Seriously?

Seriously?

The House voted yesterday to repeal much of the Dodd-Frank Act (the one that was meant to protect us from another Financial Crisis) by creating the Orwellian-named Financial Choice Act, which was unanimously opposed by Democrats because "it is bat-shit crazy." Only one Republican, Walter Jones of North Carolina, was brave enough to stand up against this bill, which was crafted by a coalition of Goldman Sachs flunkies and Koch-funded think tanks.

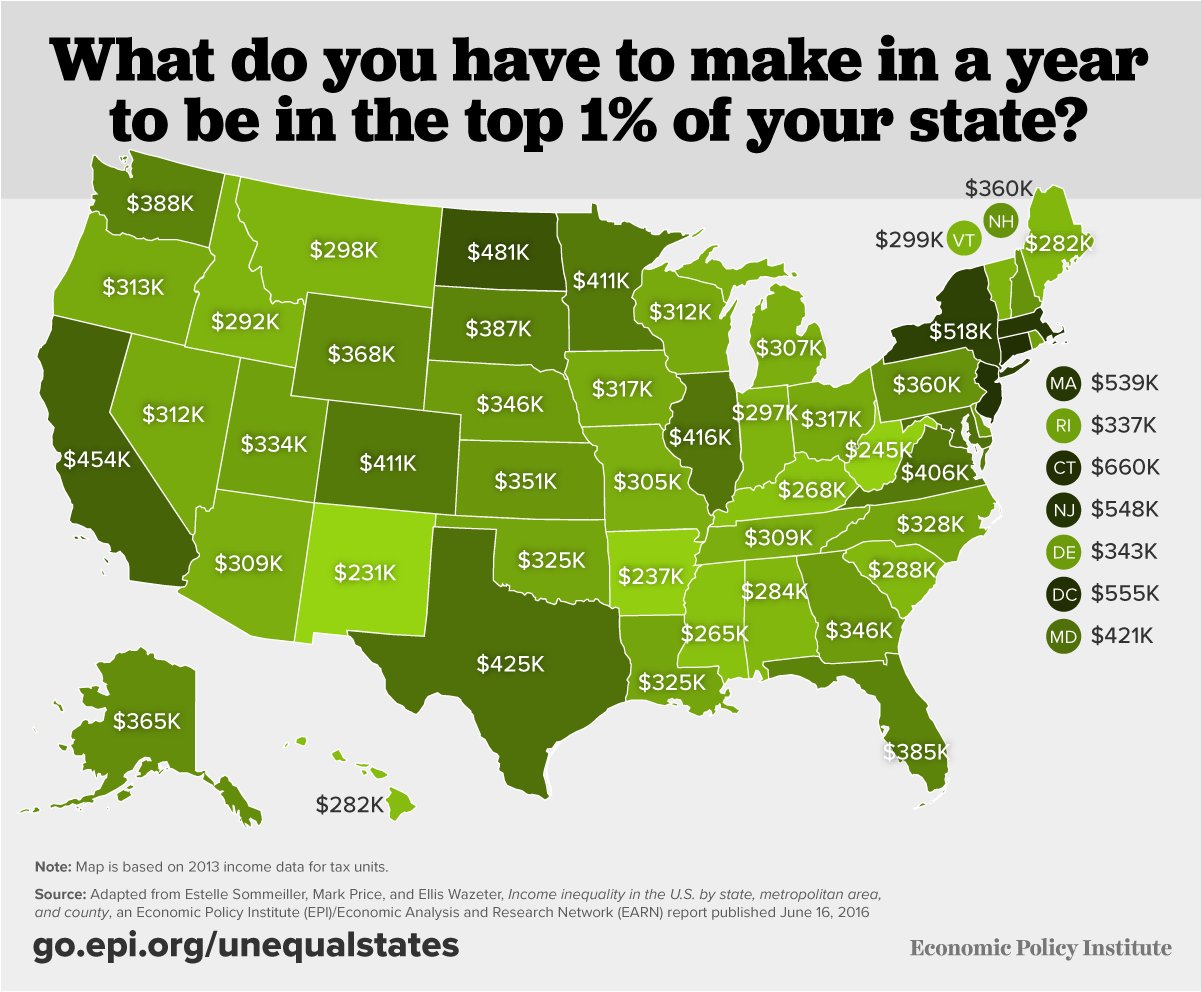

As you can see from the chart above, the financial crisis was very good to the top 1%, dropping a 15% larger share of the wealth into their laps (and out of your pockets if you are not one of us!) while the poor, of course, got 10% poorer. It's a fair trade – in order for 1% of us to get 15% richer, you only have to get 10% poorer – so we both win, right?

