Wheeee, this is fun!

Wheeee, this is fun!

It's not an indictment, it's just a probe but now we know why Trump wanted to fire Special Investigator Mueller the other day – apparently he wasn't loyal to Trump either and he's now officially investigating the President for the obstruction of justice the President has already bragged about when he said to the visiting Russians:

“I just fired the head of the F.B.I. He was crazy, a real nut job. I faced great pressure because of Russia. That’s taken off. I’m not under investigation.”

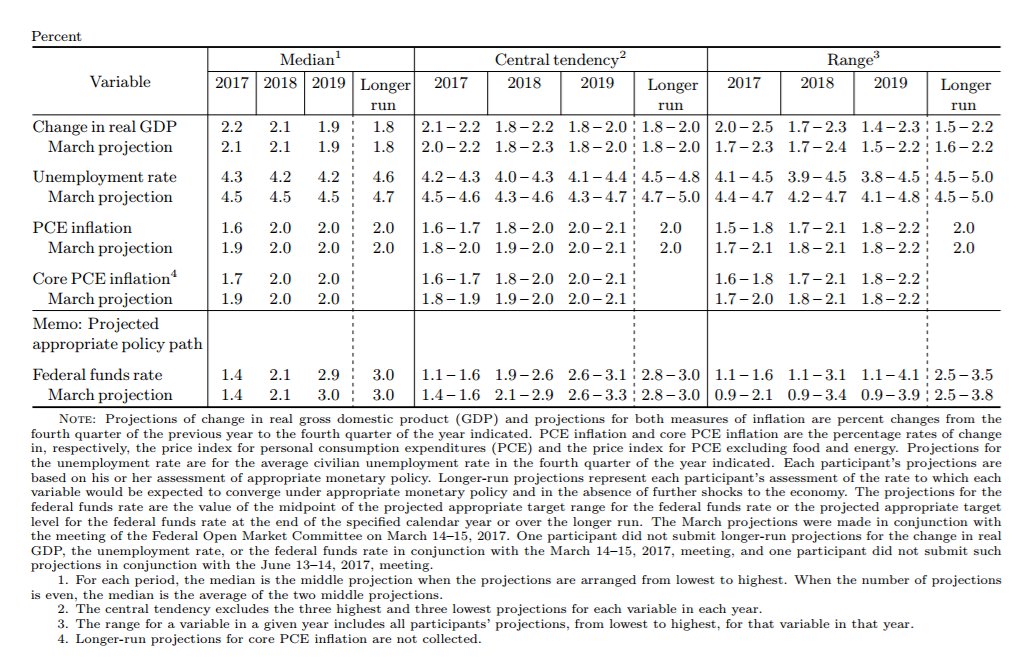

Master. Oh sorry, that last word might not have been a direct quote – just stating the obvious. Well, it's not even a month later and NOW the President is under investigation and Trump himself just said that the GOP health care proposal is "mean", so that's not going to pass – especially with "more money" because the Fed just took Trump's Budget off the table with updated forecasts that indicate we'll be LUCKY to see 2% GDP growth for the rest of this decade:

