Behold the tragedy of NAFTA!

Behold the tragedy of NAFTA!

Before the evil Bill Clinton signed the North American Free Trade Alliance, US companies exported $24Bn worth of goods and services to Mexico. In the 30 years since then, our trade EXPORTS to Mexico have gone up 10 TIMES, creating hundreds of thousands of US jobs that never existed before.

Mexico had similar success, with even more exports going to the US but a lot of that is oil (and the rest are avocados) and the US is going to import oil from somewhere, regardless – better we do it from a friend and trading partner like Mexico than buy more oil from OPEC, right? Well, not according to our President, who thinks we are better off not exporting $236Bn to Mexico in order to redress a $60Bn Trade Deficit.

Perhaps we would be better off figuring out what kind of things Mexicans would like to buy from the US and encouraging that kind of manufacturing in the US? Just a thought… Also a thought that the US economy is $19Tn and Mexico's economy is $1Tn so the fact that they are anywhere close to an equal trading partner is amazing. In fact, 1/4 (25%) of their ENTIRE economy is imports from the US while the US only imports 1.5% from Mexico. If anyone should be pissed off at their trading partner – it's Mexico!

Perhaps we would be better off figuring out what kind of things Mexicans would like to buy from the US and encouraging that kind of manufacturing in the US? Just a thought… Also a thought that the US economy is $19Tn and Mexico's economy is $1Tn so the fact that they are anywhere close to an equal trading partner is amazing. In fact, 1/4 (25%) of their ENTIRE economy is imports from the US while the US only imports 1.5% from Mexico. If anyone should be pissed off at their trading partner – it's Mexico!

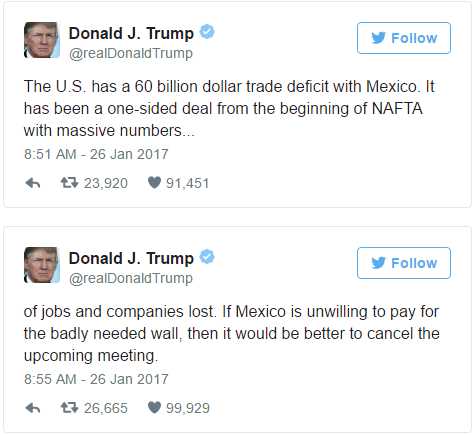

That's not the way our Tweeter-In-Chief sees things and yesterday he threw a little temper tantrum and cancelled the SCHEDULED meeting with Mexico's President because Nieto said they were not going to pay for Trump's monument to his own stupidity.

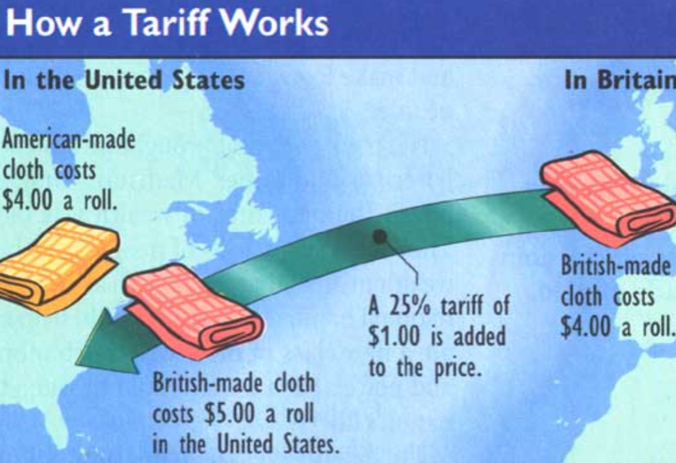

Trump says Mexico WILL pay for the wall by imposing 20% tariffs on imports from Mexico but perhaps the President doesn't understand how tariffs work? A tariff is a TAX (that's right, Trump is raising taxes) on imported goods and those taxes are simply passed along to the consumers who, in this case, are the American (not Mexican) people. YOUR avocados will be 3 for $5 instead of 4 for $5 – that's what a tariff will accomplish.

Trump says Mexico WILL pay for the wall by imposing 20% tariffs on imports from Mexico but perhaps the President doesn't understand how tariffs work? A tariff is a TAX (that's right, Trump is raising taxes) on imported goods and those taxes are simply passed along to the consumers who, in this case, are the American (not Mexican) people. YOUR avocados will be 3 for $5 instead of 4 for $5 – that's what a tariff will accomplish.

So when Donald Trump says "Mexico will pay for that wall," what he really means is that people who don't understand the mechanics of trade or simple math will THINK Mexico is paying for the wall while, actually, they are paying for the wall. Of course, anyone in the media who challenges his spin (ie, attempts to educate the public) immediately becomes an enemy of the state.

Wow, see what I mean? You would think, after 1,000 years of trial and error, the idea of trade tariffs would be one of those things we only learn about in history under the heading of "Bad Ideas We Should Never Do Again" but, here we are, reviving one of the worst economic policy tools ever wielded.

Wow, see what I mean? You would think, after 1,000 years of trial and error, the idea of trade tariffs would be one of those things we only learn about in history under the heading of "Bad Ideas We Should Never Do Again" but, here we are, reviving one of the worst economic policy tools ever wielded.