So the incentive for Trump and his Top 1% buddies and their pet Congresspeople is to create another financial emergency, which will allow them to once again take on sweeping emergency powers and plunder the Treasury while plunging the Bottom 99% further into National Debt (now $20 TRILLION) to pay for it – just like we did last time. Or maybe I'm wrong – how is that trickle down thing working for you so far?

That's just the Top 1% minimum cut-off. To get into the Top 0.01% (32,000 Americans), you need a minimum income (not wealth) of $36M per year. THEN you will get the attention of a Congressman! As it stands now, the banks are in for a good old time as they are once again allowed to engage in speculative trading (the kind that drove oil over $100/barrel and gold to $1,800/once) and, if you want to complain about it, you can't – because the bill also guts the Consumer Financial Protection Bureau because, if Wells Fargo creating millions of fake accounts to charge their customers extra fees has proven anything – it's that banks don't need regulating.

“It destroys nearly all of the important policies we put in place…to prevent another financial crisis and protect consumers,” said Rep. Maxine Waters (D., Calif.), referring to the Dodd-Frank law.

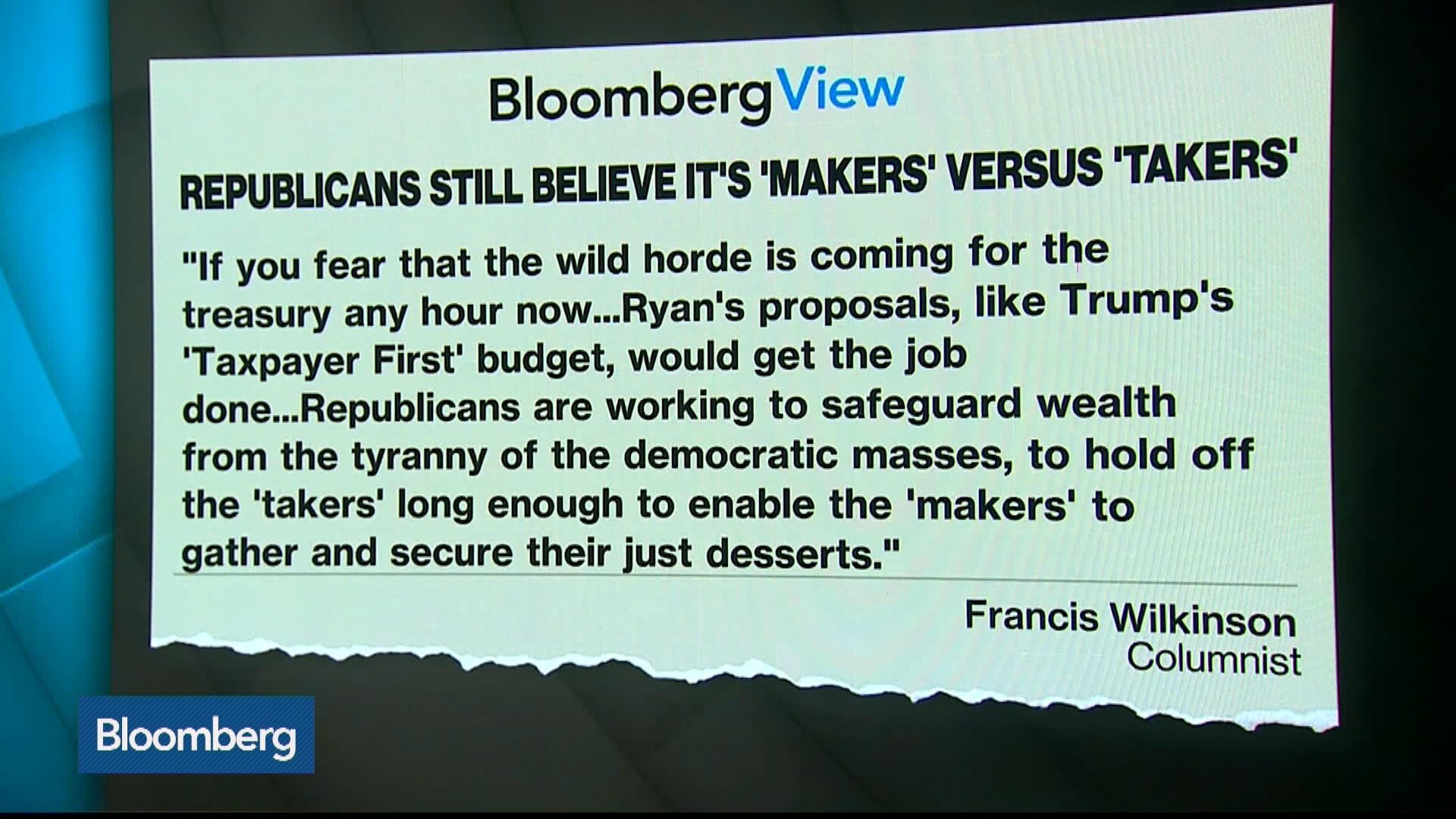

LOL – Oh Democrats, they are so cute, aren't they? Don't worry because GOP Committee Chairman Jeb Hensarling said he is looking for ways to push pieces of the plan through the Senate without Democratic support by attaching some measure to the annual budget bill, which passes on a majority vote because that's how democracy works – you get a voting advantage and then you steamroll in whatever extreme legislation you are paid to write, no matter how much it harms your constituents and despite all objections from the other party. Ah, Democracy – the tyranny of the majority (well, the electoral college majority, anyway).

LOL – Oh Democrats, they are so cute, aren't they? Don't worry because GOP Committee Chairman Jeb Hensarling said he is looking for ways to push pieces of the plan through the Senate without Democratic support by attaching some measure to the annual budget bill, which passes on a majority vote because that's how democracy works – you get a voting advantage and then you steamroll in whatever extreme legislation you are paid to write, no matter how much it harms your constituents and despite all objections from the other party. Ah, Democracy – the tyranny of the majority (well, the electoral college majority, anyway).

It's funny because, before the 2008 crisis, one could maybe forgive us for being ignorant of the danger but this is just plain stupid and economically suicidal – these people are laying the groundwork that will destroy America far more thoroughly than any terrorist ever could.

