13 record highs for the Dow since the election!

13 record highs for the Dow since the election!

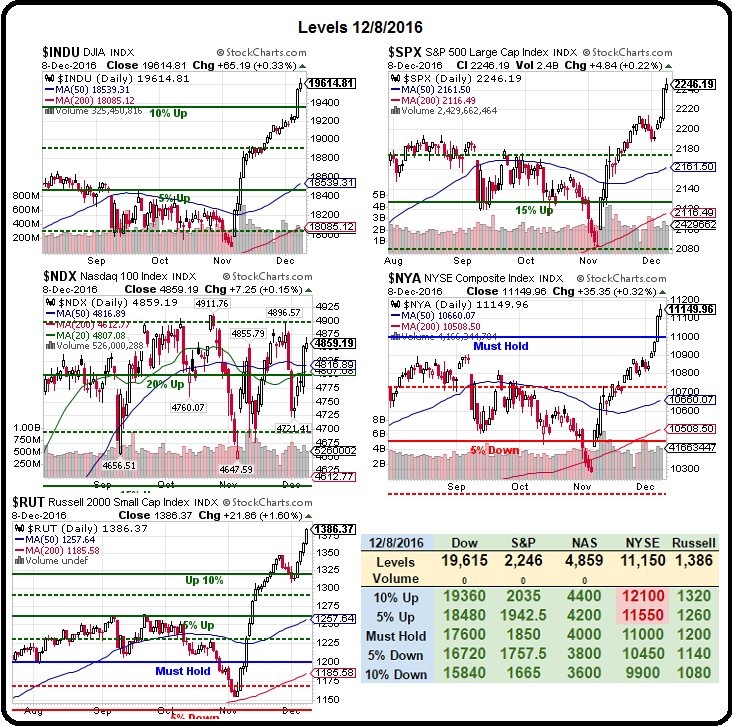

We finished the day yesterday at 19,614 and that's up 1,731 (9.67%) from 17,883 before Donald Trump saved America just a month ago. 19,671 will be the official 10% move and we did flatline at 18,777 (the 5% line) on the way up but never a pullback. Per our fabulous 5% Rule™, we expect a 20% retrace of the 10% run so a 2% pullback from 19,671 would be 357 points back to 19,313 but we didn't even pause there on the way up, which is a possible indicator that we're in the midst of a 20% run – not at the top of a 10% run.

This is not, of course, unprecedented. When Obama was elected, the Dow was at 9,712 in November of 2009 and we added 1,000 points by Jan 14th, 2010 and hit 11,200 by April (up 1,488 or 15%) before having a significant correction and believe me, Republican voters were totally baffled by the markets reaction to that rally as well. Of course the Dow went on, in the Obama adminstration, to hit 13,600 in Sept for a total gain of 3,888 points or 40% but, at this rate, Trump should be able to blow that gain away before his first 100 days are up.

Because, after all, what's the difference how much we pay for stocks as long as there is someone else willing to pay more for them tomorrow. That's called "The Greater Fool Theory" and it works fantastically until you run out of fools but Trump got 60M votes – that is a really great number of fools we have to work with!

Because, after all, what's the difference how much we pay for stocks as long as there is someone else willing to pay more for them tomorrow. That's called "The Greater Fool Theory" and it works fantastically until you run out of fools but Trump got 60M votes – that is a really great number of fools we have to work with!

Trump just picked Andrew Puzder, CEO of CKE Restaurants, which is Hardees and Carl's Junior, who went private as Apollo bought them in 2010. Aside from being a strong opponent to raising the minimum wage and running ads like this, when speaking to Business Insider earlier this year, Mr. Puzder said that increased automation could be a welcome development because machines were “always polite, they always upsell, they never take a vacation, they never show up late, there’s never a slip-and-fall or an age, sex or race discrimination case.”

Isn't that great, our new Secretary of Labor thinks the bad thing about human employees is that they don't like to be sexually harassed or discriminated against and, when they are injured on the job – they should just suck it up and stay out of court. Enjoy your $7.25 an hour while they build a machine to replace you, Trump fans. And how does a guy get to be Secretary of Labor these days? Well donating $322,000 to Trump's campaign seems to do the trick!

Isn't that great, our new Secretary of Labor thinks the bad thing about human employees is that they don't like to be sexually harassed or discriminated against and, when they are injured on the job – they should just suck it up and stay out of court. Enjoy your $7.25 an hour while they build a machine to replace you, Trump fans. And how does a guy get to be Secretary of Labor these days? Well donating $322,000 to Trump's campaign seems to do the trick!

Despite how great America is getting already, we're a bit concerned about a correction here so yesterday, in our Options Opportunity Portfolio, we cashed in $40,000 worth of positions bringing our cash level up to $172,000 out of $233,000 (73%). It's very easy to cash out your winners for good prices while the market is going up – not so much so when it's heading down – so we're being a bit proactive and will do so in our Long-Term Portfolio as well.

