“In a word, I was too cowardly to do what I knew to be right, as I had been too cowardly to avoid doing what I knew to be wrong.” – Dickens, Great Expectations

Great expectations.

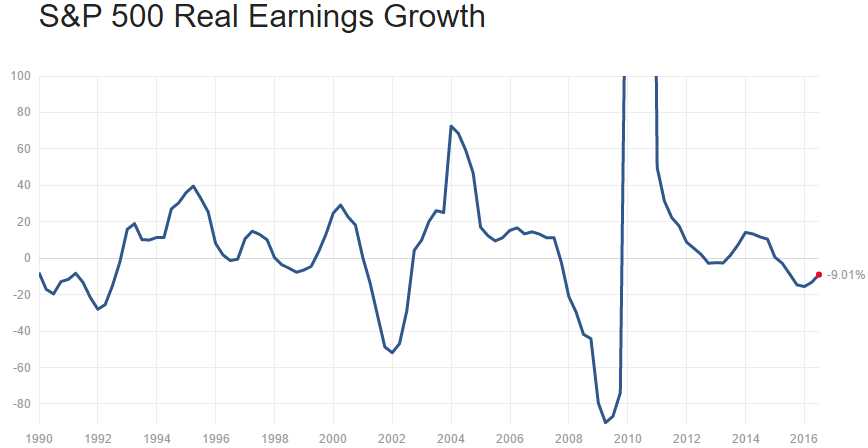

That sums up the mood of the market very nicely. In this very interesting chart (thanks Scott Miller), you can see how the earnings expectations for the S&P 500 are generally fantastic at the start of each year, only to lead to crushing disappointment by the end of the year. 2017 earnings expectations are already down 15% from where they started and 2016 actual earnings are coming in 20% below early estimates.

In fact (I know, what are facts?), ACTUAL earnings for 2016 are only 8% higher than 2013s earnings were yet the S&P itself has risen from 1,500 in Jan 2013 (when expectations were higher than the actual 2016 earnings) to 2,268 at yesterday's close. That's up 51.2% on 8% more earnings – boy are we suckers! And keep in mind these are OPERATING EARNINGS – not including interest payments and taxes or, as investors like to call them – real profits!

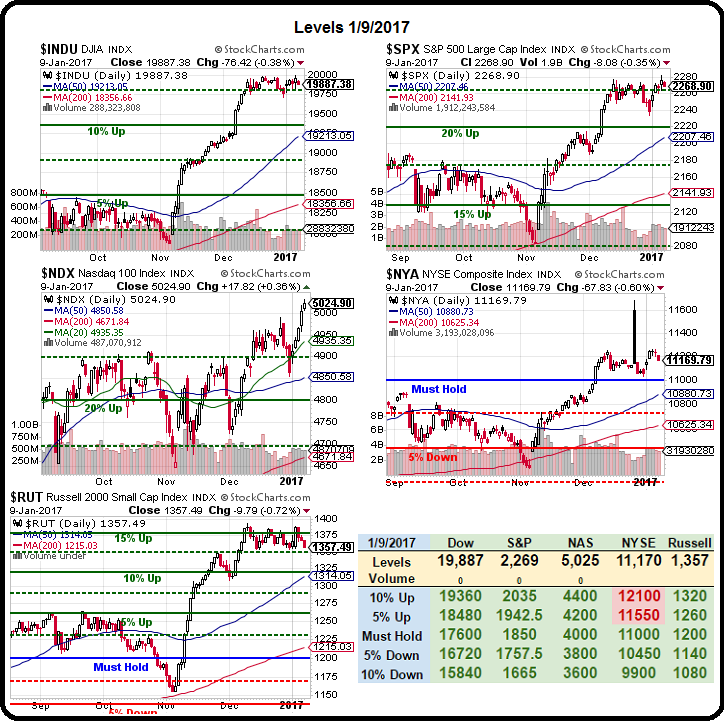

Any way you slice it, we're paying at least 20% too much for equities based on their actual performance. 20% off 2,268 is 1,814 and our fair value estimate for the S&P on our Big Chart is 1,850 and if earnings do rise 8%, as expected, then we'll be happy to raise our bar 10% to 2,035 so let's say that's the fair forward value of the S&P.

Any way you slice it, we're paying at least 20% too much for equities based on their actual performance. 20% off 2,268 is 1,814 and our fair value estimate for the S&P on our Big Chart is 1,850 and if earnings do rise 8%, as expected, then we'll be happy to raise our bar 10% to 2,035 so let's say that's the fair forward value of the S&P.

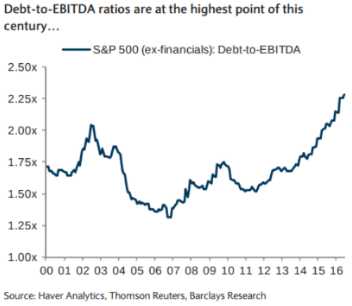

As you can see from this Haver Analytics chart, since 2013, S&P companies have taken on a tremendous amount of debt, much of it used for stock buybacks, which reduces the number of shares the earnings are divided by to make earnings look like they are improving – even when they are actually not. In fact, the real earnings of the S&P 500 are DOWN 9.01% from 2013.

