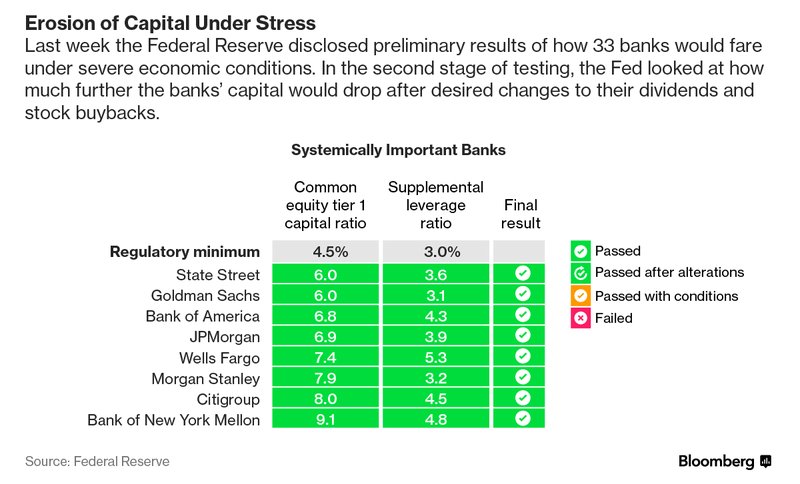

The banks all passed!

The banks all passed!

After being handed $3.5Tn in various forms of relief by the Federal Reserve (and we already forgot another Trillion from TARP), our friendly Banksters were all given the go-ahead from the Fed (a cartel of Banksters that is NOT a Government Agency) to beign transferring that wealth (through dividends and stock buybacks) to the Top 1% while the losses from those bailed-out assets will be taken on by the Bottom 99% as additional Federal Debt.

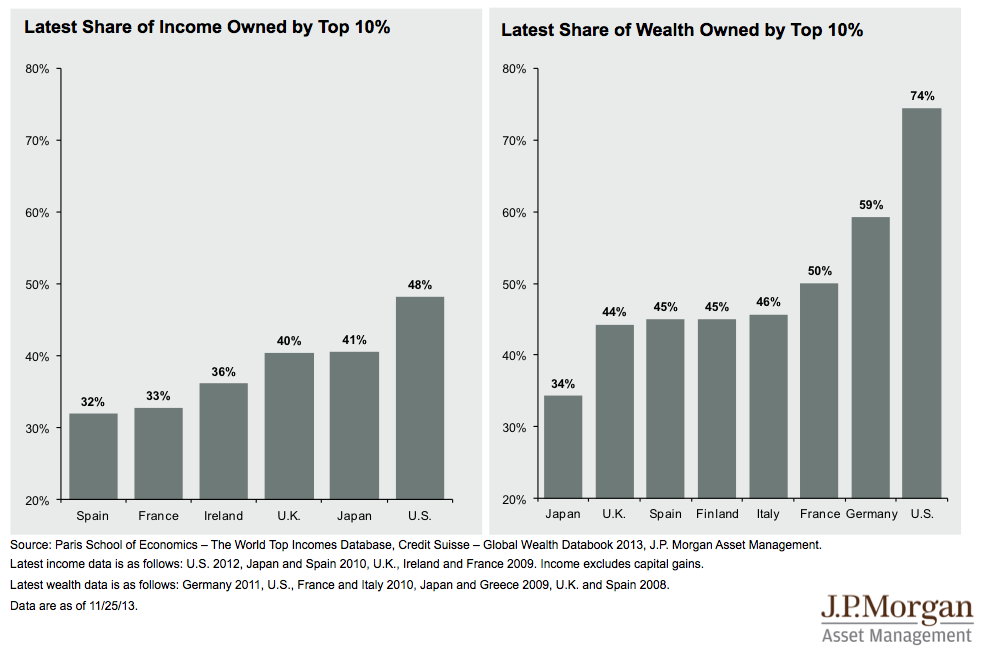

Seems like business as usual in America to me where the Top 10% of the population (30M) hold 75% of the nation's wealth AND make 50% of the income – yet they need tax breaks to get by….