Meanwhile, speaking of bad economies – our Q4 GDP Report just came in at a very disappointing 1.9% (2.5% expected) and a lot of that is explained by a TERRIBLE Durable Goods Report, which came in at -0.4% for Christmas vs +4% expected so a miss of 110% there by leading economorons. For the year, real GDP is up just 1.6% – yet the market is at an all-time high – can you blame us for being short?

Speaking of shorts, you'll be loving the Chevron (CVX) puts we recommended in yesterday's morning post (never miss one by subscribing HERE). We were liking the June $100 puts, which were easy to pick up at $1.05 and this morning, as expected, they missed by earnings by a mile (0.22 not 0.66) and revenues missed by $2.26Bn (6.66%) at $31.5Bn because, as I said: "the expectations for earnings ($4.72) are based on unrealistically bullish expectations for oil prices." Come on folks, this isn't rocket science – just do the math!

Speaking of shorts, you'll be loving the Chevron (CVX) puts we recommended in yesterday's morning post (never miss one by subscribing HERE). We were liking the June $100 puts, which were easy to pick up at $1.05 and this morning, as expected, they missed by earnings by a mile (0.22 not 0.66) and revenues missed by $2.26Bn (6.66%) at $31.5Bn because, as I said: "the expectations for earnings ($4.72) are based on unrealistically bullish expectations for oil prices." Come on folks, this isn't rocket science – just do the math!

Math is also the tool we used to decide to short the Dow Futures (/YM) at 20,000 in our Live Trading Webinar and yes, we're wrong so far at 2,033 but we KNOW the economy is too weak to support record-high markets once Trump loses that new President smell.

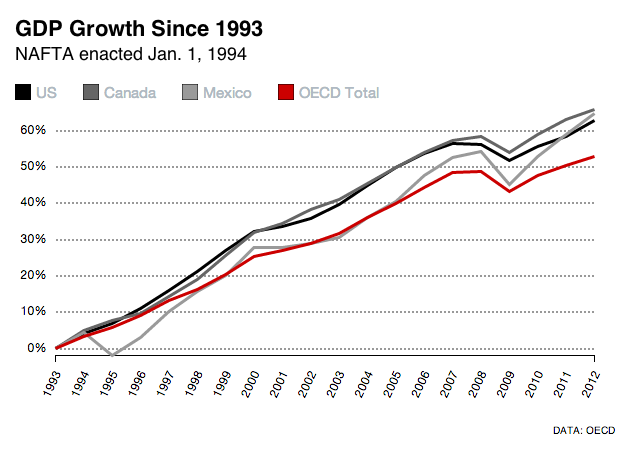

That new President smell will wear off REALLY fast if tearing up NAFTA drops our GDP back in line with non-NAFTA countries – 10% below where we are now. When the evil Bill Clinton signed NAFTA in 1993, the GDP of the United States was $6.5Tn, the explosive growth in trade between the US and Canada was one of the factors that have TRIPLED our GDP to $19Tn today – will America be great if we unwind all that? The President seems to think so. Giving back even half of that 10% growth advantage we've had since NAFTA would cost this country $1 TRILLION – that's 20 MILLION $50,000 jobs. Way to stick it Mexico dummy!

That new President smell will wear off REALLY fast if tearing up NAFTA drops our GDP back in line with non-NAFTA countries – 10% below where we are now. When the evil Bill Clinton signed NAFTA in 1993, the GDP of the United States was $6.5Tn, the explosive growth in trade between the US and Canada was one of the factors that have TRIPLED our GDP to $19Tn today – will America be great if we unwind all that? The President seems to think so. Giving back even half of that 10% growth advantage we've had since NAFTA would cost this country $1 TRILLION – that's 20 MILLION $50,000 jobs. Way to stick it Mexico dummy!

Nonetheless, the markets remain irrationally exuberant as US stocks have gained $2.2 Trillion (on paper) since the election on November 8th. "Where did that $2.2Tn come from?" you might wonder… Well don't, it's all smoke and mirrors and, as I keep saying, in no way, shape or form supported by actual inflows of money into US equities.

Nonetheless, the markets remain irrationally exuberant as US stocks have gained $2.2 Trillion (on paper) since the election on November 8th. "Where did that $2.2Tn come from?" you might wonder… Well don't, it's all smoke and mirrors and, as I keep saying, in no way, shape or form supported by actual inflows of money into US equities.

As you can see from the chart, we've barely gone positive (over 50) on Money Flows since the election yet the market has gained TRILLION more in valuation than it had when actual money was flowing in most of the year (since early March). All the election did was reverse the strong outflows that were picking up steam in October but stopping outflows is NOT to be confused with causing inflows – we're nowhere near there yet.

So it's a very silly market and we're mainly in CASH!!! and this is why because, at the moment – there are plenty of fools willing to give us cash for our equities but what happens when sentiment changes and everyone wants to sell? Will there be enough fools to pay you 300 times earnings for Netflix (NFLX) or Amazon (AMZN) then (we're short on both) – if not, then you'll find out what your stocks are really worth.

Have a great weekend,

– Phil