$8.5 Trillion.

That's the value of the Russell "small cap" Index (IWM), which is up $3.7Tn (77%) from $4.8Tn in 4 years. While that's impressive, of course, it's lagging the Nasdaq, which is up 130% in the same time-frame, so the Russell (and the other indexes) have a long way to go if they are going to catch the Nadaq (QQQ) – or maybe the Nasdaq is ridiculously overvalued?

The Russell rebalancing or "Reconstitution", as they like to call it, takes place today and thank goodness they have made their own infographic to explain it because I couldn't figure out how to do it in less than 10 pages – so click here if you want the details. There will not likely be a huge effect, they are simply rearranging the deck chairs – it's not like when the Dow or S&P add or drop companies but strange things do happen as companies shift from the Russell 3000 to the 2000 or the 1000 because it takes them out of one ETF and puts them in another in some cases.

Last year you can see that red spike down in June though – that was the last rebalancing and the index dropped from 1,175 to 1,075 (-8.5%) in 2 days – but then recovered the next week. We went long on the Russell Futures (/TF) yesterday in our Morning Report and caught a $500 per contract gain up to 1,410 but today we are watching and waiting to see what happens.

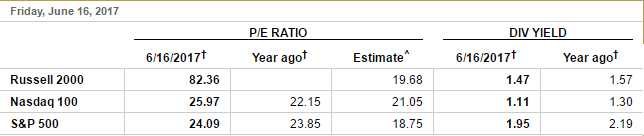

Getting back to the Nasdaq, although it seems outrageously high, the tech companies have come on strong with earnings – or at least Apple (AAPL) has, since that one company added $11Bn in profits or 50% of the Nasdaq's gains but that's enough to keep the p/e ratio of the entire index at a not-too-crazy 25.97 vs 24.09 for the S&P while the Russell 2,000 has a p/e ratio of 82.36 – THAT is why it's lagging so far behind!

Getting back to the Nasdaq, although it seems outrageously high, the tech companies have come on strong with earnings – or at least Apple (AAPL) has, since that one company added $11Bn in profits or 50% of the Nasdaq's gains but that's enough to keep the p/e ratio of the entire index at a not-too-crazy 25.97 vs 24.09 for the S&P while the Russell 2,000 has a p/e ratio of 82.36 – THAT is why it's lagging so far behind!

Now, to be fair, the Russell 2,000 tends to include some start-ups that are still in the money-losing phase of their existence and they have to get much bigger before they graduate to the Nasdaq 100 or S&P 500 so the bet on the Russell is a general bet on growth and what's been going wrong for the Russell is their relatively strong dependence on the US market (80% of revenues) and, of course Amazon (AMZN), which is killing small retailers with assists from WMT, TGT, COST, etc.

