The Futures went flying this morning.

The Futures went flying this morning.

Apparently, after having a strong day in the US yesterday and despite the Fed minutes that indicated imminent tightening, China decided to stick it in Moody's eye by strengthening the Yuan to boost their own markets. The move drove the Shanghai Composite 1.4% higher for the day while the Hang Seng gained 0.77% and the subsequent plunge in the Dollar, to 96.80, goosed our own stock Futures to even higher highs.

We're long on the Dollar (/DX) down here and we also have Dollar ETF (UUP) June $25 calls, now 0.24 with UUP at $25.08 as we think there are still strong odds the Fed tightens at their June 14th meeting. We went over the minutes of the last meeting in yesterday's Live Trading Webinar and noted that the Fed was waiting for evidence that an "economic slowdown is transitory" since May 2nd and, since then, we've had generally bullish data that indicates the Fed will go ahead with the next phase of tightening sooner rather than later.

Goldman Sachs (GS) agrees with us and pegs the likelihood of a June hike at 80% with another rate hike in September, followed by the announcement of balance sheet normalization at the December meeting and possibly another hike there though I think they'll be more likely to hike on Nov 1st if the markets take the Sept hike well. Citibank agrees with me there, saying: "The fact that operational details are closer to being specified shows that the FOMC could be ready to announce tapering of its balance sheet earlier than previously expected. This increases the risk of a September announcement relative to our current view for an announcement in December."

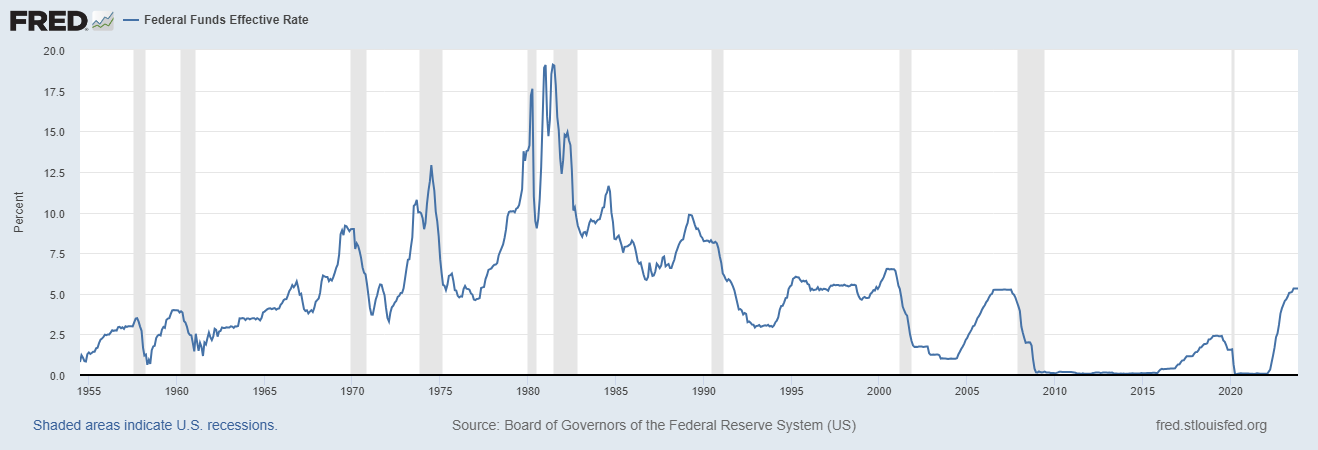

The chart above is not complicated, Fed tightening ALWAYS leads to recession (grey lines) and recessions are rarely more than 10 years apart. The markets are very likely enjoying their last harrah at the top but my advice is to SELL IN MAY (get back to CASH!!!) and go away until we have a proper correction. Our Member Portfolios are roughly 80% CASH!!! (have I mentioned how much I like CASH!!! lately?) and we are very, very well-hedged – some would say over-hedged at the moment as this annoying market never goes down!

