This is a good day to take off.

I can't take off because I'm doing a Live Trading Webinar at 1pm, EST (all are welcome), where we will be showing people NewsWare – the best way to get the FACTS in real time. Other than that, though, we don't expect much action today at tomorrow we have Jame's Comey's testimony, the UK election and the ECB rate decision. The Euro didn't wait and dropped half a point this morning as the UK is in electoral turmoil while Draghi has given every indication that "easy" is his only setting.

That's punched the Dollar up (we're long), giving us a nice start to the morning. The ECB is very focused on inflation and Draghi has repeatedly said that inflation must look like it's on a sustained path to 2% before he will remove monetary stimulus and inflation fell to 1.4% in May with core inflation way down at 0.9% – so there's really no drama tomorrow and that's what made our Dollar longs such an easy call.

It's a good thing the ECB doesn't have a jobs goal because PricewaterhouseCoopers (PwC) projects that 38% of jobs could be at risk of replacement by automation within the next 15 or so years. That's odd since Treasury Secretary Steven Mnuchin thinks that we're so far away from seeing artificial intelligence take American jobs that "it's not even on my radar screen." 38% of the US workforce is 62M jobs – about 4M per year over 15 years and our Treasury Secretary doesn't think it's worth thinking about?

In the shorter-term, the World Economic Forum projects a loss of 7.1M jobs in the World's top 15 countries by 2020 and, last I looked, we're halfway through 2017 so 2.5 years of carnage before the main event begins to devastate the workforce. Just last night, Elon Musk was talking about rolling out electric, self-driving trucks that would eliminate the need for 3.5M truckers working in the US – Jimmy Hoffa must be spinning in his unmarked grave!

Fortunately, Congress is on the case with the House having passed a bill to phase out Medicaid starting in 2020 in order to allow President Trump to give himself and his rich friends another $834Bn in tax breaks. Hopefully the bill fails in the Senate as it would immediately take away Health Care from 24M Americans and, over time, another 30M seniors – effectively killing close to 100,000 people a year simply because they can't afford health care.

Fortunately, Congress is on the case with the House having passed a bill to phase out Medicaid starting in 2020 in order to allow President Trump to give himself and his rich friends another $834Bn in tax breaks. Hopefully the bill fails in the Senate as it would immediately take away Health Care from 24M Americans and, over time, another 30M seniors – effectively killing close to 100,000 people a year simply because they can't afford health care.

The GOP policy here is a complete rejection of reality and creates a crisis out of nothing in order to loot the Government for the sake of the Top 1% (mostly the 0.01% – a club that includes Trump and Mnuchin). The long-term repercussions of having the entire population of the UK, Germany or France uninsured is simply immeasurable and will likely drop this country down to 3rd World status in terms of overall quality of life for the "average" (aka not rich) citizen.

Speaking of rich citizens, we're a lot richer today as ABX took off like a rocket for us yesterday (see morning Report for our trade idea) and we're still waiting for gold (/YG) to cross the $1,300 line so we can take a long play from there while yesterday's trade ideas for Oil (/CL) and Gasoline (/RB) were good for another $4,000 worth of gains in yesterday's trading.

Sadly, we can't make it 3 days in a row because we don't like the morning action but Coffee (/KCU7) is back to $128 and we're still bullish there. While Natural Gas Futures (/NGV7 is what we like to play) are already up 0.10 ($1,000 per contract) from last week's Webinar call, this may be your last chance to get in this cheap as the WSJ has finally caught on to our premise that increasing LNG exports will inevitably drive the market much higher over time.

The Natural Gas ETF (UNG) was our Stock of the Year in 2016, the first time AAPL wasn't selected since 2012. We were down at $7 at the time and we cashed out around $10 but now it's back to $6.86 and once again interesting – although the decay makes it a rough long-term hold. I do like this simple way of playing it to be over $7 at the end of the year with the following spread:

- Buy 20 UNG Jan $5 calls for $2.02 ($4,040)

- Sell 20 UNG Jan $7 calls for 0.85 ($1,700)

- Sell 5 LNG 2019 $40 puts for 4.10 ($2,050)

That puts you in the $4,000 spread for net $290 in cash with a $3,710 (1,279%) upside potential at $7 or better in January (as long as LNG stays over $40 as well). Worst case is you end up owning 500 shares of Cheniere (LNG) for net $40.58 ($20,290) but we like LNG long-term (they are the primary exporter of US Nat Gas).

See, a very simple play for a very simple premise and it returns an average of 50% of your cash each month for the next 18 months – beats bank or bond rates, right? No wonder everyone keeps putting more money into the market. We even put more money into the market yesterday as we added to longs in our Butterfly Portfolio and we did the same in the OOP and STP last week and, over the next two days, we'll be making additions to our Long-Term Portfolio to reflect the undying bullishness of the market. Balance is what we strive for when adjusting our portfolios.

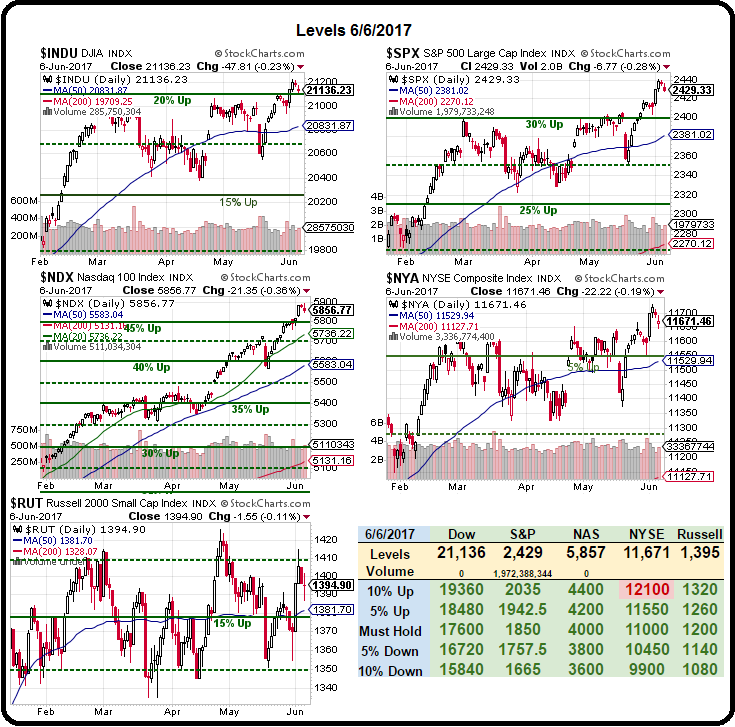

While it's hard to imagine the markets going even higher than this – you can't fight the trend all the time and we'll be happy to go with the flow if they can make it through Comey's testimony without a pullback. Meanwhile, don't forget to join us for our Live Trading Webinar at 1pm, EST today – we'll be looking at Futures Trades and discussing some additional hedging strategies – just in case…