How quickly they forget.

How quickly they forget.

It was just two months ago that the Fed directly told us (at S&P 2,280) they were concerned there was an equity bubble yet already, after just one rate hike and a 100-point additional gain (5%), the general consensus is that the Fed will not be hiking at today's meeting. Granted Trump's first Jobs Report was a disaster, falling 50% below Obama's average of creating 200,000 jobs per month for 8 straight years (15M+) but hey, you can't go calling the President a complete and total failure just because of one horrible jobs report, right?

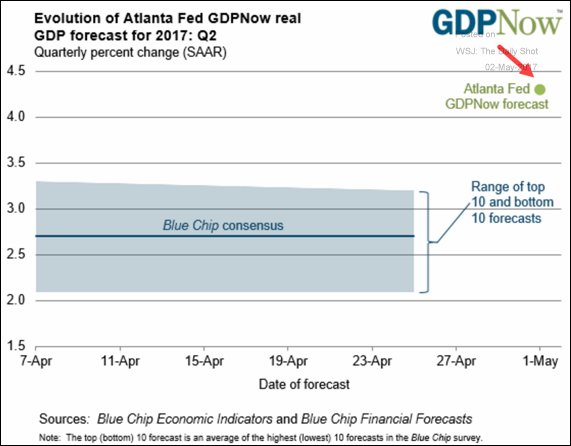

We'll get another jobs report on Friday but, meanwhile, the Atlanta Fed has already pumped up their forecast for Q2 GDP to 4%, looking to repeat the huge rebound we had between Q1 and Q2 of 2014 and that was good for a 100-point S&P rally – but back in those days we used to wait for the actual improvement to take place before rallying the markets – now we rally on rumors of GREAT things to come!

We'll get another jobs report on Friday but, meanwhile, the Atlanta Fed has already pumped up their forecast for Q2 GDP to 4%, looking to repeat the huge rebound we had between Q1 and Q2 of 2014 and that was good for a 100-point S&P rally – but back in those days we used to wait for the actual improvement to take place before rallying the markets – now we rally on rumors of GREAT things to come!

So, it's kind of doubtful the Fed, who are about 50% above the general consensus of where Q2 (you're soaking in it) will be over the next 58 days, are thinking Friday's Non-Farm Payroll Report will be another bomb and, if that's the case, why wouldn't they be looking to raise rates another quarter point since the last quarter-point hike did nothing to deter investors and it did nothing to change the yield curve either as rates are lower now than they were at the last meeting (3/15).

In theory, the Fed cares about jobs and inflation but recently they've been talking about stock bubbles and they are very wary of causing a housing bubble and home prices are back at their 2006 bubble peak when the Fed regrets not having taken action before allowing the entire economy to collapse and almost destroying life as we know it. Do you think they feel lucky this time or just forgetful?

Inflation is certainly on target over the Fed's 2% level and, in fact, the Urban CPI is getting close to a red flag-level 3% while countries like Turkey (11.9%) and Kenya (11.5%) are already flirting with hyperinflation with Syria (37%), Argentina (41%) and Venezuela (808%) having already gotten completely out of control. Inflation is the thing the Fed fears the most and they will try to stay ahead of the curve to keep it under control.

In fact, if March's NFP number turns out to have been a glitch and we are stuffed with jobs in April, just 36 hours after the Fed Meeting, the Fed will look incompetent if they DON'T raise rates ahead of a big jobs number. Since the market is not expecting it, we have a better chance of a downside surprise this afternoon than an upside one.

Join us this afternoon at 1pm (EST) for a Live Trading Webinar, where we'll analyze the Fed Statement and, hopefully, come up with a nice way to profit from it.

Speaking of profits, our "wash, rinse, repeat" Coffee Futures (/KC) trade is back to $136.50 for another nice gain this morning – are you tired of winning yet? If not, keep a tight stop on the profits and wait for the next pullback and play long on the cross over the $135 line again, and again, and again.

Oil Futures (/CL) popped from $48.50 over $49 for a $500 per contract gain but then plunged to $47.50, where we are going long yet again. I can't explain this morning's weakness in oil as the API report showed strong draws and we'll get the EIA Report at 10:30, so we'll see.

Consumers remain confident but, as noted by Matt Klein in the Financial Times, it's the old people and uneducated people that are the most confident (ie. Trump's core voters) while the economic expectations of those who have college educations looks like this:

We previously noted the huge disparity between Trump supporters and Democrats but the disparity between the educated and uneducated is truly stunning. This goes a long way towards explaining why the so-called "smart money" keeps selling into this rally – even as the dumb money continues to pour in. Corporate insiders have also been heading for the hills, selling $10Bn worth of shares in March, the biggest outflow since 2010.

"This is definitely a negative sign," Lamensdorf wrote in his April newsletter. "They do not see value in their own companies!"

Have I mentioned how much I like CASH!!! lately?