What a fantastic speech!

Well, not really but for the low bar we set for President Trump, it was a good speech although I, like many Americans, was put off a bit by Trump's shameless use of the Widow of Ryan Owens (the guy who died on Trump's first mission) as a prop to push forth his agenda. As noted by the liberal media:

"What Trump did with Carryn Owens was not presidential at all; it was obscene. He authorized an attack that killed her husband, tweeted during the raid, shifted the blame for said raid, unapologetically milked her husband's story for applause, and then proceeded to brag about the size of applause from the story. Please stop lowering the bar for this man."

?"When you lose a $75 million airplane and, more importantly, an American life is lost … I don't believe you can call it a success," Senator John McCain told NBC News in early February.

Some are accusing Trump of political posturing as Owens' father has been calling for an investigation into the botched mission that killed his son. This was a big, political grandstanding play that will either diffuse the situation or blow up in Trump's face (most likely when a reporter next week asks Trump the name of the guy he said the nation would never forget). Other than that, the speech was forgettable but it did manage to promise something to everyone – and that seems to be enough to take us, yet again, to record highs.

Some are accusing Trump of political posturing as Owens' father has been calling for an investigation into the botched mission that killed his son. This was a big, political grandstanding play that will either diffuse the situation or blow up in Trump's face (most likely when a reporter next week asks Trump the name of the guy he said the nation would never forget). Other than that, the speech was forgettable but it did manage to promise something to everyone – and that seems to be enough to take us, yet again, to record highs.

Fortunately, we put off making adjustments to our hedges yesterday but we'll sure be making them this morning as this is just getting silly. How many times can the market rip higher on the same empty promises? There were no specifics offered up yesterday and what few specifics we've seen, like the GOP Health Care Bill, are horrifying (see Monday's post).

If you are a trader – you may still catch a move in the market to Dow 21,000 – less than a month after we hit 20,000. At this pace, we'll be over 30,000 by the end of the year, up almost 100% since the election because, gosh darn it – THAT is how great Trump has already made America.

Yesterday, the market took a slight dip but the volume of declining shares outpaced advancing shares by 3:1. That's right, 3 times more selling than buying on the heaviest volume day in a week and the market barely went down. In fact, 134 stocks on the NYSE made new 52-week highs. This market is truly unstoppable – even if you sell 3/4 of the shares, apparently…

Yesterday, the market took a slight dip but the volume of declining shares outpaced advancing shares by 3:1. That's right, 3 times more selling than buying on the heaviest volume day in a week and the market barely went down. In fact, 134 stocks on the NYSE made new 52-week highs. This market is truly unstoppable – even if you sell 3/4 of the shares, apparently…

Now, with no volume at all, the Futures have flown up 160 points and we're shorting /YM here (20,975) with a stop at 21,005 and a $150 loss per contract. The potential reward, if we head back to 20,850, is $625 per contract so it seems like a good risk/reward profile on these Futures shorts. See, I just hit "publish" and now this article has been Emailed out to all of our PSW Report Members, so they have the idea pre-market – while it's hot. If you are reading this later in the day and wondering why you always miss these trade ideas – that's why.

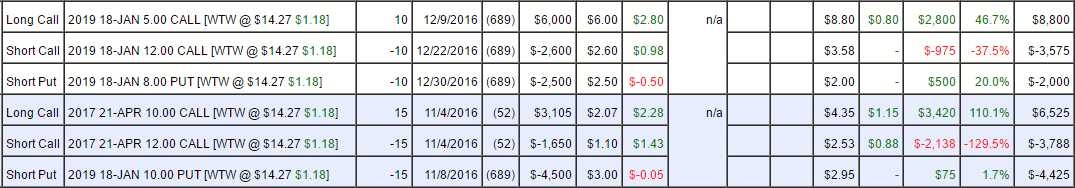

Speaking of our Members, congrats to all on Weight Watchers (WTW), which was a Top Trade Idea that we liked so much that it was also taken in our Options Opportunity Portfolio – twice! We never double dip an open trade but WTW seemed like such an obvious bargain that we added a long-term position to our existing April trade:

The two trades were made for a combined CREDIT of $2,145 and already the net of the spread is $1,537, which is a $3,682 profit (171%) so far – not bad for the first 3 months but yesterday WTW knocked it out of the park on earning and it looks like they are going to open over $16 today. The full potential on the two spreads is $12,145, so another $8,463 (another 230%) above yesterday's close – that's why we call it the Options Opportunity Portfolio!

As exciting as it is to see the Dow climb 1,000 points per month, we will be spending 1/3 of our profits on more hedges today. Our primary hedges in the OOP are the Ultra-Short Russell ETF (TZA) and the Ultra-Short Nasdaq ETF (SQQQ) and, while it is annoying to have to constantly drop a percentage of our profits into these perennial losers – it certainly helps us sleep better at night as well as letting us enjoy our weekends and vacations – there's value in that as well.

If the big dip ever comes, we should be well-protect and, if it doesn't – we'll make 2/3 of what we could have made if we didn't protect ourselves – hardly a tragedy and we're certainly NOT underperfoming the market as we're up 16% for the month, which will be 12% after we donate to the hedge fund (still beating the indexes by a mile).

But today, it's all about Dow 21,000 and whether or not that is going to be too big a pill for traders to swallow. If it isn't – then Dow 30,000 here we come because – well, why not? Valuations don't matter, news doesn't matter, Fed hikes don't matter, Trade Wars don't matter. It's all very 2007/early 2008 but none of that matters until it does. For now, enjoy the show!