Now we're 7 for 7 in 2017 Futures picks!

Now we're 7 for 7 in 2017 Futures picks!

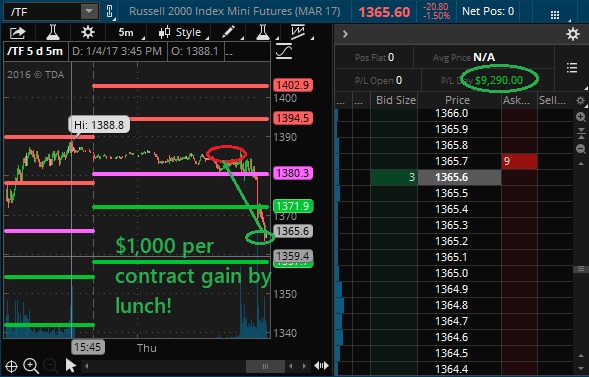

As I noted in yesterday morning's post, we were still waiting for Wednesday's Live Trading Webinar (replay here) pick, shorting the Russell (/TF) Futures at 1,385, to bear some fruit and we were well-rewarded with a $1,000 per contract drop that began about 10:30, leading us to a $9,290 winner on our 10 contract position, capping off a perfect week for our Futures Trade Ideas.

While it would be smart to quit while we're so far ahead, no one ever said we were smart and this morning we're back to shorting Oil (/CL) below the $54 line as It's up on a weak Dollar as well as general silliness after the Saudis announced that yes, they really have cut production, just like they said they would when oil was $40. We've already gotten a 40% bump out of this news – how many times can they say the same thing and get another bullish reaction?

OPEC won't actually publish production levels until mid-February and, even when they do, you can't trust them. OPEC data is not based on physical counts but on surveys and computer modeling based on numbers submitted by member states – who have been known to cheat and fudge their numbers for decades.

Speaking of decades, we're just one decade away from the US becoming a net exporter of energy in 2026, according to yesterday's EIA Report. In all but two of the seven cases modeled in the report, the EIA predicts that the US will become an energy exporter within the next decade, as natural gas production and exports rise and petroleum imports decrease.

Speaking of decades, we're just one decade away from the US becoming a net exporter of energy in 2026, according to yesterday's EIA Report. In all but two of the seven cases modeled in the report, the EIA predicts that the US will become an energy exporter within the next decade, as natural gas production and exports rise and petroleum imports decrease.

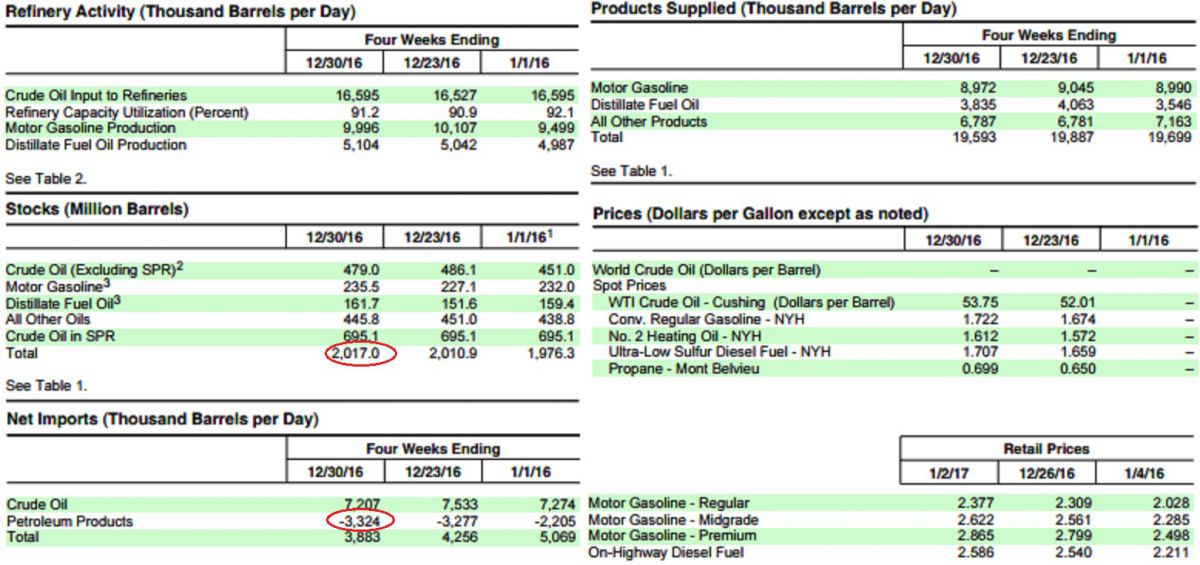

One could argue that the US is practically a net exporter already as we exported 23.26M barrels of Petroleum Products last week and we STILL had a net build in inventories of another 6.1M barrels. So already, 29.36M (58%) of the 50.45M barrels we import from overseas in a week were not needed for US consumption – yet oil prices are $22 (68%) higher than they were last year – there is no logical reason for this!

Here's the really quick summary. We are importing about 1Mb/week LESS oil than last year and we're exporting 8Mb/week MORE oil than last year and we STILL are ending up with 1Mb/day more than we need. The reason we're paying more for oil is because Congress eased restrictions on product exports so that, instead of letting market forces do their work here – the refined products go to the highest bidder outside of our country.

Hopefully President Trump cares enough to do something about this (tweet this article to him) as it's projected that this rip-off of the American public will cost our citizens $52Bn in 2017 – and that's just at the pump at $2.49/gal. Add in the cost of heat, electricity, airfares and consumer products made from petroleum and we're talking well over $100Bn taken from the American people with much of it going overseas to countries that have been known to sponsor terrorism. How is this making America great?

