"We've got a lot of killers."

"We've got a lot of killers."

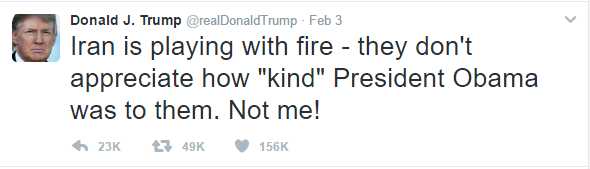

That, and the headline above are things our President said on Fox ahead of the Superbowl. That followed up on his tweet on Friday that Iran is "playing with fire" which has been keeping Oil (/CL) up around the $54 line so we can thank President Trump for another GREAT opportunity to short oil this morning below the $54 line.

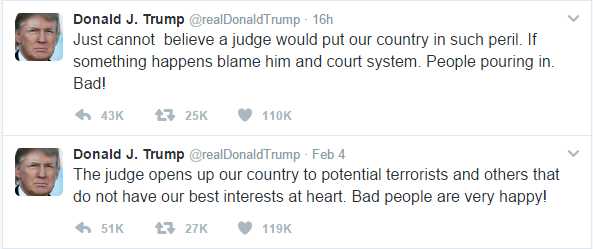

Trump has been on the warpath all weekend because hundreds of top business leaders are petitioning against his immigration ban and a the 9th US Circuit Court struck down his ban on Sunday, which led Trump to tweet: "What is our country coming to when a judge can halt a Homeland Security travel ban?"

Yeah, that system of checks and balances upon which our entire Constitutional system is based – what a disaster! Despite overwhelming "fake news" polls that show the vast majority of the country think the Travel Ban is going too far, Team Trump is appealing the matter to the Federal Appeals Court in San Francisco but, you know – San Francisco – so it's likely this will fly (unlike Arab immigrants) towards the Supreme Court soon enough.

Yeah, that system of checks and balances upon which our entire Constitutional system is based – what a disaster! Despite overwhelming "fake news" polls that show the vast majority of the country think the Travel Ban is going too far, Team Trump is appealing the matter to the Federal Appeals Court in San Francisco but, you know – San Francisco – so it's likely this will fly (unlike Arab immigrants) towards the Supreme Court soon enough.

Uncertainty is not a good thing for the stock markets and the CEOs that are protesting the ban are flat-out saying it's bad for their companies so, if Trump wins, companies like AAPL, FB, GOOGL, MSFT, HPQ are flat-out saying they will lose business and a long-term competitive edge? It's a good time to have Ultra-Short Nasdaq (SQQQ) hedges!

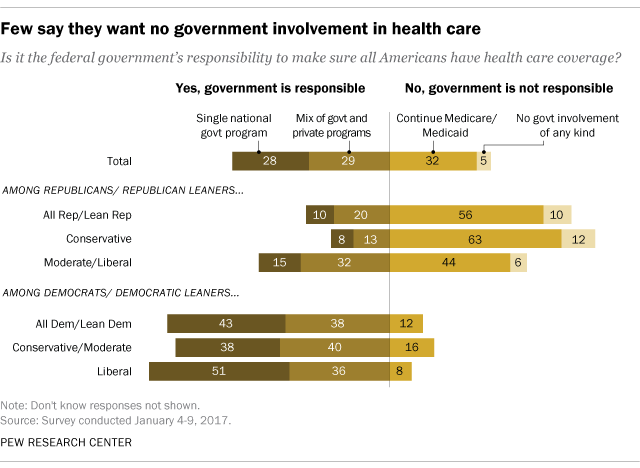

Open Borders are now closed, the era of Free Trade is ending, Financial Regulations are being reversed, 1/10th of the US Population is losing its Health Care, US policy on Climate Change has reversed and we're back to war talk in the Middle East and you think this isn't going to affect the markets?

Open Borders are now closed, the era of Free Trade is ending, Financial Regulations are being reversed, 1/10th of the US Population is losing its Health Care, US policy on Climate Change has reversed and we're back to war talk in the Middle East and you think this isn't going to affect the markets?

If everything that was happening for the past 8 years has been bullish – as the Dow climbed from 8,000 to 20,000 (up 150%) under the "terrible" Obama Administration, how will the opposite policies also be "GREAT" for the markets under the Trump Administration. Are we saying that, in the end, nothing the Government does actually matters and the markets will go up about 20% every year? If so, then BUYBUYBUY, but I'm a little dubious.

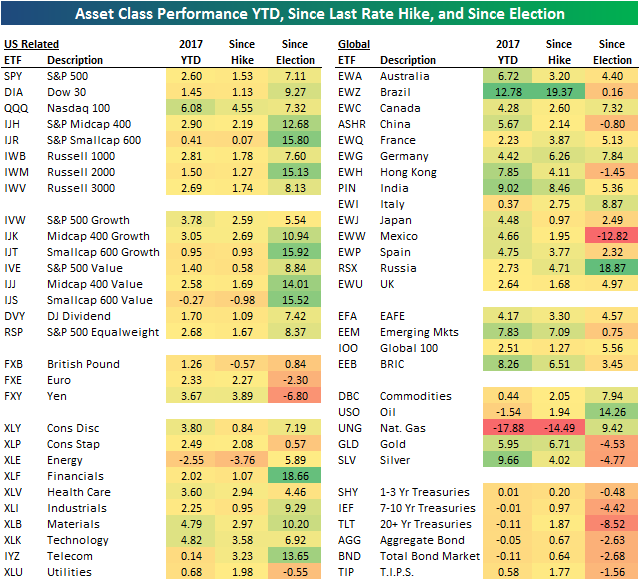

US markets have done well since the election, especially our un-regulated Financials (what could possibly go wrong?), who jumped 18.66% through Friday. In fact, Goldman Sachs' 10-point gain on Friday was responsible for 85 (45%) of the Dow's 186-point gain on Friday – kind of a narrow rally, on the whole:

The only thing doing as well as our banks is another Trump favorite – Russia! Their market has jumped 18.87% since Trump's election as it seems Russia couldn't be happier – that's double the gain of our own Dow Jones – THAT is how happy Russia is with our new President and you could tell he's just as happy with them, the way he defended them on the O'Reilly show, scheduled to be in the most-watched time-slot of the year (ahead of the Superbowl).

The only thing that's certain going forward is uncertainty but that is not at all reflected by the Volatility Index (VIX), which is sitting at long-term lows at 11.76, though up from 10.5 but the lack of volatility is also a sign if complacency and we are avoiding that potential trap by remaining "Cashy and Cautious" and we're likely to remain so for Trump's first 100 days – through March and into April earnings – because I'd rather miss a quarter than get stuck in a downturn it takes years to dig out of.

It's a light week for data and "only" 4 Fed speeches (Harker today, Bullard and Evans Thursday and Fisher Friday am) so the focus will shift back to earnings as we downshift to the mid-caps and small caps, who have gained 50% more than the broad S&P.

The S&P is only 20 points higher than where January began so, on the whole, I'd have to say earnings were not helpful – that means they may be detrimental as we take a closer look at the smaller companies who don't have the ability to fluff up their earnings with stock buybacks and Non-GAAP accounting tricks.

Let's be careful out there.