It's Fed day with the FOMC's rate decision at 2pm.

Yellen will give a press conference at 2:30 where she will answer endless questions about Donald Trump by saying variations of "I don't know" and "We'll wait and see." It will not stop reporters from asking them though… We predicted Dow 20,000 back on Thanksgiving Friday (11/25) and we're so close now it would be a real shame to fail before we take that line. At the time, I said:

The Russell 2,000 is just under 1,350 and that's up 200 points since early November (not counting their spike down) and that is just shy of 15% so the Dow is MILES behind if the move in the Russell is real (we have bet it is not but those bets are killing us!). The Nasdaq is up 4.3% and the S&P is up 5.5% and the NYSE, the broadest index, is up 4.8% so it's really the Russell that's a huge outlier – and that's why we're shorting it.

HOWEVER, we could be (and have been) very wrong about the Russell and, if so and it heads higher still, then it's the other indexes that should be catching up so we can hedge our hedges with long positions on the Dow, S&P and Nasdaq. For example, the Dow ETF (DIA) is at $190 so a 5% move in the Dow would be $199.50 and we can make the following play to gain leverage:

- Buy 30 DIA March $188 calls at $6.70 ($20,100)

- Sell 30 DIA March $193 calls at $3.75 ($11,250)

- Sell 5 AAPL 2019 $97.50 puts for $10 ($5,000)

This spread requires a net cash outlay of $3,750 and the spread pays $15,000 back if the Dow even squeaks higher into March expiration (17th) and you can use any stock for an offset but Apple (AAPL) is a major Dow component and makes a very desirable buy at $97.50 and the margin on 5 short puts is just $5,000 – so it's a very efficient trade that profits $16,250 (433%) if the Dow goes up 2.5% – good deal, right?

The Russell Futures (/TF) are now at 1,372, so down $2,200 per contract but the bullish DIA play, fortunately, is miles in the money and well on it's way to the full $16,250 profit goal. In fact, it's already at net $7,500 – a solid double in less than a month and I'm inclined to take the profit here, ahead of the Fed, in the hopes the market does sell off and then those Russell Futures can do their stuff.

I know, so many market newsletters give you actionable plays that return 200% on cash in a month that it's hard to tell which one to subscribe to. If you do want to get trades like this all the time – you can subscribe here. Thanks!

If you want a good downside hedge into the Fed, you can play the Russell with the Ultra-Short ETF (TZA), which has been relentlessly driven lower during the rally but I love them at $19.35 and the way I would set up a hedge (we already have them in our Member Portfolios) is as follows:

- Sell 5 Gilead (GILD) 2019 $60 puts for $5.80 ($2,900)

- Buy 40 TZA Feb $19 calls for $2 ($8,000)

- Sell 40 TZA Feb $23 calls for 0.90 ($3,600)

That spread nets out to $1,500 cash and then you have an obligation to buy 500 shares of GILD (you can use any stock you REALLY want to own) for $60 ($30,000). Ordinary margin on the short puts is $6,000 but, as with the DIA trade and AAPL above – you don't have to hold it open the whole two years if you don't want.

If all goes well (or badly for the Russell), TZA will pop over $23, which is a 20% gain. Since it's a 3x ETF, the Russell would have to pull back 7% (to 1,275) to pay off in full. At $23, the spread returns $16,000 for a $14,500 profit (966%) so it's an excellent way to hedge if you are worried about getting caught in a nasty downturn.

Not too much to do ahead of the Fed. We'll be doing our Live Trading Webinar at 1pm, EST and hopefully we can catch a good ride as everyone repositions though a rate hike will be no surprise, what's more important is Yellen's outlook for 2017.

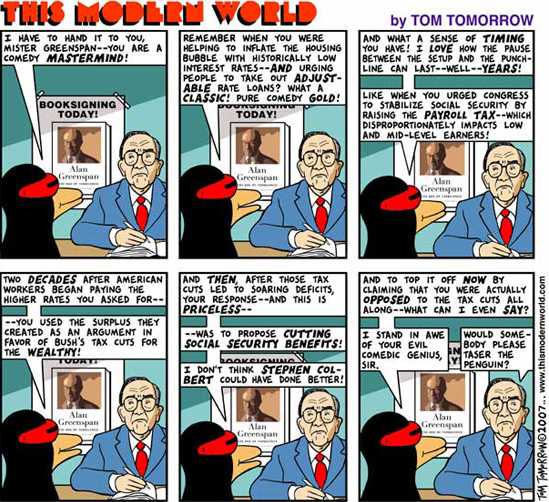

Speaking of outlooks, Retail Sales for November were a big miss at 0.1% vs 0.4% expected and 0.6% in the prior reading. Nonetheless, Producer Prices jumped 0.4% vs 0.3% expected and that, my friends, is what we call STAGLFLATION – a stagnant economy with rising prices. If you don't believe me – ask Allan Greenspan, who says:

"When money supply accelerates, inflation picks up after a while. My concern now is actually stagflation. I think we're in a period because of fiscal reasons [that have led to] a sluggish economic growth rate," he said.

On top of this are "very early signs of a pickup of inflation" that will boost profit margins for a period, Greenspan added. "But it's a false dawn," and we will eventually enter into a state of stagflation.

"The whole political structure that's been in a state of chaos for the last several years has not been good." The solution to the problems require some "very important and very tough political judgments."

Just remember who you are dealing with when you read these prognostications. Greenspan steered our economy right off a cliff just 8 years ago, all the while telling people not to worry. I'd love to tell you not to worry but I'm very worried indeed but let's see what reaction we get to the Fed this afternoon – but we already have lots of CASH!!! on the sidelines – just in case.