I love a good short!

I love a good short!

As you can see from the Fed's own GDP forecast, Q1 expectations are now down to 0.9%, down 0.3% from just last week on weaker than expected Consumer Spending Growth which went hand-in-hand with weaker than expected Retail Sales Reports.

Nonetheless, on the same day the Fed was releasing a 25% downgrade to our GDP, they also chose to raise rates 0.25% and the market went crazy and rallied us all the way back to our highs, which you would think we'd be upset about but now we can (as I noted to our Members this morning) put on the following shorts:

- Dow Futures (/YM) at 2,100

- S&P Futures (/ES) at 2,390

- Nasdaq Futures (/NQ) at 5,440

- Russell Futures (/TF) at 1,390

These are dangerous plays and we need to be mindful that the markets are very irrational and could go higher so if any two are over the line, it's a no play. At the moment, on the Nasdaq is at the line so that's our short for the moment (and we also have Nasdaq Ultra-Short ETF (SQQQ) as a hedge, see yesterday's post). Those contracts pay $20 per point and a 25-point move in the Nasdaq is a big day so $500 would be a nice win but $250 is just fine on a pullback if the markets aren't looking too weak.

If the Futures start heading lower we begin using a strategy called "shorting the laggard" where we wait for 2 of the 4 indexes to cross below the next support and then short the others with tight stops (and out if either of the first two go back above).

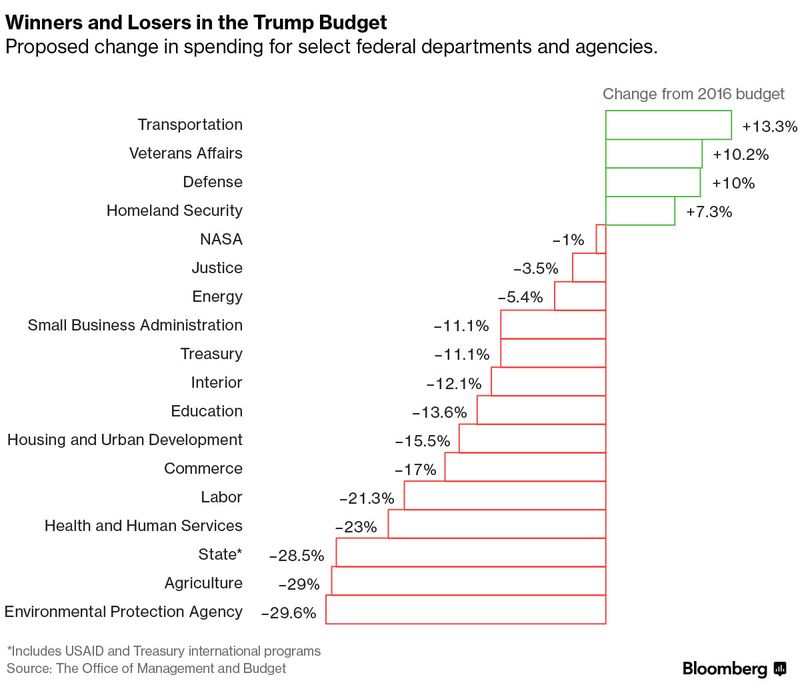

Aside from the Fed's downgrade to our overall GDP, we're very concerned with the effect Trump's Budget will have on the market as these spending cuts are effectively money that will come straight out of the economy and, as you can see from this chart, it's impacting every sector but Defense/HomeSec/Veterans and Transportation and before you get excited about Transportation – that's the wall-building budget!

Aside from the Fed's downgrade to our overall GDP, we're very concerned with the effect Trump's Budget will have on the market as these spending cuts are effectively money that will come straight out of the economy and, as you can see from this chart, it's impacting every sector but Defense/HomeSec/Veterans and Transportation and before you get excited about Transportation – that's the wall-building budget!

This is not austerity because the goal of austerity is to SAVE money but Trump's budget also gives out over $600Bn worth of tax breaks to people in his tax bracket (just looking out for the common man!) and, of course, Defense is more than half of all discretionary spending so a 10% increase in Defense alone requires 10% cut from ALL the other agencies just to cover it. It is a good idea to beef up Homeland Security though, since President Trump has stirred the pot and angered the terrorists, effectively goading them to attack us – which would then prove the need for more security, etc – good strategy!

