And down we go!

And down we go!

I'll bet those hedges are looking better and better every day now, right? Now that the enthusiastic GOP investors have learned their first (of many) political lessons of the Trump Error (and we had plenty under Obama when we had both houses), we'll see how their enthusiasm for the market holds up because, as we've noted before – there is/was a huge disparity between economic optimism of Republicans and Democrats and, if the Republicans begin to doubt to the Power of Trump – all those confidence numbers can drop like a rock tied to a bigger rock.

Even as I write this we're getting mail from people trying to explain gravity to us. Yes, we get it, it was an expression! On the other hand, a lot of the basics need to be explained to the Trump camp and their supporters if they are going to get anything other than executive orders passed this term (however long that lasts). The Futures, meanwhile, are following through to the downside this morning and we ran our 5% Rule through the Charts in this morning's Alert to our Members. Here are the Dow notes as an example:

So Dow 21,000 less 5% is 19,950 and 2.5% is 20,475 so we'll look for that for support and the 525 drop we can call 20,500 the line that matters with 100-point bounces to 20,600 and 20,700 but I'd start shorting at 20,600 – if we even make that. Worse would be failing to retake 20,500 – then it's almost a certainty we drop another 500.

This is happening despite us being wrong about the Dollar on Friday morning, as 99.50 did not hold and we are now at 98.90, which is down $700 per contract (/DX) at the moment but I still have faith but, if I'm right, that will be bad news for the indexes as the weak Dollar is the only thing keeping them from those 5% corrections that we think are inevitable at this point (so you may was well lay back and enjoy it – hat tip to Clayton Williams).

Speaking of enjoying a correction, Wednesday's SDS hedge should be doing fantastic this morning as we picked up 30 SDS June $12 calls for $1.65 (a free trade idea from the morning post) for a little extra protection (we're already very well-hedged and very much in CASH!!!) ahead of the drop we expected (this one). Now we can just lay back and see how low we can go.

Speaking of enjoying a correction, Wednesday's SDS hedge should be doing fantastic this morning as we picked up 30 SDS June $12 calls for $1.65 (a free trade idea from the morning post) for a little extra protection (we're already very well-hedged and very much in CASH!!!) ahead of the drop we expected (this one). Now we can just lay back and see how low we can go.

We also gave you our Russell Ultra-Short (TZA) hedge idea on Thursday Morning (don't miss another timely, money-making post by subscribing here) and TZA should be right about $20 this morning, putting that $1,200 cash spread $15,000 in the money out of it's $24,000 potential pay-off – you are very, very welcome!

There's nothing like a good hedge to take the sting out of a market correction. Learning how to hedge properly is learning how to play the market with confidence and it gets you off the market roller-coaster and on a nice, steady path to reliable returns. THAT is what we teach our Members to do at PhilStockWorld!

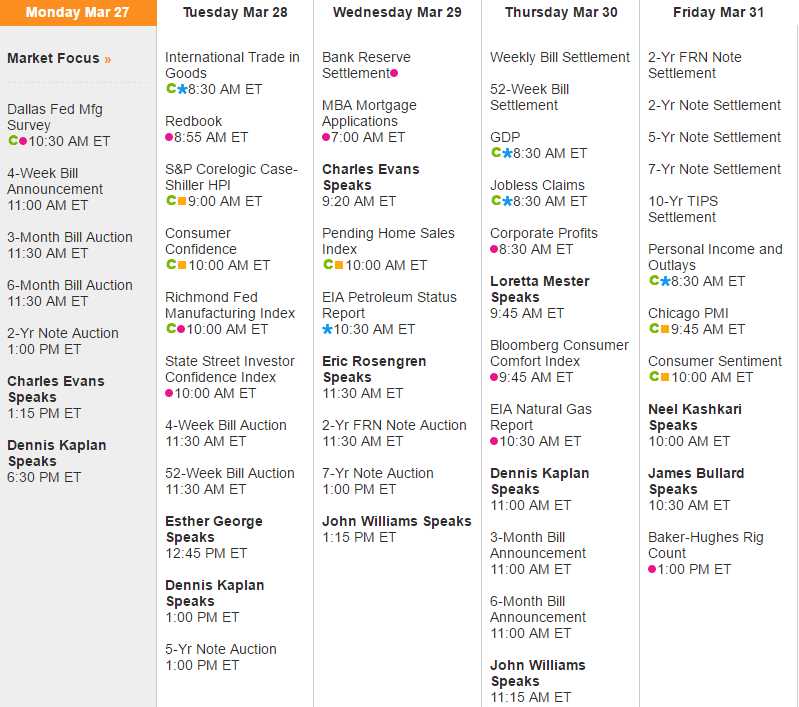

It's going to be another crazy Fed Speak Week with 13, count 'em, 13 Fed speakers in just 5 days. That's 2 per day and a 3rd on Wednesday and 2 extra on Thursday – just to make sure they have all their bases covered while the Government auction off another $100Bn worth of bonds this week. We'll also see Dallas and Richmond Fed Reports as well as Consumer and Investor Confidence (uh-oh), Housing Data and, on Thursday – it's our GDP (uh-oh) along with Corporate Profits:

Dudley got cut off, at 4:30 on Thursday.

There are still plenty of earnings to play with. Some are early reporters and some are late, so a fun mix of data to get us ready for the official start to Q1 earnings season – with probably more shoring opportunities than anything else as most things are still over-priced and this little correction won't likely fix that.

I have to run to NYC to do a Nasdaq interview so please be careful – watch those bounce lines and we'll see where things settle down this afternoon. We already have our lines to watch and, as I've said, I think we fail the 2.5% lines and move down at least another 2.5% from here but, as long as we're not accelerating the drop – it's not too bad.

Happy trading!

– Phil