What a crazy vacation day.

What a crazy vacation day.

At Monday's close the Nasdaq went wild as a computer "glitch" sent the price of many stocks to $123.47 per share which, in the case of Amazon (AMZN) was a 87% drop, which briefly made us a LOT of money as AMZN is one of our hedges in our Short-Term Portfolio, along with our general hedge on the Nasdaq, using the Ultra-Short ETF (SQQQ).

We were also long on Microsoft (MSFT), which went UP to $123.47, valuing the company suddenly at about $1Tn on the 100% instant gain. The Nasdaq says the glitch was the result of "improper use of test data" but, of course, if they were hacked, they certainly wouldn't tell you, would they?

In other testing news, North Korea fired a nuclear-capable missile that, in theory, could reach Alaska and that will be used to justify another $50Bn in military spending in order to protect a state we bought for $7.2M and gave us Sarah Palin – I say let Kim Jong Un have it! North Korea will certainly be a big topic of discussion at this week's G20 meeting but it's really the Trump and Putin show we have to look forward to.

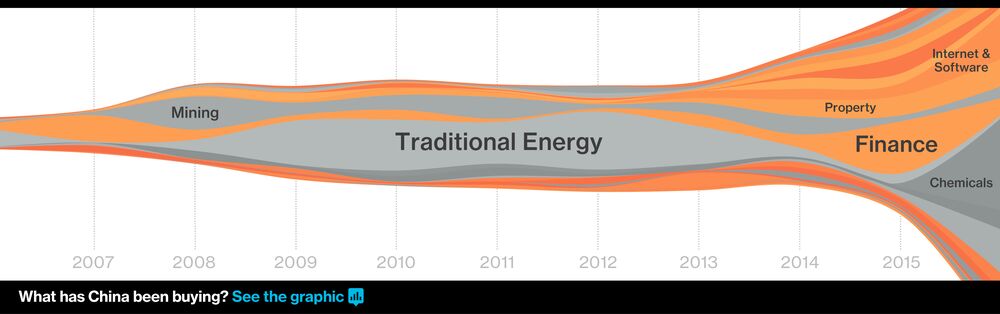

In other bombshells, the Chinese Government is reigning in some of that free money and is asking for $11.5Bn back from Corporations by the end of next year, which is just a drop in the $162Bn bucket that Chinese companies have been usuing for M&A transactions around the World and it's an indication that the PBOC feels they have begun to overpay for these transactions and this is a "nice" way to review the quality of these loans.

“We anticipate that yield levels for bonds from companies like HNA, Dalian Wanda and Fosun could rise in the near term,” said Anne Zhang, executive director for fixed income, currencies and commodities at JPMorgan Private Bank in Asia. “For now, we are advising investors to take a cautious view on those companies’ bonds and we are waiting for the dust to settle before taking further actions.”

The new debt has ballooned the firms’ balance sheets. A local bond market rout that began at the end of last year means the cost to refinance some of those liabilities has risen. Add to that the uncertainty of rising regulatory risks, and some investors are getting cold feet. The companies’ high leverage is a key concern, according to Christopher Lee, managing director of corporate ratings at S&P Global Ratings.

There are many signs around the globe that indicate caution but we are well-hedged and our play this morning in our Live Member Chat Room was to go LONG on the Nasdaq Futures (/NQ) at 5,775, expecting at least a weak bounce (and a $500 profit) to 5,600 and maybe a strong ($1,000) bounce to 5,625 because we're still in a low-volume environment, so we're not expecting any major selling just yet.

The Nasdaq remains our primary hedge, of course, this is sort of a hedge on the hedge, which has made good money as the Nasdaq corrected from 5,900 (down 5%) and that's all the more reason to expect at least a bounce back to 5,650 (the 5% Rule™ kicks in).