You will not hear this from the usual MSM cheerleaders, even though the numbers are right there – they don't want to let facts get in the way of a good story and nobody likes to hear negative news and, more importantly, viewers don't tune in to hear it. They want to hear that their investments will all double and they are going to become rich very soon and, if you can't tell them how to make that happen – they will find someone who will (tell them, that is – it won't actually happen).

Rallies equal ratings so they will milk a rally long after it's time has past – They are "too cowardly to do what they know to be right, too cowardly to avoid doing what they know is wrong." It's amazing, after ruining so many people's lives in 2008, the media is right back at it in 2017 – telling people the rally will never end and encouraging them to BUYBUYBUY at any price – consequences be damned!

Don't forget – none of these people were fired – they are, in fact, the same people, telling you the same things today as they did 9 years ago:

Note the sincerity in their awful advice. Note how sure they are that your money is safe, so sure that they tell you that you are a fool for worrying. This went on month after month as they told their poor followers to buy on every dip and every month we dipped lower still. Only when the market bottomed did they finally tell viewers to get out – at exactly the wrong time!

Don't get me wrong, sentiment can take a market very far (see 1999) and Government stimulus can take it even further but isn't a 51.2% gain on a 9% decline in earnings far enough? If you are a momentum investor – God bless you, have fun but, if you are a fundamental investor who is building for the future – well, have I mentioned how much I like CASH!!! lately?

Don't get me wrong, sentiment can take a market very far (see 1999) and Government stimulus can take it even further but isn't a 51.2% gain on a 9% decline in earnings far enough? If you are a momentum investor – God bless you, have fun but, if you are a fundamental investor who is building for the future – well, have I mentioned how much I like CASH!!! lately?

There are still value stocks out there. It's actually amazing the things that have fallen out of favor in this mega-rally. That also happened in 1999 when "boring" companies like IBM, KO, PG, PFE, JNJ… couldn't find buyers as all the money was chasing tech stocks. In our Live Member Chat Room, we're finding 3-5 value stocks per day to play with – they may not be as sexy as the momentum plays – but they'll do much better if the market turns sour and people fly back to safety.

Meanwhile, we remain "Cashy and Cautious" in what we think is a very toppy and overpriced market. If we survive earnings and the first month of the Trump Error, then we might be willing to bring more cash off the sideline but, for now – we'd rather watch and wait. Of course, waiting can be very profitable too. Back on Thanksgiving, in case we were being too conservative, we took an upside hedge in case the Dow popped. At the time, I said:

The Russell 2,000 is just under 1,350 and that's up 200 points since early November (not counting their spike down) and that is just shy of 15% so the Dow is MILES behind if the move in the Russell is real (we have bet it is not but those bets are killing us!). The Nasdaq is up 4.3% and the S&P is up 5.5% and the NYSE, the broadest index, is up 4.8% so it's really the Russell that's a huge outlier – and that's why we're shorting it.

HOWEVER, we could be (and have been) very wrong about the Russell and, if so and it heads higher still, then it's the other indexes that should be catching up so we can hedge our hedges with long positions on the Dow, S&P and Nasdaq. For example, the Dow ETF (DIA) is at $190 so a 5% move in the Dow would be $199.50 and we can make the following play to gain leverage:

- Buy 30 DIA March $188 calls at $6.70 ($20,100)

- Sell 30 DIA March $193 calls at $3.75 ($11,250)

- Sell 5 AAPL 2019 $97.50 puts for $10 ($5,000)

This spread requires a net cash outlay of $3,750 and the spread pays $15,000 back if the Dow even squeaks higher into March expiration (17th) and you can use any stock for an offset but Apple (AAPL) is a major Dow component and makes a very desirable buy at $97.50 and the margin on 5 short puts is just $5,000 – so it's a very efficient trade that profits $16,250 (433%) if the Dow goes up 2.5% – good deal, right?

Oddly enough, the Russell is only at 1,358 so we backed the right horse and the Dow did catch up and DIA is already at $198.76, which has driven the March $188 calls to $12.28 less the cost of the $193s ($7.85) is $4.43 out of a possible $5 already and 30 contracts is $13,290 which is up $9,540 (254%) in less than two months. I'd leave the short Apple puts to expire worthless but, even if you cashed them at $8.25, that's $4,125 and you're still netting $5,415 for a 144% gain well ahead of schedule.

So, like I said – it's not like we don't find lots of fun ways to make money in our Live Member Chat Room – it's just that we're being selective and keeping plenty of buying power on the sidelines. Even if the market doesn't go down – earnings season always throws a few bargains our way.