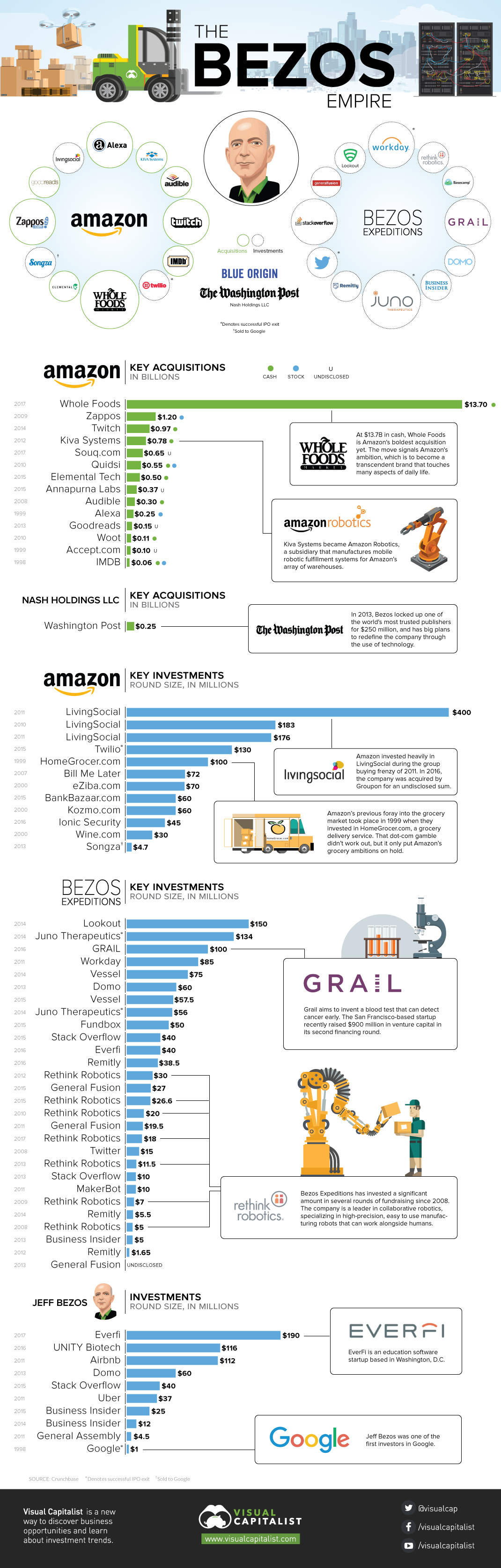

You can see it on Main Street – there aren't many towns in America that don't have empty storefronts, even in "prime" shopping areas. While there may be more jobs in America, they are jobs that pay low wages while the successfull middle to upper-middle class people who used to own those stores and the landlords that used to rent to them are the ones who are getting squeezed out of existence by the super-rich, like Bezos, who added $60Bn to his wealth in the last 4 years while his company gained $320Bn in market cap. AAPL gained $500Bn since 2013 too so really – what's left for the little guys?

3,000 Russell companies gained $3.7Tn in 4 years while AAPL and AMZN alone added $820Bn – it's very hard to compete with that act. While I could tell you 3,000 reasons why AAPL is a bargain at $750Bn, Amazon's $478Bn valuation is a bit insane, considering they only made $2.3Bn last year for a p/e of 200 vs Apple's p/e of 13. If AAPL were valued like AMZN, it would be an $11Tn company!

Apple is 10 years older than Amazon but, looking at the last 5 years (2011-2016), AAPL has grown their profits by $25Bn while AMZN has grown profits by $2Bn (less than 1/10th). As you can see from the chart above, AMZN is growing by making a lot of acquisitions, noteably Whole Foods (WFM) just last week while AAPL just sells more stuff that they invent themselves.

Should you trade in your $1,000 share of AMZN for 7 $145 shares of AAPL? OF COURSE YOU SHOULD!!! Come on, how can you even wonder about that. If this tech rally is real, eventually AAPL's p/e of 13 (not including $250Bn in CASH!!!, which is 1/3 of their market cap) will look like a bargain to someone and, if the tech rally isn't real – then I'd sure rather be holding stock in the company that makes $50Bn a year with $250Bn in the bank for $750Bn than the company that makes $3Bn (assuming growth) with no money in the bank (WFM used it all up) and a $478Bn valuation. This is just common sense folks – let's get real!

Should you trade in your $1,000 share of AMZN for 7 $145 shares of AAPL? OF COURSE YOU SHOULD!!! Come on, how can you even wonder about that. If this tech rally is real, eventually AAPL's p/e of 13 (not including $250Bn in CASH!!!, which is 1/3 of their market cap) will look like a bargain to someone and, if the tech rally isn't real – then I'd sure rather be holding stock in the company that makes $50Bn a year with $250Bn in the bank for $750Bn than the company that makes $3Bn (assuming growth) with no money in the bank (WFM used it all up) and a $478Bn valuation. This is just common sense folks – let's get real!