Hopefully President Trump cares enough to do something about this (tweet this article to him) as it's projected that this rip-off of the American public will cost our citizens $52Bn in 2017 – and that's just at the pump at $2.49/gal. Add in the cost of heat, electricity, airfares and consumer products made from petroleum and we're talking well over $100Bn taken from the American people with much of it going overseas to countries that have been known to sponsor terrorism. How is this making America great?

The higher the price of oil goes, the more money ISIS makes and the more money they make the more problems they cause, forcing us to spend even more money to send troops into the region, which causes instability, which causes oil prices to go higher – giving ISIS even more money. Certainly all the oil people in the Trump administration are aware of this and will put a stop to this cycle by doing all they can to keep oil prices down – the way Obama did for the past 8 years (avg $100 under Bush, avg $50 under Obama).

Meanwhile, Barclays issued a useful report outlining 13 possible "Black Swan" events that could affect commodity prices in 2017 and I love the handy chart – that let's us know what to look out for as the year progresses. As noted by Barclays:

Our analysis illustrates an important point: politics are likely to matter just as much as economics" and not just any politics: "in particular, the new politics of populism and protectionist trade policies have the potential to disrupt global supply and demand assumptions for various commodities."

Commodity market black swan events come in many forms, and the market may take years or an instant to price them in. Technological innovation caused the US shale gas revolution, the Great Recession caused structural demand destruction, while geopolitical strife has disrupted commodity supplies overnight. We all know that markets will surprise in some fashion in 2017, so we attempt this review to shine a spotlight on the specific commodity market risks that clients should watch.

In short, Barclays agrees with our Christmas premise for "Secret Santa’s Inflation Hedges for 2017" as most of the risks are skewed to the upside for commodities. Top of the list is Venezuela, which is heading towards default and unlikely to escape their fate – it's more of a "when" and not "if". Venezuela produces 2.2Mb of oil per day and if the Government is unable to pay for oil workers and ongoing operational costs, their cutback could be bigger than OPEC's. The US imports twice as much oil from Venezuela (1.2Mb/d) as we do from OPEC (500,000b/d).

That's the only legitimate upside risk in oil but, until that happens, $55/barrel is a ridiculous price to be paying and it's unlikely to last through the Winter. In the Summer, if Europe, Japan, China and India avoid collapsing – then we could make a run to $60 per barrel (and we are long USO for July).

8:30 Update: December Non-Farm Payrolls came in at 156,000, which was a solid miss from 175,000 jobs expected. November jobs were revised down 26,000 to 178,000 and Unemployment ticked up from 4.6% to 4.7% so, if nothing else, the economy is showing signs of slowing down and that means GDP forecasts are likely to tick down as well.

8:30 Update: December Non-Farm Payrolls came in at 156,000, which was a solid miss from 175,000 jobs expected. November jobs were revised down 26,000 to 178,000 and Unemployment ticked up from 4.6% to 4.7% so, if nothing else, the economy is showing signs of slowing down and that means GDP forecasts are likely to tick down as well.

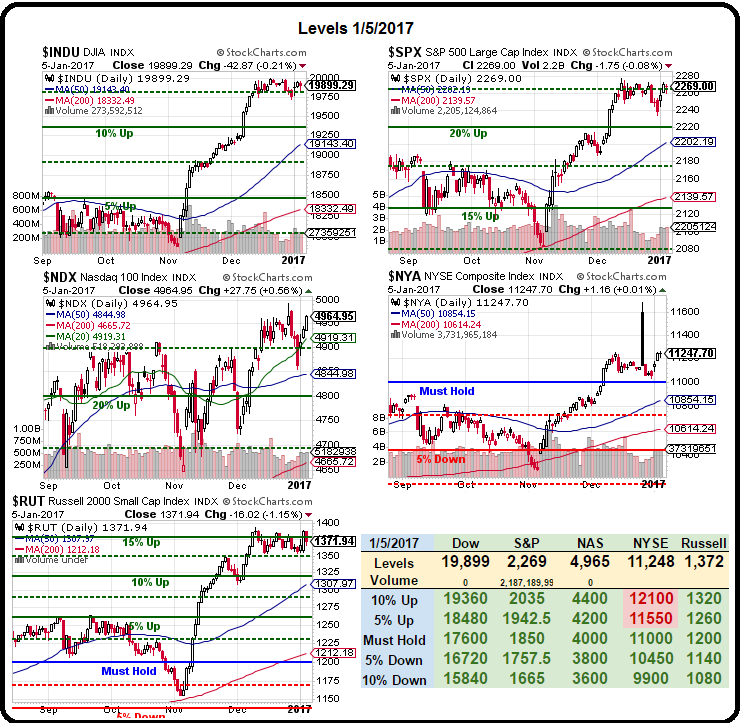

The most recent forecast from the Atlanta Fed predicted 2.6% GDP growth in Q4 but now we've seen weak retail sales and now weak job growth heading into December – that's not something they were counting on. The good news for the bulls is this is likely to keep the Fed from moving to tighten too quickly but we were fairly certain they were not going to do anything until May in any case so I don't see this as changing anything and we'll be happy to short the indexes again if they pop off this news.

Our indexes, meanwhile, are drifting along. The S&P last made a new high on Dec 13th and, since then, it's been up and down around 2,200. The Nasdaq made an all-time high yesterday but 1,713 stocks in the index declined while 1,182 advanced so a very narrow rally – to say the least! The NYSE also had more declines than advances, with 25% more volume to the downside so be VERY CAREFUL about following this "rally" – it's more like a bubble that's stretching to the limit before it pops!

Have a great weekend,

– Phil