Last Christmas, I gave you my heart

But the very next day, you gave it away

This year, to save me from tears

I'll give it to someone specialOnce bitten and twice shy

I keep my distance but you still catch my eye

Tell me baby do you recognize me?

Well it's been a year, it doesn't surprise meNow I know what a fool I've been.

But if you kissed me now

I know you'd fool me again.

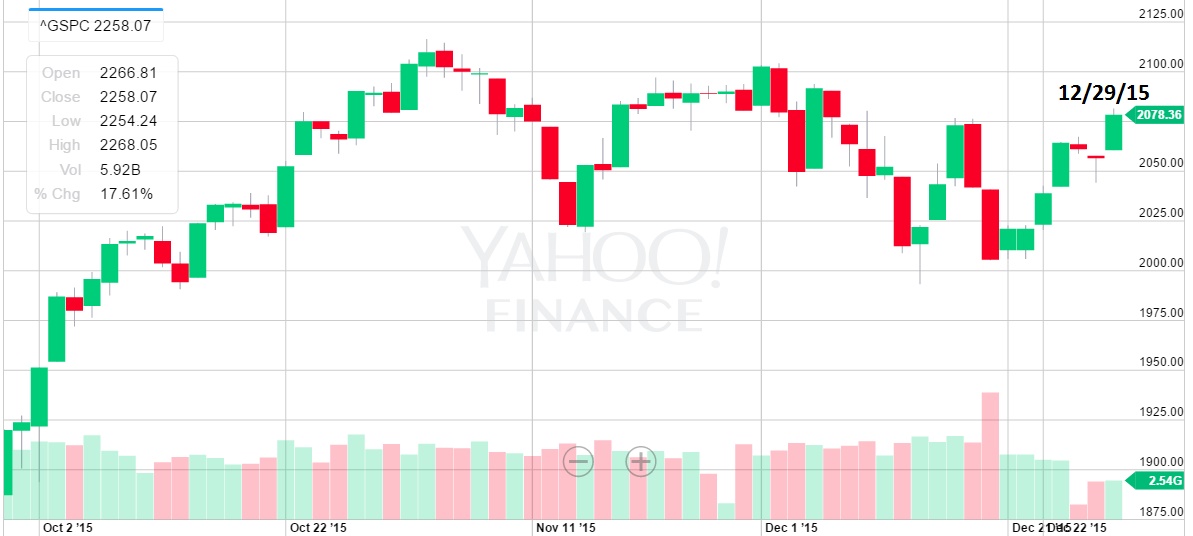

As you can see from last year's S&P 500 chart, we had a fantastic 3-month rally leading into Christmas and New Year's, when the index was up 180 points but, as you may remember, the 6 weeks after that SUCKED and the S&P fell 225 points, from 2,075 all the way back to 1,850 in mid-February:

Sure we recovered. In fact, we just had a rally from 2,150 on October 1st all the way to 2,275 and that's 75 whole points – almost half of last year's rally yet last year's rally wasn't called the Obama rally, for some reason, even though it was 140% bigger than the rally we're having now. The difference is, this "rally" began with a blow-off bottom and that made is FEEL like it was a bigger rally than it actually is:

Of course, to hear the self-righteous morons on TV and the rest of the Corporate Media talking about how it's because their guy got in office or because the economy did this or business did that – you would think last year's 140% bigger rally in Q4 was nothing compared to this one when, in fact, this Q4 rally is, like the new President's hands, only 41% as big…

Of course, to hear the self-righteous morons on TV and the rest of the Corporate Media talking about how it's because their guy got in office or because the economy did this or business did that – you would think last year's 140% bigger rally in Q4 was nothing compared to this one when, in fact, this Q4 rally is, like the new President's hands, only 41% as big…

Most of the people interviewing me recently have asked if I think there is going to be a Santa Clause rally and I've said to them "What do you think this was?" and I use the past tense intentionally because the next thing they ask me is will we see Dow 20,000 and I say no, we will not – or at least not for long before we have a nice correction because this house of cards has no foundation and volume is getting thinner and thinner as we head into the holidays.

Companies have not raissed guidance, only the price of their stocks has been raised. Oddly, you don't go into the Mercedes dealership and say to the dealer, "You know that SL4400 I was looking at for $90,000? Well, Trump got elected so I'd like to buy it for $110,000 right away" yet you do this with stocks all the time!

That is simply not how rational pricing decisions are made yet, somehow, in the great Stock Market Casino game – you seem to forget that this is real money you are spending and, for that money, you are buying an actual percentage of a company that has actual, quantifiable earnings that can be compared rationally to other companies and other capital investments in order to determine the best place to invest your money at any given time. It's easy to do – but hardly anyone does it!

Well, God bless them because they make it possible for us to find great value stocks in almost any kind of market. In fact, just last week we cashed out 25% of our long positions and damned if we didn't end up adding a few new positions and we even sent out a Top Trade Alert on Friday (SLW) as it seemed like the best bargain in the market at the moment (we are also still long /SI Futures at $16).

We're still short the indexes, of course, especially the Russell (/TF Futures), as noted in last week's Live Trading Webinar and here's a great article detailing why and the gist of it is that in 2009, Russell 2,000 stocks had a Net Income of $10Bn and the Russell had a Market Cap of 750Bn but, in 2016, the Russell 2,000 stocks have a Net Income of $10Bn and the Russell now has a Market Cap of $2.3Bn – about 3x higher. Do you want to buy that $90,000 Mercedes for $270,000 or are you not an idiot?

Well, if the answer to the Mercedes question is obvious, then the answer to the stock market question should be too – it's too expensive – don't buy it! You have to WAIT for a sale to get a good price. Chasing the stock and HOPING it's a better price than the next idiot will pay is NOT a valid investing strategy. It is OK not to play the game while the game isn't making sense.

"THEY" are trying to scare you out of CASH!!! but CASH!!! has been performing pretty well right now. Those Dollar that are burning a hole in your pocket are up 8% for the quarter and that's up more than twice as much as the S&P's 3.4% gain since Oct 1st so why, Why, WHY do you think it's so urgent to buy stocks?

I don't want to be the Grinch here but the best Christmas present I can give you is the one I told you about on Friday – CASH!!! in your stocks while they are ahead, take money off the table into the holidays, don't wait for the market to start dropping to find out what your stocks are really worth – you may not like what you find…

You know we have reached peak ignorance when CNBC's Joe Kernen this morning said: "Well you know his "fake" news is my real news and I bet my real news is his fake news, so it's all just a matter of perspective." No Joe, it isn't. There are such things as objective facts yet I can see how that objective fact can be difficult to grasp by a man who sits next to Jim Cramer in the morning telling people which overbought stocks to buy next in this "never-ending" rally.

They are all idiots – trust me – I'll be referring to this next year just like I referred to the same idiots back in 2008 for essentially the same reason. Not just idiot – dangerous idiots…

They are all idiots – trust me – I'll be referring to this next year just like I referred to the same idiots back in 2008 for essentially the same reason. Not just idiot – dangerous idiots…

- Stock Market Crash – Year One in Review – The Gathering Storm

- Stock Market Crash – Year One Review II – The Next 30% Down

- Stock Market Crash – Year One Review III – March Madness!

- Phil Davis and Tim Sykes live on March 6th, 2009 during a massive market crash.

- The 13 picks from that live show that made 469% over the next 6 months!

Remember, if you don't have any cash on the side – what are you going to buy the bargains with?