market, which is all excited about higher oil prices – even though that takes money out of consumers' pockets and puts it into the hands of states who fund terrorism but, hey, why not, right? ADP showed 216,000 new jobs which blew past 160,000 expected and we have Non-Farm Payroll on Friday, so we'll see if they agree.

Dallas Fed's Robert Kaplan spoke this morning and said it is time for the Fed to hike rates but also said hikes should be "gradual and patient" and we're waiting for Powell (9:15) and Mester (12:35) to speak ahead of the Fed's Beige Book Report at 2pm, during our Live Weekly Webinar, which you may join right HERE at 1pm, EST.

We just got the Personal Income report and that's up a very inflationary 0.6%, 50% more than the 0.4% predicted by leading economorons (good reason for the Fed to hike as they hate wage inflation) and, unfortunately, Consumer Spending was only up 0.3% and that was 40% below what leading economorons predicted and that caused consumer prices (PCE) to flatline at 0.1%. We still have the Chicago PMI at 9:45 and Pending Home Sales at 10 before the 10:30 oil report and yet another chance to short the indexes at our lines (see yesterday's post).

We just got the Personal Income report and that's up a very inflationary 0.6%, 50% more than the 0.4% predicted by leading economorons (good reason for the Fed to hike as they hate wage inflation) and, unfortunately, Consumer Spending was only up 0.3% and that was 40% below what leading economorons predicted and that caused consumer prices (PCE) to flatline at 0.1%. We still have the Chicago PMI at 9:45 and Pending Home Sales at 10 before the 10:30 oil report and yet another chance to short the indexes at our lines (see yesterday's post).

Notice on the chart above, both Personal Income and Personal Spending are in a 13-year growth down-trend yet, to read the GDP Report, you'd think things were going like gangbusters in our economy. Something is wrong, possibly the $500Bn "adjustment" they made to the GDP beginning in 2014, which makes it seem 2.6% better than it actually is if you were to use consistent measurements? Let's see, if we deduct 2.6% from 3.2% that's 0.6%, which is in-line with Europe and makes a lot more sense with the consumer data we see – yep, that was it!

It's so easy for your Government to lie to you – it's a good thing we elected a guy who can really clean up all that stuff, right?

That's right, I will risk having my post censored because you need to be WARNED! We have not, since the Harding Administration, had such a collection of self-serving cronies being put in charge of our Government and, from January 20th forward, you will not be able to trust ANYTHING you hear out of Washington, including these market-moving reports. They can't fool all of the people all of the time if some of us are willing to do our homework and that's going to be a full-time job starting next year!

And yes, all administrations stretch the truth, the GDP changes above is something we discussed in 2015 but there's nothing we can do about it so we just work with the new data rules. Well, there's not much we'll be able to do about the other 100 changes that are coming, which will measure the economy against ever-lower bars. Hey, that's what China does and they get away with it so why can't we claim 7% GDP growth too?

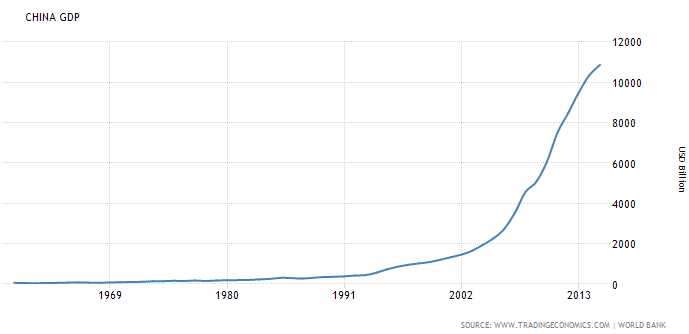

According to China, their GDP has grown from $2Tn in 2004 to over $11Tn last year so up 450% in 9 years – China has truly been made great again!

According to China, their GDP has grown from $2Tn in 2004 to over $11Tn last year so up 450% in 9 years – China has truly been made great again!

Now, you would think, with that kind of GDP growth, that China's stock market would also be doing fantastically well, right? Since 2010 alone, the GDP has grown from $7Tn to $11Tn, a gain of over 50% yet the CSI 300 Stock Index, despite hitting highs of over 5,000 last year, is right back at 3,000 – where it was in 2010. Does that mean that Chinese stocks are possibly the greatest bargain on the planet or does that mean that their GDP numbers for the past 5 years have been pretty much bullshit?

Stimulus has played a large role in China's continued expansion. In 2014 alone, China spent $4.6Tn on fixed assets, that's double the entire GDP of India. This was, of course, debt-funded and, since the turn of the Century, China has borrowed $28.2Tn (through 2014 only), which is bigger than the combined GDP of the US, Japan and Germany! Much of this money is siphoned off to Party officials and their friends, who own the companies that do the infrastructure projects (which average 30% over budget) – something we will see a lot of in the US beginning next year!

China's debt is now close to 300% of their GDP – even worse than Japan and they have also devalued their currency by doubling the supply of it since the crash in 2008. Unlike Western Nations, China owes almost all of it's debt to Chinese households, who have put their life savings into Government Bonds. As long as rates stay low and the interest payments are made on time (print more money?) then who's going to worry – especially when there is no press suggesting they do so?

China's per-capita debt level is 11.5, second only to Greece (11.8) but there's no ECB to bail out China and, in fact, all the money in the World isn't enough to bail out China at this point! China has an aging population with a relatively low level of wealth. Yet China’s social safety net and pensions system are far less developed than in advanced indebted economies and they have 200M more men than women due to decades of the "one-child" policy and a cultural preference for male children.

China's per-capita debt level is 11.5, second only to Greece (11.8) but there's no ECB to bail out China and, in fact, all the money in the World isn't enough to bail out China at this point! China has an aging population with a relatively low level of wealth. Yet China’s social safety net and pensions system are far less developed than in advanced indebted economies and they have 200M more men than women due to decades of the "one-child" policy and a cultural preference for male children.

At the moment, China is getting away with printing money to pay their debts and expenses in a way Venezuela (yesterday's topic) could not get away with as Venezuela doesn't control their media like China does. As noted by TheNewsLens:

"The central bank’s willingness to provide additional funding to state-owned banks to prevent default. This hides financial fragility for the time being, and as the carousel of credit goes around, observers may interpret the system to be one happy affair. Until the wheels come off."