Seems like business as usual in America to me where the Top 10% of the population (30M) hold 75% of the nation's wealth AND make 50% of the income – yet they need tax breaks to get by….

As you can see from this distribution chart, no, this is not normal – the US has the worst wealth distribution in the developed world, you have to go to Oilgarchys like Russia or Dictatorships to find another country where the Top 10% takes more of the pie away from the Bottom 90% than they do in the US. That's why our own Oligarchs rigged an election to install a more Russia-like system (where the top 10% have 85% of the wealth) – at some point they need to worry about the rubes realizing how much they are being screwed and rising up against them so the time to install an authoritarian regime is now – you have to nip dissent in the bud before it spreads.

That's why the "Fake (non-Fox) News Media" is under attack, ideas cannot be spread to the masses unless they are the State's ideas – all other opinions must be squashed or invalidated. Just the fact that I'm saying this here will cause this post to be censored at Seeking Alpha and several other places that usually syndicate our Morning Report.

That's why the "Fake (non-Fox) News Media" is under attack, ideas cannot be spread to the masses unless they are the State's ideas – all other opinions must be squashed or invalidated. Just the fact that I'm saying this here will cause this post to be censored at Seeking Alpha and several other places that usually syndicate our Morning Report.

And it's not really about the Top 10%, they are generally poor compared to the Top 1% but they do go along (like any good party Member) because what's good for the Top 1% is usually good for the Top 10% as they actually do get a little bit of trickle from time to time. What the Russian takeover of the United States is about is the Top 1%, who currently have about 35% of the wealth wanting to double their share and the ONLY country in the World that has pulled that off without a Government overthrow (well, after they overthrew the last Government) is Russia.

And it's not really about the Top 10%, they are generally poor compared to the Top 1% but they do go along (like any good party Member) because what's good for the Top 1% is usually good for the Top 10% as they actually do get a little bit of trickle from time to time. What the Russian takeover of the United States is about is the Top 1%, who currently have about 35% of the wealth wanting to double their share and the ONLY country in the World that has pulled that off without a Government overthrow (well, after they overthrew the last Government) is Russia.

So Russia is welcomed with open arms by our own oligarchs. Isn't that always the way though? The gates are opened from within the fortress by greedy people who are willing to watch their fellow citizens be slaughtered in order that they may enrich themselves. And, whether you believe this Administration is tied to Russia or whether you think the Russians simply chose Trump to be President over Hillary, it's all a distraction as to what's really happening, which is the largest-ever transfer of wealth from the Bottom 99% to the Top 1% in the history of "Democracy" – whatever that means these days.

This is your future. When Putin took power in 1999, he was a former spy of modest means from a middle-class family. Now, just 18 years later, he is one of the richest men in the World with a net worth of approximately $75Bn accumulated while he was Prime Minister, President, Prime Minister and now President again.

This is your future. When Putin took power in 1999, he was a former spy of modest means from a middle-class family. Now, just 18 years later, he is one of the richest men in the World with a net worth of approximately $75Bn accumulated while he was Prime Minister, President, Prime Minister and now President again.

Putin's wealth is just a "tip" for overseeing the transfer of roughly 40% of the country's wealth from the Bottom 99% to the Top 1% in less than two decades. Notice the "Next 4%" in Russia has dropped to 11.7%, less than half of what our Next 4% holds. The 5% after that also had their wealth cut in half becuase, what the idiots in the US Top 10% don't understand is that the bottom 90% – even if they gave ALL of their wealth and ALL of their salaries to the Top 1%, would not have enough to double their wealth so the money MUST come from the Top 10% – they are the last fortress left to pillage.

This is going to be a crisis folks, but it will take a very long time to play out and you will have forgotten all about it by Tuesday so I guess it doesn't fit the American definition of crisis, which is something very scary that will be solved by tomorrow (or at least someone will pretend to solve it or deny it's real or, failing that, deny it's a big deal or blame God or Obama or some other outside thing that can't be fixed), when the next distraction will come along.

Windows are still being dressed but S&P 2,440 is still a strong barrier – be very careful out there.