Meanwhile, this stuff is great for the banks, of course, and XLF popped yesterday but still has a long way to go if it's on a path to recovery. We got a nice pop in the Dollar overnight and our long play on the /DX Futures from last Friday's PSW Report was good for a nice $854 gain and now we're long /DXU7 (Sept) at 97.08 as we cashed out the front-month in our Live Member Chat Room this morning.

Meanwhile, this stuff is great for the banks, of course, and XLF popped yesterday but still has a long way to go if it's on a path to recovery. We got a nice pop in the Dollar overnight and our long play on the /DX Futures from last Friday's PSW Report was good for a nice $854 gain and now we're long /DXU7 (Sept) at 97.08 as we cashed out the front-month in our Live Member Chat Room this morning.

Aren't you glad you didn't spend $3/day to subscribe to the PSW Report last week? By saving $15, you also save having to pay taxes on $15,000 worth of trade gains over the past 5 days – that's like saving $5,000 – congratulations!

Premium Memberships are almost full and that means it's almost time to raise our prices again, as there is a limit to how many Members we can have in our Live Chat Room. To help you pay for a Membership, I'll let you follow our Russell (/TFU7) trade idea from chat this morning, where we shorted 4 September contracts at 1,418.25. The 4 contracts pay $200 per point so a drop of 25 points, to 1,397, will generate $5,000 and fully pay for a Basic Live Chat Membership for a full year, which would also lock in the current prices – that will save you more than the taxes you saved by not subscribing last week!

Another way to play the Russell short is by using the Ultra-Short ETF (TZA), which is way down at $16.50 and the simplest way to play is to buy 100 June $16/16.50 bull call spreads at 0.29 ($2,900) which makes up to 0.21 ($2,100 – 72%) by next Friday if TZA is simply over $16.50. That's pretty good money for a week's work!

Next week is going to be wild as we have the Fed decision on Wednesday (2pm) along with PPI on Tuesday, Retail Sales, CPI and Business Inventories also on Wednesday, Philly Fed, Import/Export Prices, Empire Manufacturing and Industrial Production on Thursday and Friday we have Housing Starts and Michigan Consumer Sentiment. That's a good week of data and Retail Sales will be key on Wednesday and we don't think the Philly Fed can continue it's blistering pace – another good reason to hedge.

Speaking of trade gains, by the way, oil is back at $45.50 but we had a nice $500 per contract run up to $46 and of course we are reloading this morning. Oil (/CL) holding up against a rising Dollar is a good sign. We will also reload Gasoline (/RB) back at $1.495 and those gains have been uninspiring so far.

The Dow shorts were huge winners from yesterday morning's PSW Report as we peaked out right at our 21,200 target and then fell back to 21,100 for a nice $500 per contract gain there as well (you're welcome) and the Russell (/TF) shorts were good for $450 per contract as we dropped back to 1,410 and, as noted above, we're back on that horse this morning. Not bad for a $3 newsletter, right?

Have a great weekend,

– Phil