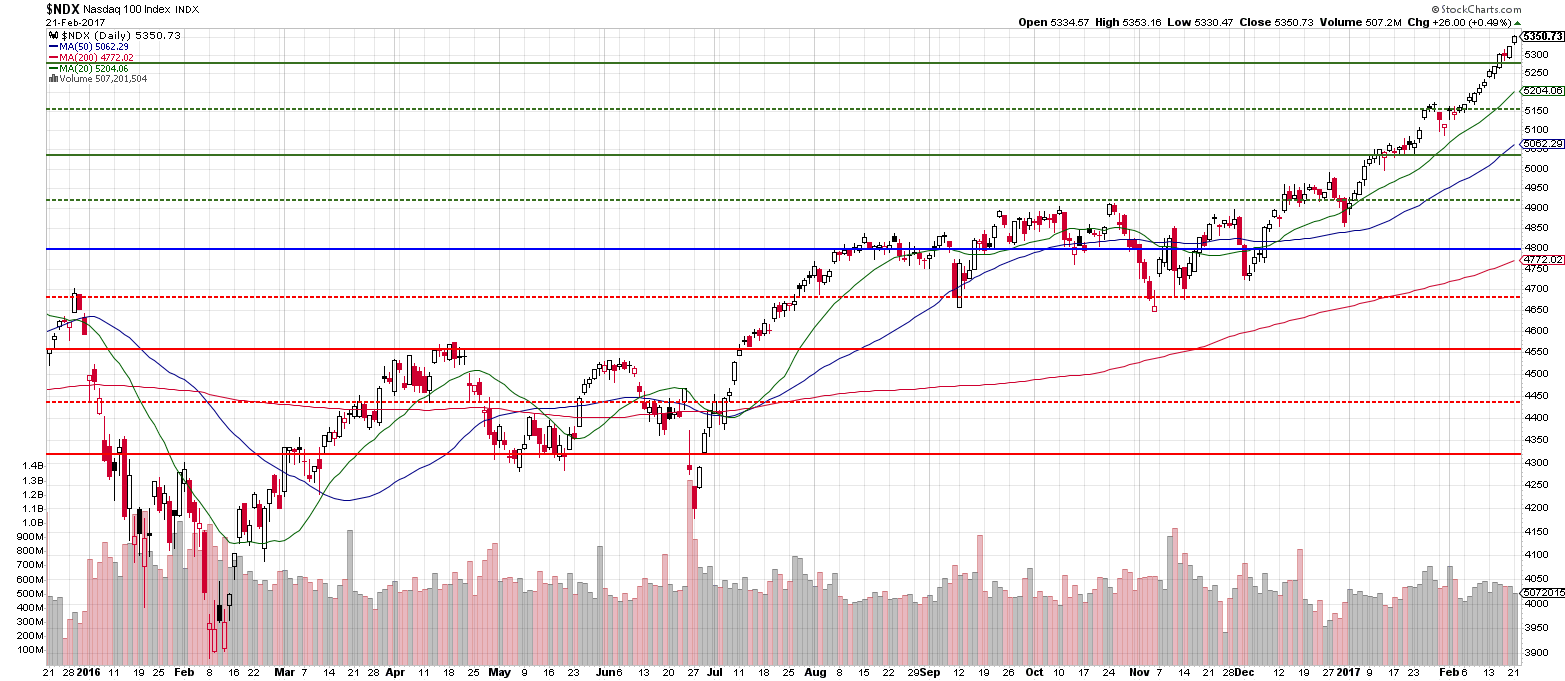

"The 7% Solution" was the "lost" manuscript of Dr. John Watson recounting his famous patient's recovery from cocaine addiction. In a similar manner, we have a market that is clearly on crack and, coincidentally, the Nasdaq Composite is up exactly 7% (5,350) from it's 5,000 line since Jan 1st – time for a bit of reflection indeed!

The real story to the Nasdaq is, of course, Apple (AAPL), which is up 19% at $137 from $115 at the start of the year. AAPL is about 15% of the Nasdaq so it's responsible for 2.85% of the 7% gain in the Nasdaq, which is 40% of 7% – that's quite a burden for one company to carry. However, we feel the move in AAPL is justified so it's not AAPL's value we're questioning but whether or not AAPL should have dragged his 99 brother and sister stocks up the hill with him or are they all irresponsibly flying too close to the sun and investors are about to get burned?

There are a lot of overpriced (by normal standards) stocks on the Nasdaq but I think Tesla (TSLA) can serve as a good proxy this evening when they report Q4 results (or lack thereof) after running up 53% since Dec 2nd, when they were at $181.50 (now $277). That's a market cap of $44.6Bn, just shy of Ford (F) at $49Bn and GM (GM) at $56Bn – even though TSLA produces just 50,000 cars a year and lost approximately $2Bn doing it. That's a loss of $40,000 per car people! How on Earth are they going to sell $35,000 cars if they are losing $40,000 per $90,000 car they sell now?

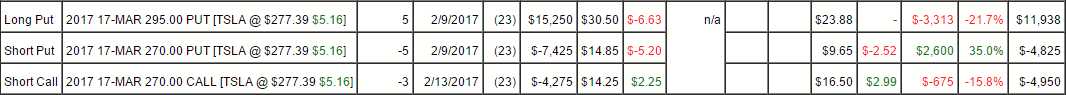

We're short on TSLA in our Short-Term Portfolio as this Q should include the "earnings" of SolarCity, Musk's solar venture which had been bleeding cash before TSLA acquired it. Musk has to check a lot of boxes and explain how he's going to sell over 100,000 Model 3s in 2017 when there isn't even an actual car yet. Our short play is this:

Nowhere to run on that one as it's a March spread, we need TSLA to disappoint tonight or it's an expensive one for us. If all goes well, this currently net $2,163 spread will return $7,500 for a quick $5,337 (246%) return on cash – nice work if you can get it.

Speaking of getting it, we got it good this morning with a nice dip on Oil Futures (/CLJ7) and we took the money and ran at $53.50 with a $620 per contract gain from yesterday's remaining plays in our Live Member Chat Room. Just this morning, while oil was still just under $54, I said to our Members:

Speaking of getting it, we got it good this morning with a nice dip on Oil Futures (/CLJ7) and we took the money and ran at $53.50 with a $620 per contract gain from yesterday's remaining plays in our Live Member Chat Room. Just this morning, while oil was still just under $54, I said to our Members:

Oil has been on a wild ride but back under $54 at the moment (/CLJ7) and the Dollar is no stronger (101.50) than it was yesterday so that's not to blame. Hopefully we'll get a proper breakdown.

There's nothing better than making a quick $500+ on each short contract before the market even opens. We're actually ready to go bullish on oil into the summer but it's way too early for $55, or even $54, so we're still taking some quick shorts when appropriate but, for today, $53.50 is a good dip, so we're done and hoping it goes back up so we can short it again.

We're doing a Live Weekly Webinar this afternoon at 1pm (EST) but it's Members Only this week as we have the Fed Minutes to look at at 2pm, so it's going to be a hectic session.