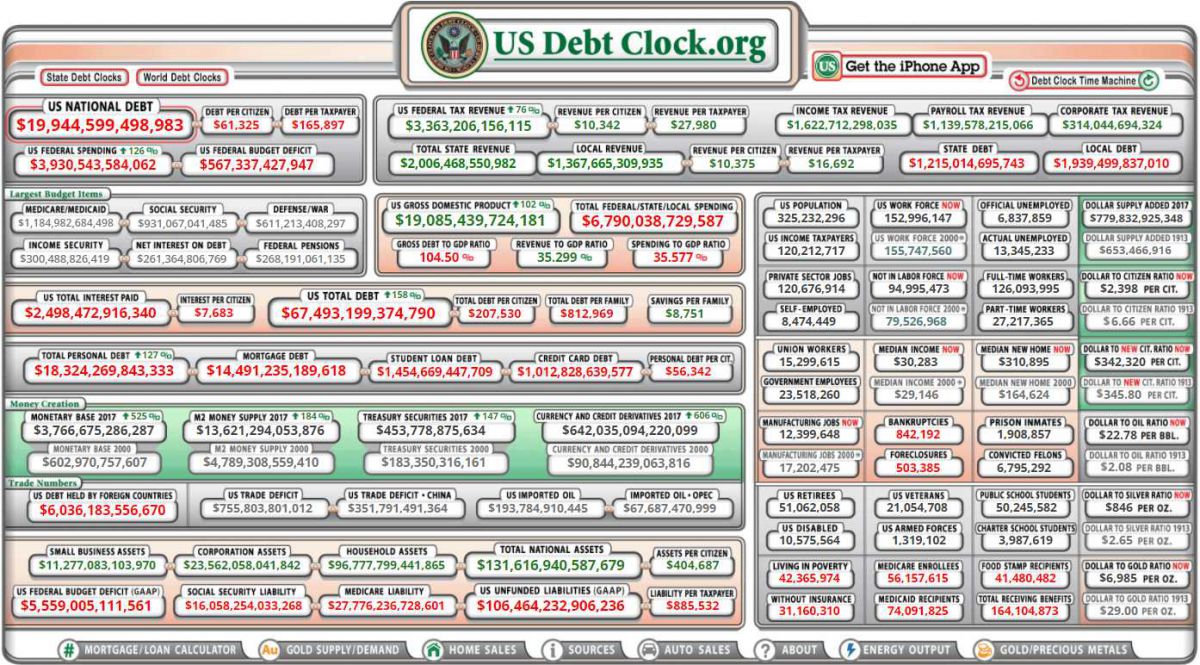

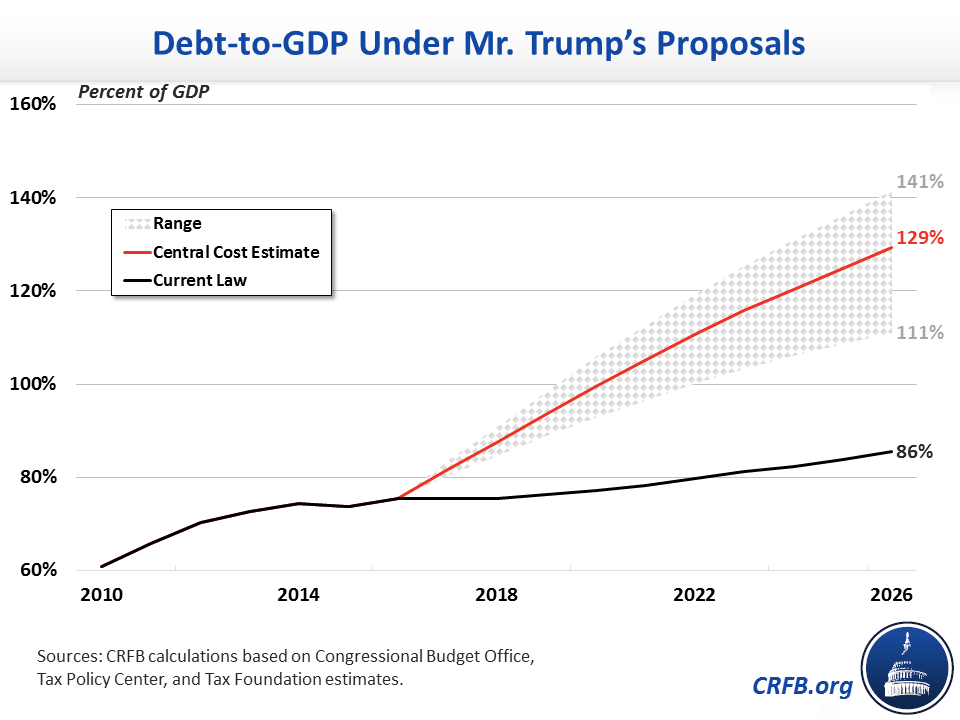

That's HALF of the Trump Budget Projections that STILL put us over $1 TRILLION in debt for each of the next 10 years AND, with the Fed on path to TRIPLE interest rates over the next 2 years, the $285Bn of interest payments we now pay will also triple to $855Bn, making interest on debt alone the most expensive line item in the budget and that's ONLY if we keep the debt down to "just" $20,000,000,000,000.00 – at Trump's projected $30Tn, our interest payments would be $1.3Tn but THAT is assuming 4% growth boosts revenues. At 2% growth, we'd end up about $40Tn in debt paying $2.6Tn a year in interest and running a $2.5Tn annual deficit.

So either the Trump budget is dead or you should quickly make arrangements to get out of the country while you still can because, even at "just" $20Tn, your share of the National Debt is $165,897 (each taxpayer). Of course, if you are in the Top 0.1% and making more than $3M a year, that doesn't bother you very much so let's hope the budget passes and we get those tax cuts but, for the poor slobs who take home less than 7-figures, $165,897 sounds like real money.