One good thing about cashing in longs is it saves us money buying shorts to protect ourselves and the way shorts are getting slammed, we're not in the mood to buy more. Nonetheless, reducing our outstanding stock value by 40% without cutting back on the shorts effectively tilts us more bearish into next week's Fed meeting – and we didn't have to spend a penny!

We like CASH!!!, especially in times of political uncertainty and it literally does not get more uncertain than this, as indicated by the Economic Policy Uncertainty Index, which is pinning the needle at the moment as President Trump appoints a Labor Secretary who hates laborers, an EPA head who thinks the environment doesn't need protecting and a National Security Adviser who is famous for, like our new President, passing on fake news conspiracy theories as if they are facts.

We like CASH!!!, especially in times of political uncertainty and it literally does not get more uncertain than this, as indicated by the Economic Policy Uncertainty Index, which is pinning the needle at the moment as President Trump appoints a Labor Secretary who hates laborers, an EPA head who thinks the environment doesn't need protecting and a National Security Adviser who is famous for, like our new President, passing on fake news conspiracy theories as if they are facts.

While Trump voters in the US may think all this is good stuff – the rest of the World is clearly freaking out and imagine how high that chart would be if it WASN'T for 60M Americans who are saying "I don't see the problem with any of this." Those 60M "greater fools" are BUYBUYBUYing stocks at any price because, really, what could possibly go wrong?

Of course there are many people out there who think dismantling the US Government is a great idea – they've been pushing for it for years now and, under President Trump, they are getting closer to realizing their dreams already.

Of course there are many people out there who think dismantling the US Government is a great idea – they've been pushing for it for years now and, under President Trump, they are getting closer to realizing their dreams already.

But, before we get ahead of ourselves betting on the Trumpocalypse, keep in mind that Trump isn't actually the President yet. On Monday, the 19th, the Electoral College Members will cast their final ballots for President and, though it's never happened before, they don't actually have to cast them for Donald Trump. It would take 36 defections (10%) to flip the election but imagine the chaos that would cause!

Meanwhile, that bullish Dow spread we went over on Wednesday morning at a net cash price of $3,850 has already jumped up to net $6,300 for a lovely 63% gain and THAT is why we love our hedges and this one was an upside hedge against our bearish hedges as the marker rise was making us uncomfortable back on 11/25 (but the value didn't take off until Wednesday, so you had 2 weeks to join in the fun!).

In that trade we had 30 Dow ETF (DIA) March $188 calls we bought for $6.70 against 30 DIA March $193 calls we sold for $3.75 and we sold 5 AAPL 2019 $97.50 puts for $10 to offset it. DIA is at $196.50 this morning and the March calls are $11, substantially more than the $5 we would collect on the spread. We can adjust that spread to play for a possible pullback by cashing 1/2 (15) of the $188 calls for $11 ($16,500) and buying the following:

- Buy 30 DIA June $193 calls for $9 ($27,000)

- Sell 30 DIA June $199 calls for $6 ($18,000)

- Sell 5 GILD 2019 $65 puts for $9.50 ($4,750)

Now we have a new spread that requires net $4,250 but we just cashed out $16,500 and our original purchase was net $3,850 so we have $8,400 profit already in our pocket and we are left with the above spread as well as what's left of the old spread, which is:

- 15 long DIA March $188 calls at $6.70 ($20,100)

- 30 short DIA March $193 calls at $3.75 ($11,250)

- 5 short AAPL 2019 $97.50 puts for $10 ($5,000)

So what we've done is flipped a bit more bearish in DIA by taking our profit off the table and covering our 15 exposed short March $193 calls with $15,000 worth of new spreads. Since we have a net credit of $8,400, all that matters now is what else we can take off the table and, if DIA is over $193 in March, we have another $7,500 coming to us from our 15 March $188/193 bull call spreads which would be $15,400 in our pockets – more than our maximum original goal!

Even better though, because we've locked in $8,400 of our gains, if the Dow falls short of $193, the short calls expire worthless but we still make money over $188 and the net of the June spread is unlikely to drop more than 50%, so once the March calls go worthless we can recover that cash (up to $9,000) as well. So many ways to win! Of course we do have the obligation to buy 500 shares of Apple (AAPL) at $97.50 and now 500 shares of Gilead (GILD) at $65 and that's no joke – never sell short puts against stocks you don't REALLY want to own at the net price!

Remember, this is an upside hedge against our bearish bets, which will also make money when and if the market ever goes lower (assuming things like that can still happen). If you want to learn to make money CONSISTENTLY in the markets, you have to learn how to make balancing trades like these. Meanwhile, this one is a great exercise in managing these kinds of spreads in a crazy market and we'll check back as the rally progresses.

Have a great weekend,

– Phil