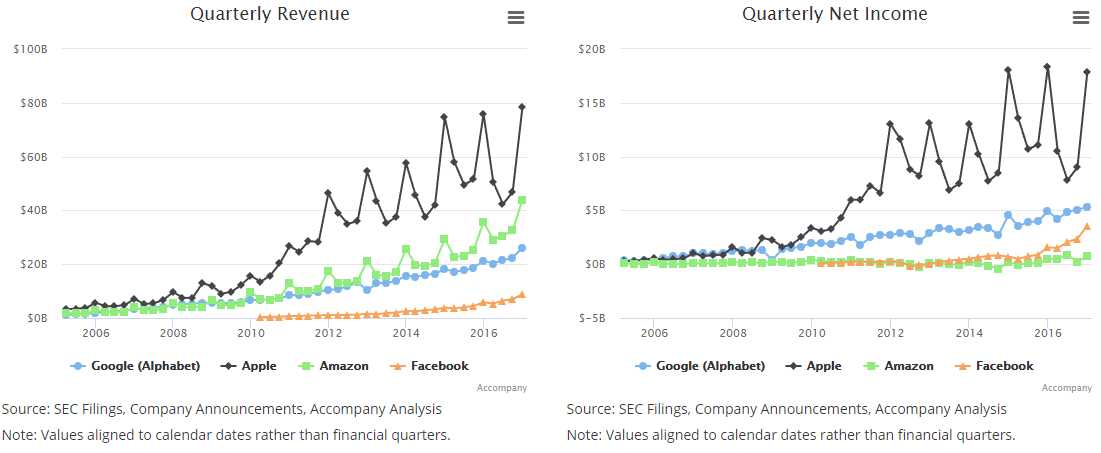

While Amazon has been second in revenue growth over the past decade out of the tech leaders, income growth has been essentially non-existent while AAPL has gone up 10x. In fact, Apple products are Amazon's number one source of revenues, accounting for over 10% of total sales but that amount ($17Bn) is is only 8% of AAPL's overall sales so Apple could pull their products from Amazon and it would hurt AMZN a lot more than it would hurt AAPL.

Walmart (WMT), of course, dwarfs all of them in sales ($500Bn), which is 1/6th of all US Retail Sales and WMT makes $14Bn a year – 7 times more than Amazon yet you can buy WMT for $228Bn, 1/2 of AMZN's market cap. Walmart is getting pissed about that and they are hitting Amazon where it hurts by going after their profit center – cloud computing – by issuing a warning to tech companies it does business with: Don't use Amazon's cloud services!

The World's largest retailer is starting to tell technology companies it works with to stop using Amazon Web Services and move to competitors instead, The Wall Street Journal reported. An Amazon spokeswoman referred to Wal-Mart’s moves as attempts to “bully” tech suppliers. “Tactics like this are bad for business and customers,” the spokeswoman said.

The World's largest retailer is starting to tell technology companies it works with to stop using Amazon Web Services and move to competitors instead, The Wall Street Journal reported. An Amazon spokeswoman referred to Wal-Mart’s moves as attempts to “bully” tech suppliers. “Tactics like this are bad for business and customers,” the spokeswoman said.

Wal-Mart and Amazon have sparred for years. Last week, Amazon sent shockwaves through the grocery industry—one of Wal-Mart’s biggest businesses—by announcing a $13.7 billion deal to buy Whole Foods. That came after Wal-Mart in recent years slashed grocery prices in part to stanch an Amazon’s online incursion into the business. More recently, Amazon lowered its Prime membership fee by nearly half for people who obtain government assistance, targeting a Wal-Mart stronghold.

Their cloud battle takes aim at the financial advantage AWS gives Amazon. The company’s global retail business operates on thin margins, but they are offset by the enormous profits AWS generates. In the first quarter, AWS posted $890 million in operating income, accounting for 89% of overall operating income, even as AWS’s $3.66 billion in net sales accounted for just 10% of the company’s total. WMT is looking to hit AMZN where it will hurt the most and this is likely to be just an early round in a long war for retail dominance.

“People jump through hoops to do business with Wal-Mart all the time,” said Robert Hetu, an analyst with the research firm Gartner Inc. “That should absolutely accelerate the competition from Azure.”

We are long WMT, long AAPL and short AMZN.

Have a great weekend,

– Phil