That's far from annoying for our Long-Term Portfolio, where we still have 55 long positions and, at last week's review, we didn't find a single one we even needed to change. The month before we had a purge to get to more CASH!!! and, since our April 9th Review, the LTP has gained $80,414 while our hedges in the Short-Term Portfolio (STP) have lost $18,901 so the net gain of our paired portfolios has been $61,513 or 10% of our $600,000 basis for the two.

That's far from annoying for our Long-Term Portfolio, where we still have 55 long positions and, at last week's review, we didn't find a single one we even needed to change. The month before we had a purge to get to more CASH!!! and, since our April 9th Review, the LTP has gained $80,414 while our hedges in the Short-Term Portfolio (STP) have lost $18,901 so the net gain of our paired portfolios has been $61,513 or 10% of our $600,000 basis for the two.

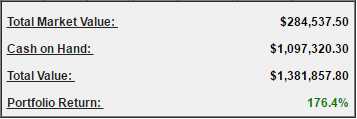

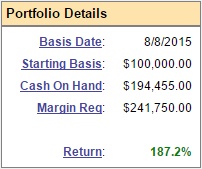

It's all about balance and, fortunately, we got a nice test of a 2.5% dip in the markets last week and our Short-Term Portfolio did its job and covered the losses of our LTP. Unfortunately, our self-balancing Options Opportunity Portfolio (OOP) has been a bit too bearish and we have lost $4,752 in the past month, pushing us a bit further away from our goal of having a 200% gain by our 2nd anniversary. The OOP is the one we trade live, over at Seeking Alpha, and we just added a bullish spread on Monday on Taser (AAXN) as follows:

It's all about balance and, fortunately, we got a nice test of a 2.5% dip in the markets last week and our Short-Term Portfolio did its job and covered the losses of our LTP. Unfortunately, our self-balancing Options Opportunity Portfolio (OOP) has been a bit too bearish and we have lost $4,752 in the past month, pushing us a bit further away from our goal of having a 200% gain by our 2nd anniversary. The OOP is the one we trade live, over at Seeking Alpha, and we just added a bullish spread on Monday on Taser (AAXN) as follows:

TASR (5/22) – Our Stock of the Decade has pulled back to only 350% above our $5 entry so we're interested again. A combination of widespread civil unrest and too many cameras (which TASR sells too) makes it impolitic to shoot protestors (though beating grannies seems fine). There's a lot of competition in the body camera biz but TASR owns the stun gun market and those relationships give them a big advantage over the competition. Sales are not a problem for TASR – camera sales were up 150% from last year with overall growth at 46% – it's a margin issue ("only" 60%) and margins can be fixed quickly in electronics.

This one is a buy for us as we took $29 and ran last year and now, getting back in is a must near $22. We already have 5 short 2019 $20 puts in the OOP at $3.20 and we can add 10 2019 $20 calls ($7.30) and sell 10 2019 $27 calls ($3.80) for net $3.50 ($3,500) less $3.20 ($1,600) we originally collected is net $1,900 on the $7,000 spread with $5,100 (268%) upside potential.

As you can see, we caught a nice bottom but you can still get more or less the same prices and it's easy to get good returns when you fill your portfolio with sensible, well-hedged trades like this one that have 268% upsides, right? The (5/22) notation is from the Watch List over at PSW, which we shared with our OOP Subscribers over at Seeking Alpha when we did a full review in Monday's Live Member Chat Room.

That's the purpose of our Watch List. Whenever the market is more bullish than we thought we simply pick one of the stocks we're watching that's still on sale and add it to our list. For instance, in the LTP, we sold 5 Verizon (VZ) 2019 $50 puts for $8.60, dropping $4,300 of lovely, lovely CASH!!! into our pockets in exchange for our promise to buy VZ at net $41.40. That would be $20,700 of Verizon stock (which pays a 5% dividend) and our allocation blocks in the LTP are $50,000 so we'd still have plenty of room to double down if the market collapsed and VZ went on a bigger sale.