As to the wall-building, Steven Colbert got a panel of actual construction experts together and they came up with more like $1Tn to build an actual wall – which would be a real budget-buster. Of course, it's more likely to end up being a fence – THAT we can probably afford (but no electricity!). Colbert also agreed with our observation from yesterday's chat that Trump released Trump's tax returns to prove he did pay some taxes once.

Now that the Fed is out of the way, we can focus back on the wobbly Global Economy as well as Q1 earnings, which are right around the corner already. So far, no good, per the Atlanta Fed's forecast, that GDP outlook was 3.5% in January, when the Dow was at 20,000 (down 1,000) and the S&P was at 2,280 (down 100) so the reality of the economy is falling very, VERY far short of the expectations yet dumb money keeps flying into the market as retail investors fear they are missing something – just like they do at every great market top!

What if the rally continues? Well, first of all, in yesterday's morning report, we noted that our Options Opportunity Portfolio was up 170.5% and we discussed our bearish hedges. Yesterday the market blasted higher and our OOP finished the day up 172.5% – up 2% in a day. Why? BALANCE!!! It's all about balance – we have longs and we have hedges and we don't confuse the two. The longs are investments and the hedges are short-term bets – in case the investments don't work out.

If you are worried about the market getting away from you because you are too cautious, how about adding an upside hedge that will return 435% if the S&P hits 2,600 by Jan 2019 – up less than 10% in two years. Surely you can't be bullish about your current positions if you don't think the market can gain another 10% in two years, right? Well, if so, this is a no-brainer using the S&P ETF (SPY):

- Buy 10 SPY 2019 $230 calls for $24 ($24,000)

- Sell 10 SPY 2019 $260 calls for $9 ($9,000)

- Sell 10 SPY 2019 $200 puts for $9.40 ($9,400)

That's net $5,600 cash and it pays back $30,000 for a $24,600 (435%) return on cash if the S&P is up just 10% in two years. If it's down 10% (2,142), you lose the $5,600 and if it's down 20% (1,904), you would also have to pay $10,000 because SPY would be about $190 and you're obligated for 1,000 shares at $200. The ordinary margin requirement is $20,000, which is what you would lose at $180 on SPY (S&P 1,800), which is 59 points (25%) below today's open (239).

In short, a 25% drop in SPY costs you $25,600 (assuming you do nothing along the way) while a 10% gain in SPY makes you $24,600. This is a very positive risk/reward profile and, if you are not bullish enough to make that trade – you might want to take a very hard look at your other positions and consider whether it might be time to take some profits off the table.

In short, a 25% drop in SPY costs you $25,600 (assuming you do nothing along the way) while a 10% gain in SPY makes you $24,600. This is a very positive risk/reward profile and, if you are not bullish enough to make that trade – you might want to take a very hard look at your other positions and consider whether it might be time to take some profits off the table.

At PSW, we teach our Members to maintain positive risk/reward profiles on all their trades and, if you win more than we lose on the bull side and win more than we lose on the bear side – that sets up many, many possible ways we can come out with a net win in almost any market situation. We just reviewed our Options Oportunity Portfolio's postions yesterday and seven of them are still good for new entries and, on the whole, we're very pleased with our balance. We also went over our Butterfly Portfolio Positions on Tuesday Night and our Short-Term Portfolio (STP) and Long-Term Portfolio (LTP) were reviewed last week so we are all ready for tomorrow's expiration day madness (hopefully).

I encourage you to go through your own portfolio and evaluate each of your positions (we do it every month) as if they were brand new trades you were considering now and keep track of your risk/reward profiles on each one. As you get used to doing it, it will become very obvious which trades are underperforming and need to be cut to make room for more productive positions. The SPY example above is a benchmark, as you could cut any position you now have that isn't going to make 435% in a bull market and use that instead!

Until then, we're more comfortable shorting this silliness.