Why are you here?

Why are you here?

I'm not even here, I'm in Paris – it's a holdiay, you know… Americans work way too hard, we don't take enough vacations. America is the ONLY country in the OECD that doesn't have any mandated paid vacations and everyone else, other than Japan, takes AT LEAST 20 days off during the year with France at 31. Not only that but the average Parisiene works 40 hours on weeks they do show up while American workers tend to work 47 hours a week.

The really strange thing about this is that America is also the only country where time off is trending DOWN, not up. What's all this talk about automation if we still have to show up for work every day? After making steady progress to about 20.3 days off through 1998, the twin economic upeheavals of 2001 and 2008 dropped the average US vacation time to 16.2 days, that's including our 5 public holidays!

The short story is, Americans are generally terrified of losing their jobs so they don't even take the days off they are entitled to. Yes, our Per Capita GDP of $57,000 blows France's $42,000 out of the water but I don't think you'd find many people here who would trade their lifestyles for an extra $13,000 (and all that extra money we make goes towards paying for Health Care and College anyway).

Anyway, American's REALLY don't want to get into the GDP measuring game as we fall very far short of other vacation champs like Norway and Ireland ($69,000), Singapore ($87,000), Luxemboug ($104,000) and Qatar ($127,000) and no wonder everyone is jealous of them, right? Luxemborg requires workers to be paid 70% more to work on Sundays and strictly limits the work-week to 40 hours with a minimum of 25 paid vacation days AND 10 public holidays.

Less vacation time is simply another way the Capitalists steal from the workers. As you can see from the chart on the left, more productivity meant more wages until the 70s and, as noted above, that was also the era of peak vacation time for US workers. Since that time, Productivity has continued to grow at the same pace only wages have failed to keep up (in other words, the Corporations no longer share profits) and vacation time has dropped 20% as well.

Less vacation time is simply another way the Capitalists steal from the workers. As you can see from the chart on the left, more productivity meant more wages until the 70s and, as noted above, that was also the era of peak vacation time for US workers. Since that time, Productivity has continued to grow at the same pace only wages have failed to keep up (in other words, the Corporations no longer share profits) and vacation time has dropped 20% as well.

The real quesiton is "Why do Americans put up with this kind of BS?" What is wrong with American workers that they simply don't stand up for themselves. How is it they have been convinced that making the elites ever richer will somehow benefit the average worker? Clearly it has not. Wages have stagnated for 40 years while Corporate Profits are up 150% and, as we noted last week, Corporations pay just 10% of all taxes collected in the US while in Europe it's closer to 20%, as Corporations pay a VAT for their consumption of finished goods as well.

That 10% means a lot, in the US, it would be another $300Bn – halfway to balancing the budget. France has a budget defict of $84Bn, which has been cut in half since 2009 and is on track to drop to $40Bn or less over the next 2 years. Our budget defict will climb from $440Bn to $1.5Tn PER YEAR if Trump passes his tax plan. The US spends $4Tn out of a $20Tn GDP (20%) the French Government spends $1Tn out of $2.5Tn (40%) – the French may pay more taxes – but they get a lot more back.

Health care if free, college is free at the bottom with top schools capped at 10,000 Euros ($12,000), public transportation is plentiful, pensions are generous and the social safety net is wide and strong. In the US, because we are denied these benefits – you MUST work much harder than a French person to have the same lifestyle – that's no reason to crow about having a better GDP per capita. As inconcievable as it may be to a lot of Americans – Europeans don't want your lifestyle and you probably wouldn't either if you realized you had a choice!

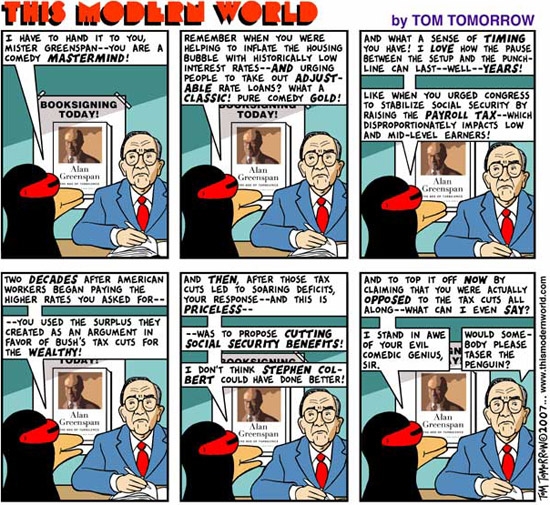

Choices will be made at this week's G20 summit in Hamburg and Trump is heading off to Europe while putting pressure on relations with Japan and China over North Korea which seems like he's winning Putin's bet that he can't piss off the entire World at the same time. Abe lost a key election this weekend and his party has been weakened as Abenomice (ie. QExtreme) is coming off the rails. Alan Greenspan thinks our Fed has done too little, too late and that we are "entering a very tough period of Stagflation."

Choices will be made at this week's G20 summit in Hamburg and Trump is heading off to Europe while putting pressure on relations with Japan and China over North Korea which seems like he's winning Putin's bet that he can't piss off the entire World at the same time. Abe lost a key election this weekend and his party has been weakened as Abenomice (ie. QExtreme) is coming off the rails. Alan Greenspan thinks our Fed has done too little, too late and that we are "entering a very tough period of Stagflation."

“The short term outlook begins to look sort of slightly buoyant, because the inflation actually moves profitability, and you get a sense that maybe things are over. But that’s going to be a false dawn.”

“We’ve been through this period before of stagflation, back in the 1970s, and it’s going to be very tough to get our way beyond it.”

The action today will be essentially meaningless but we do want to grab Silver (/SI) long at $16.50 again and Natural Gas (/NG) at $2.95 (/NGV7 is our preferred contract) – tight stops below should keep us out of trouble and they are both great stagflation plays.

Now get out of here – it's a holiday!