That's how we fill our LTP with drastically discounted stocks over time (see: How To Buy A Stock For A 15-20% Discount) – we simply find a VALUE level we are willing to play at and then get paid to promise to step in and make a floor. Of course, the vast majority of those short puts expire worthless but then we get to keep the money and move on to promise to buy another stock we'd like to own if it gets cheaper. In our Long-Term Portfolio, we have 24 short put plays – generally we try to add one per month that pays $4-5,000, which gives us a nice $50,000 income stream on the side and, as noted above, if we keep the margin requirements near $10,000 per trade – we can make those kinds of returns against $250,000 of idle CASH!!! (20%). Sure beats the bank, right?

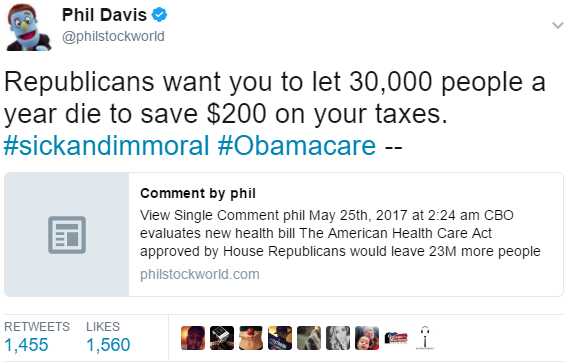

Now, on a more serious note. I have to chastise you, the citizens of the United States, for participating in one of the worst atrocities in human history. As I tweeted last night, the Congressional Budget Office (now run by Republicans, mind you!) has evaluated the "TrumpDon'tCare" Health Bill and has determined it would drop 23M Americans off the Health Care System which will then lead to the DEATH of an additional 30,000 of those people EACH YEAR.

Now, on a more serious note. I have to chastise you, the citizens of the United States, for participating in one of the worst atrocities in human history. As I tweeted last night, the Congressional Budget Office (now run by Republicans, mind you!) has evaluated the "TrumpDon'tCare" Health Bill and has determined it would drop 23M Americans off the Health Care System which will then lead to the DEATH of an additional 30,000 of those people EACH YEAR.

This is besides the poorer quality of life that will affect 10 times that many as they have to live with diseases and injuries that could have been treated by a more caring nation. How can you possibly sit by and let people suffer like that – why are you not OUTRAGED by this atrocity being committed in your own country – supposedly on your behalf?

Is it because the costs are out of control? Well according to Trump's own optimistic numbers, depriving 23M people of Health Care will save us $119Bn over the next decade, that's $12Bn a year. Well, that sounds like a lot, I guess I would kill 30,000 people for $12Bn, right? Only, how much money is that really? Trump's budget is $4.1Tn, which is 4,100Bn so $12Bn is 0.29% of the budget. Surely there are other things we could cut that are less murdery, right?

Also, even if you go with the party line that only the Top 20% pay significant taxes, that's still over 60M people and 60M people saving $12Bn works out to…. drum roll please… $200 per person! Now how good do you feel about the 100 people you sentence to DEATH every day in order not to pay not even $1 per day less tax? You should feel sick! You should feel ANGRY that there are people in Washington who would even consider carrying out this sort of atrocity – let alone to do it "for your benefit."

Also, even if you go with the party line that only the Top 20% pay significant taxes, that's still over 60M people and 60M people saving $12Bn works out to…. drum roll please… $200 per person! Now how good do you feel about the 100 people you sentence to DEATH every day in order not to pay not even $1 per day less tax? You should feel sick! You should feel ANGRY that there are people in Washington who would even consider carrying out this sort of atrocity – let alone to do it "for your benefit."

Come on, you're not an idiot, this is simply a way to justify another $119Bn in tax break for Donald and his Top 1% pals but, make no mistake about it – those deaths are on all of our heads – we let this happen – we're LETTING this happen if we sit here and do nothing to stop it!

Do something to stop it, please – 300,000 Americans Trump doesn't care about will die if they get away with this – don't let them do it!