How do you stop debt from spiraling out of control? Collect more taxes and pay it off! It's not complicated. There are 120M households in this country and the Top 1% earn $1,260,508 on average for a total of $1.5Tn/yr and Corporations make another $3Tn a year for $4.5Tn. A 20% surcharge on those incomes would put just under $1Tn per year towards deficit reduction so that + a balanced budget amendment would pay off the deficit entirely by 2038 and make America the richest country on Earth, unhindered by debt.

Or we can go with Trump's plan and DECREASE their taxes by 30% and destroy the country – you decide what really makes America Great Again.

Or we can go with Trump's plan and DECREASE their taxes by 30% and destroy the country – you decide what really makes America Great Again.

This stuff is just math folks. You can't cut taxes to the Top 1% and slash Government programs that are there to help the Bottom 99% and expect the country to fix itself or be "trickled down on" by the Top 1%, now that the pesky Government is out of the way. That's like a fairy tale we tell to children – except we hope our own children aren't stupid enough to believe that kind of nonsense, right?

I know this article will be censored on most MSM outlets that publish me, but someone has got to say something to stop this thing. This isn't just a mistake – this is National Suicide and, unlike the song, it will not be painless! If you are an American, a real American – Democrat or Republican – you have to think about what is really going to be good for your country and your children's future. If you think that giving $1.1M tax cuts to people who make $3.7M a year or more (top 0.1%) ACCORDING TO FORBES is the best thing your country can do right now – then feel free to let it happen. If not… Well, as they say: "If you see something – SAY SOMETHING!"

Meanwhile, the market is doing just what we expected it to do post Fed and the S&P (/ES) is down around 2,420 for our 3rd $400 per contract gain in a row this week from yesterday morning's PSW Report. The Russell (/TF) is just testing 1,400 this morning and that's up a whopping $1,500 per contract and the Dollar did just as we expected and rose an entire basis point (96.10 to 97.10), post-Fed and that one is good for gains $1,000 per contract so far – and I say so far because the Bank of England (also as predicted) did not raise rates so the Dollar should get even stronger by comparison.

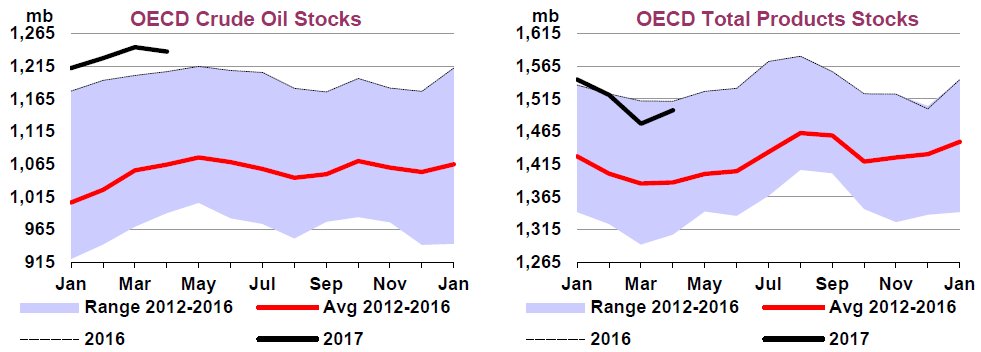

Oil (/CL) and Gasoline (/RB) took a dive on disappointing inventory reports but more so because more and more Global supply is coming on-line and demand is still nowhere in sight. Though the information is 2 months old (April), the IEA released a report showing a 19Mb net build in global inventories and we're right back at the top of our 5-year range, which is where we were last year, when oil was under $40 (briefly) in July and gasoline bottomed out at $1.27, which is another 0.16 (12%) below the current $1.43.

So far, we haven't seen a major effect in the already beaten down Energy Sector (XLE) or Oil Services (OIH) but those companies were responsible for a large portion of the S&P's earnings recovery, as were the banks that lend them money. If oil ends up performing as poorly this summer and fall as it did last summer – even with the former CEO of Exxon (XOM) as Secretary of State – well then this has the makings of a long-term economic disaster.

We are, nonetheless, playing Oil (/CL) long at $44.50 and Gasoline (/RB) long at $1.415 in hopes of a bounce into the weekend but, as with yesterday's morning play – tight stops below or things can get very ugly very fast! We think the strong Dollar is holding them down at the moment as yesterday's sell-off was a bit of an overkill in the short run but, long-term, this is about the right range for oil ($40-50), so don't expect a big move up.

With the Fed beginning to wind down QE, it's going to be very hard for the markets to sustain these all-time highs but the reason the Fed feels comfortable raising rates is because they think the economy is strong enough to grow without stimulus and that's a good thing. Unfortunately, many stocks are priced for QEForever and that's simply not going to happen and we'll sit back and see how big of a correction we get now that all the cards have been dealt.