On Friday a ransomware attack hit 200,000 computers in 150 countries and the source seems to have been files that were stolen from our very own NSA by WikiLeaks. Now, granted this attack only affects people who haven't updated Microsoft (MSFT) Windows since March and another patch came over the weekend – so the good news is that MSFT seems to be able to keep on top of these things but random cyber-attacks are yet another risk factor the market is now ignoring as we hover around those record highs.

As a trade idea off this madness, I like FEYE, who provide Corporate Cybersecurity Solutions and whose phones should be ringing off the hook this morning as it occurs to many more companies that maybe it is important to have someone make sure their computers aren't attacked by malware.

FireEye (FEYE) is a pre-profit company but growing at about 20% and likely 2 more years away from turning a profit but, at $14.79, you can sell the 2019 $12 puts for $2.05 for a net $9.96 entry, an additional 32% discount to the already low price. It's a good way to get your feet wet and watch the stock and ordinary margin on the short puts is only $978 if you sell 10 so you collect $2,000 against $978 in margin and your return on margin is over 200% and all the stock has to do is stay above $12, giving you a $2.79 cushion (19%) on your full gain.

.JPG)

Oil is up on news that Russia is agreeing with OPEC to extend production cuts through the first quarter of 2018 and that should all be ratified at the meeting a week from Thursday. Of course they are asking the US producers to voluntarily cut back and that's not going to happens, so it all may still fall apart – especially since they can't even get Libya to cut back – and they are a Member!

We're also taking the money and running on Silver (/SI) with a $1,500 gain at $16.70 since Wednesday morning's PSW Report, as it's mainly up on the weak Dollar (/DX) at 98.75 and we're going long /DX down here which means we feel /SI will pull back a bit. We still like Coffee (/KC) at $134 for quick gains to $137 and Fridays' LNG/UNG trade is also off to a great start with LNG popping 3.25% Friday and looking like it will make another attempt at $50, so you're welcome for those as well…

Also from Wednesday's Report, our FXP play will be doing poorly as President Xi announced another $100Bn in stimulus over the weekend as China moves quickly to pick up the World Leadership ball that Trump fumbled. Fortunately, we paid net 0.60 for the May $25 calls and they are still about $1.25 and we'll take that money and roll to the June $24 ($2.25) calls and leave those uncovered until the short May $28s expire at the end of the week.

As nice as $100Bn in stimulus might sound for China – it's just a drop in the bucket as liquidity evaporates and the bond market collapses over there. We went through this before, in 2015, when no one would listen to me as China began to fall apart and the US markets remained oblivious so I will just summarize China's status by saying – THE SKY IS FALLING!!!

As nice as $100Bn in stimulus might sound for China – it's just a drop in the bucket as liquidity evaporates and the bond market collapses over there. We went through this before, in 2015, when no one would listen to me as China began to fall apart and the US markets remained oblivious so I will just summarize China's status by saying – THE SKY IS FALLING!!!

The yield spread on Corporate Bonds is also rising, now over 1.4% so that's over 5% for Chinese Corporations to finance their $9Tn in debt and that's $450Bn a year in interest alone coming out of Corporate Profits. We already know the assets pledged against those loans is questionable as well and Citigroup just put out a note to their clients titled "China: Caution Ahead" and India refused to even attend China's economic summit this morning, saying China's initiatives were causing an "unsustainable debt burden", which seems to be evidenced by the explosion in borrowing costs already.

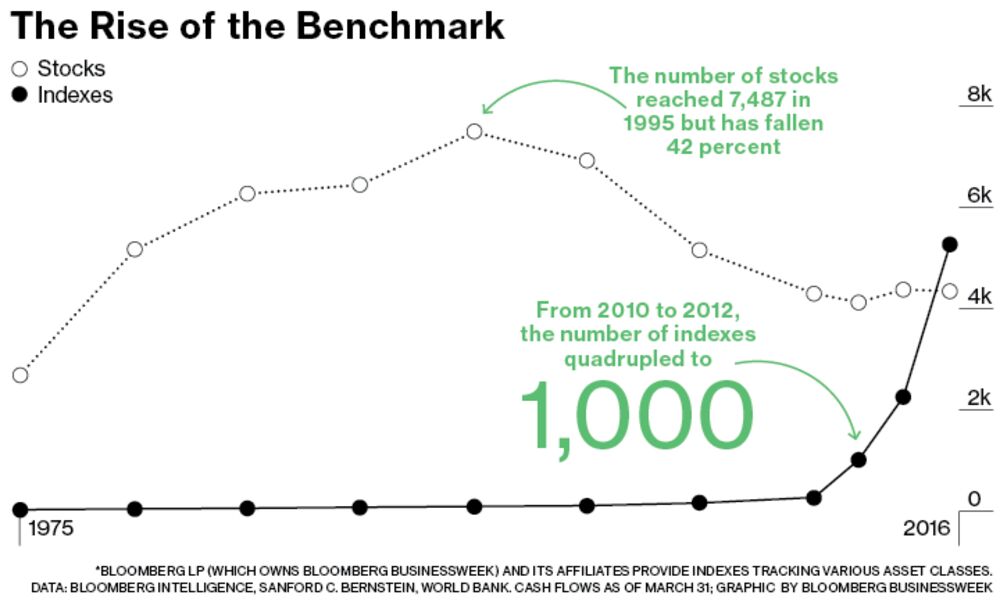

One reason the markets seem to be taking all this in stride is that there are no more markets, only ETFs and Index Funds which, in turn, mindlessly buy stocks (dumb money), no matter what the Fundamentals look like. As you can see from this Bloomberg table, there are now well over 5,000 ETFs and Indexes tracking just over 4,000 stocks. With more and more money pouring into ETFs and Funds the money simply has to jam it's way into a diminishing supply of equities – whether with or without merit.

Now an optimist can say this can keep going forever but a pessimist might note that, as the ETFs grow, the volume of trading of equities drops off leading to very, very poor liquidity and, should those ETFs turn around and try to withdraw money from the markets with the same relentless, mindless resolve they've been putting it in – well, there simply are not enough buyers to support them and we could make the 2008 crash look like a practice run.

It's a very thin data week, and only Mester (Thurs) and Bullard (Fri) scheduled to speak from the Fed so the spotlight will be on small-cap earnings as we wind down the season. Retail is, of course, on death watch so each of those reports will be extra-meaningful.

Needless to say, be careful out there.

The Dollar ETF (UUP) is a fun play at $25.50 this morning as we can buy the June $25 calls for 0.60 – just a 0.10 premium to have a call on them for a month. This seems like a very easy way to make a quick 0.15 (25%) at least as the calls were 0.80 last week and the Dollar is only down off Euro strength as Merkel had an election victory over the weekend (so more stability in the EU).