Let the manipulation begin!

Let the manipulation begin!

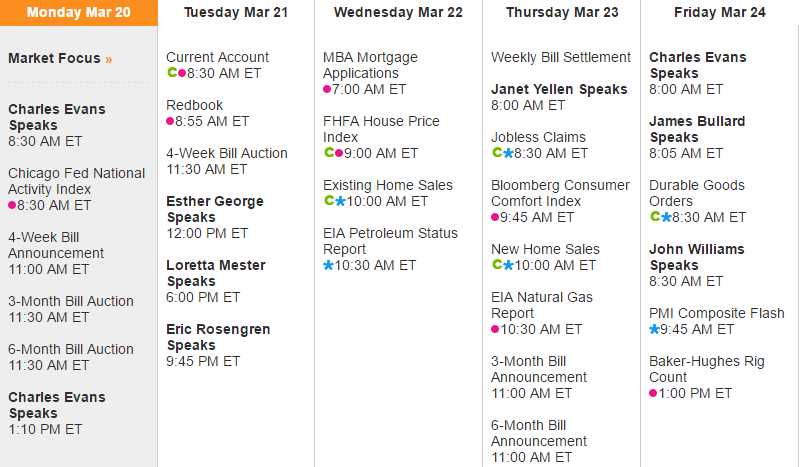

After a 0.25% rate hike did nothing to deflate the market bubble, the Fed will take another swing at things this week by speaking to us 11 times and it will be Evans (Dove), Evans (Dove), George (Hawk), Mester (Hawk) and Rosengren (Dove) on Monday and Tuesday followed by Yellen (Dove), Kashkari (DOVE), Kaplan (Neutral) , Evans (Dove), Bullard (Hawk) and Williams (Neutral) on Thursday and Friday. So an edge to the doves but the doves had a 3:1 edge last year, so it's a change in tone towards hawkish for sure. Kashkari was the dissenting voter who did not wish to raise rates at last week's meeting – he speaks Thursday at noon.

In their recent statement, the Fed says "The Committee will carefully monitor actual and expected inflation developments relative to its symmetric inflation goal." The word symmetric was added since January and indicates the Fed is warning that they do not intend to let inflation move over 2% for any period – that should be clarified a bit this week and it's a key indicator that the free money party is really winding down.

As we noted in our Friday Morning Report, the recent Fed action has driven the Dollar to the bottom end of its range, back to where we bottomed out at the Feb 1st meeting, after which we climbed back 2.5% over the next month and, unless the Fed speakers come off surprisingly doveish this week, we can expect the Dollar to rapidly move back to its mid-range at 101.50 and that will put pressure on commodities as well as the indexes.

Oil (USO) is already under rollover pressure with 3 days to trade April contracts (/CLJ7) and already we're down to $48.50 ($47.90 on April) and we hit our $49.50 shorting goal on the May contracts (/CLK7 – also from Friday's report) so you are welcome for that $1,000 per contract winner to start your week off with a smile. Our index shorts (same post) have had minor pay-offs so far but, as noted in the Report, we're confident enough in our index shorts at this point that we're beginning to short specific stocks ahead of a broad-market "adjustment."

As we expected, our 2/9 short on Tesla (TSLA) paid the full $12,500 for a lovely $8,600 (up 220%) gain on cash in five weeks – what other market newsletter do you read that does this for you?

Read this review of the Chevy Bolt and you'll see why we're so happy to short TSLA – it's everything Musk has been promising but already in production from a different car maker with thousands of dealers and much deeper pockets. TSLA is currently raising $1Bn in a secondary offering and that's just HALF of what they need just to make it through 2017 while GM just sold Opel for $2Bn after adding just over $2Bn to their cash pile in 2016. GM has salespeople and showrooms, TSLA does not – without a drastically superior car, it will be hard for Tesla to match the Bolt for consumer attention.

We're hoping TSLA goes higher but worried they won't so our trade for the moment is going to be:

- Sell 3 TSLA April $265 calls for $9 ($2,700)

- Buy 5 TSLA April $290 puts for $30 ($15,000)

- Sell 5 TSLA April $275 puts for $19 ($9,500)

That nets you into the $7,500 spread for $3,300 so the upside potential is only $4,200 (127%) but, on the bright side, it's only 32 days away (April 21st) to expiration. We only need TSLA to stay below $265 to collect the money and, if they go higher, we will roll our short calls to 6 May or June calls at higher strikes (the June $305 calls are $5 and the margin is $15,000 on 6 short ones) and then we would widen the spread, possibly adding $5 or less to roll our $290 puts to the $300 puts (now $38.50).

