We did get some awesome Consumer Spending numbers yesterday but, as you can see from the chart, it's more of a reflection of inflation than of a confident consumer that's out shopping. The cost of "essentials" has risen sharply since May, up 8% while discretionary spending has remained flat. I imagine when the credit card data comes out – we'll see that a lot of this spending has been debt-financed – not the best kind of spending...

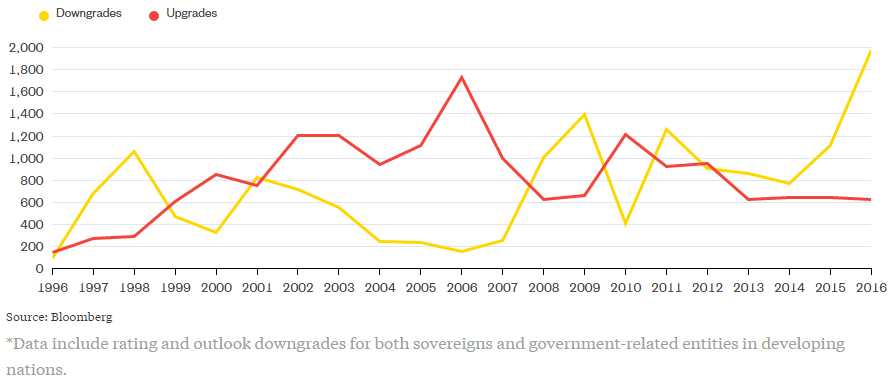

Still, the market hates nuance so YAY!!! Speaking of nuances, did you know that Fitch, Moody's and the S&P have taken a record 1,971 negative ratings actions on emerging-market sovereign and government-related entities in 2016 – and the year isn't even over yet! Isn't that awesome??? Not since 2007-2008 have we had this kind of uptick in negative ratings and back then the record was only 1,400 – we shattered that in September!

Now I'm not going to say this is a bad thing because NOTHING is a bad thing as far as this market is concerned but, it's kind of a bad thing. 26% of the 134 Sovereigns rated by Moody's still have a negative outlook – so things can get even worse. When a sovereign defaults, there's a domino effect of companies, private and state-owned, that follow. For once, S&P, Moody's and Fitch may be giving investors early indications of what to expect. The message for now is clear: Developing nations are no longer doing that well.

I'm not going to dwell on the negative, not when Bloomberg did such a good job of it in their "Pessimist's Guide to 2017".

We tried shorting yesterday and that failed, with our stops quickly broken to the upside but we're at is again today. In yesterday's post, I said the Nikkei (/NKD) was my favorite short at 18,500 and we made a +$500 move down to 18,400 (now back to 18,450) but that was disappointing given the Dollars sharp fall back to 100 so today we're not into them but we do have 19,225 on the Dow Futures (/YM) and those components are very stretched and oil is coming down, which is bad for Dow heavyweights Exxon (XOM) and Chevron (CVX), so that one is today's favorite short.

We'll be looking for the Nasdaq (/NQ) to stay below 4,800 and the S&P (/ES) to stay below 2,210 and the Russell (/TF) is already insane at 1,342.50 but we've given up shorting them unless they cross back under 1,340 or hit 1,350. Why do we keep shorting the indexes? Because they are a good hedge against the RIDICULOUS gains we're making in our long portfolios. When you don't trust a rally, you have to either lock in the gains by cashing out OR – add some hedges.

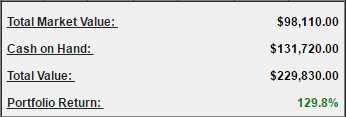

Our Options Opportunity Portfolio, for example (which you can follow over at Seeking Alpha) closed yesterday at $229,830 and that's up $10,655 (10.6%) in just 3 weeks since our November 17th review, which was up $7,843 (7.8%) since the pre-election review on Nov 6th. That's +18.4% since the election and that's just silly – so we'd better be locking in those gains. Hell, I'm tempted to just go to cash and quit for the year!

Our Options Opportunity Portfolio, for example (which you can follow over at Seeking Alpha) closed yesterday at $229,830 and that's up $10,655 (10.6%) in just 3 weeks since our November 17th review, which was up $7,843 (7.8%) since the pre-election review on Nov 6th. That's +18.4% since the election and that's just silly – so we'd better be locking in those gains. Hell, I'm tempted to just go to cash and quit for the year!

When you make ridiculous gains for no good reason, rather than being greedy and pressing your luck – take a little off the table and get ready for the turn. As you can see, our portfolio is more than half cash and we started with $100,000 in August of last year so our worst case is we have 31% more cash than we started with but, of course, we do have hedges to protect us should the market slide back.

The same is true with our paired Long-Term and Short-Term Portfolios and, though the hedges are getting crushed in the STP, the gains in the LTP much more than make up for it. Even our self-hedging Butterfly Portfolio has been on a tear but we'll be covering more of our positions and getting more conservative into the holidays. At this point, if we miss the next $10,000 gain – that's OK, we really don't need to make more money this year!

While the markets have chosen to shrug off Italy's weekend referendum and the resignation of their Prime Minister, the Monte dei Paschi Bank Crisis still looms large and Italian bond yields are rising rapidly – similar to what happened to Greece back when we thought that was no big deal. Italy has about $450Bn in non-performing bank loans and the Government's debt-to-GDP ratio is already 130% and, of course, as Members of the rapidly shrinking EU, they aren't even free to make their own decisions.

While the markets have chosen to shrug off Italy's weekend referendum and the resignation of their Prime Minister, the Monte dei Paschi Bank Crisis still looms large and Italian bond yields are rising rapidly – similar to what happened to Greece back when we thought that was no big deal. Italy has about $450Bn in non-performing bank loans and the Government's debt-to-GDP ratio is already 130% and, of course, as Members of the rapidly shrinking EU, they aren't even free to make their own decisions.

Since the financial crisis, Italy has lost over 25% of its Industrial Production and youth unemployment stands at almost 40% in a deflationary economic environment that is only increasing the nation’s already cumbersome debt burden. It has very few other tools at its disposal with no ability to implement monetary stimulus and its already high debt load limiting fiscal stimulus options. If the nation can’t get its economy going, an EU bailout would likely require so much money that it would likely trigger a political revolt in Germany’s parliament. That’s the same German parliament that is facing an election next September.

You can not worry about that stuff if it suits you but we'll keep on hedging, thanks – even when it is a bit painful!