So we'll take the spread as we'd hate for it to get away but we're actually HOPING (not a valid investing strategy) that Tesla goes a bit higher first – so we can get better prices for a bigger spread.

Meanwhile, the reason we're still generally bearish on the markets is that the G20 communiqe has, as expected, dropped anti-protectionist language, indicating that Trade Wars will be on like Donkey Kong in 2017. While delegates greeted Steve Mnuchin and said that he had been engaged in the process, they said he didn’t elaborate on how the U.S. considers itself to be treated unfairly. It wasn’t possible to reconcile his stance and that of the other members in any substantive way.

Meanwhile, the reason we're still generally bearish on the markets is that the G20 communiqe has, as expected, dropped anti-protectionist language, indicating that Trade Wars will be on like Donkey Kong in 2017. While delegates greeted Steve Mnuchin and said that he had been engaged in the process, they said he didn’t elaborate on how the U.S. considers itself to be treated unfairly. It wasn’t possible to reconcile his stance and that of the other members in any substantive way.

I “regret that our discussions today didn’t end in a satisfactory manner,” French Finance Minister Michel Sapin said in a statement. In a press conference later, he said that “there wasn’t a G-20 disagreement, there was disagreement within the G-20 between a country and all the others. This isn’t a caricature, this is the reality of things.”

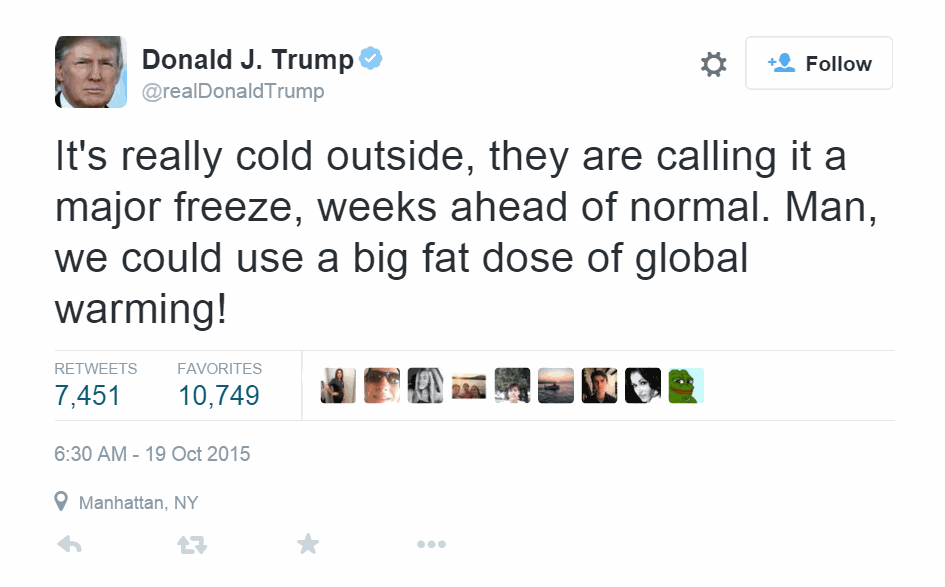

Climate change was also dropped from the agreement as the US, China, India and Saudi Arabia all wish to continue destroying the World so, in the grand scheme of things, who really cares what happens in the market during one of our last precious weeks on Planet Earth? I mean really people, you voted for your own extinction – lemmings are laughing at us!

Climate change was also dropped from the agreement as the US, China, India and Saudi Arabia all wish to continue destroying the World so, in the grand scheme of things, who really cares what happens in the market during one of our last precious weeks on Planet Earth? I mean really people, you voted for your own extinction – lemmings are laughing at us!

Aside from passing a death sentence on the planet and costing the US millions of jobs by introducing the exact same tariff program that kick-started the Great Depression, our Government is hell-bent on ripping health care away from tens of Millions of Americans and don't forget the Draconian Budget Proposal – that pumps hundreds of Billions of Dollars from the poor to the rich something I warned you Trump and his ilk would do 10 years ago "The Dooh Nibor Economy (that’s “Robin Hood” backwards!)" Here's John Oliver on the subject:

None of those things give me that "all-time market high with record valuations" kind of feeling but the market still hasn't given us a signal to cash in our longs just yet, so we will remaining "Cashy and Cautious" with plenty of CASH!!! on the sidelines and plenty of hedges protecting our longs and we'll see how the quarter finishes next Friday but don't forget the Fed has already cut GDP forecasts from 3% to 0.9% for Q1 – does that sound like all-time high to you?