Things are still toppy.

Things are still toppy.

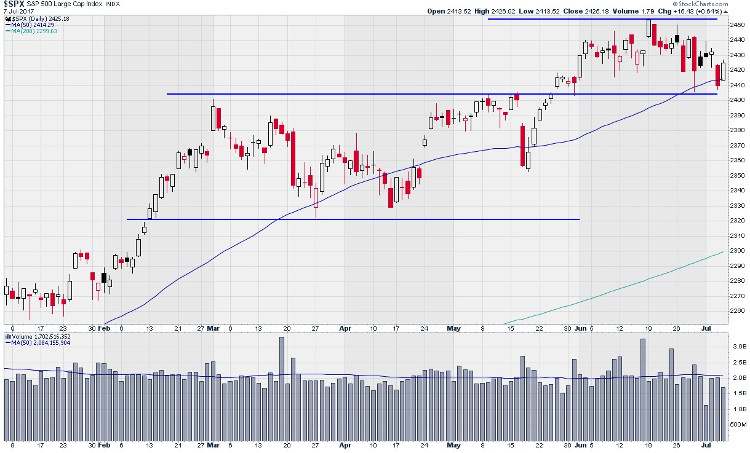

As you can see from the S&P 500 chart, we're still in that range that tops out at 2,440 but we've held 2,400 so far for June so still generally bullish but now the 50-day moving average has caught up with us at 2,415 so we can no longer be satisfied with anything less and there's really no proper support below 2,400 – all the way to the 200 dma at 2,300 (a 5% Rule™ drop).

Yesterday morning, in our Live Member Chat Room, we took a bull play on the Russell Futures (/TF) at 1,408 and we caught a nice 10-point move up for $500 per contract gains in 2 hours at which point I said to our Members:

Now we take that off the table and look for either a fresh horse or, because the indexes all look toppy now, look for a possible reversal.

/NQ 5,700 is very likely to be rejected so that's a good line if /TF is below 1,420 and /YM below 21,400 and /ES below 2,430 (which indicates they all failed their next breakout).

So shorting /NQ with the stop above 5,700 is the most likely play now.

As you can see on the Nasdaq (/NQ) chart, 5,700 has remained a good shorting line and, at the moment, we're down more than 10 points at $20 per point, per contract so $200 per contract gains on those too. We can remain short on /NQ if the S&P (/ES) is below 2,425 and the Russell (/TF) is below 1,410 but we might flip bullish on the Russell at 1,405 if the indexes look bouncy.

Yellen testifies to Cojngress tomorrow and things are very up in the air until then. We're also waiting to see if oil finds a floor at $44 ahead of this evening's API Report and tomorrow's EIA Report as last week we had a big draw that's not likely to be matched post-holiday.

As far as playing Yellen tomorrow, I like Gold (/YG) for a bounce at $1,209 but better if we test $1,205. Yellen is not at all likely to say anything other than what the Fed has been saying (3-4 0.25 increases a year for 3 years with a 3% target) and it's very possible she'll backpeddle a bit and give a more doveish outlook, which will send gold back up. Overall economic uncertaintly and oil weakness are also good for gold.

Of course we love ABX, and they tested the $15 line, where we've often played them before. ABX is already in our Long-Term Portfolio and the spread is still playable now at about the same prices we started it with:

| Long Call | 2019 18-JAN 13.00 CALL [ABX @ $15.82 $0.47] | 50 | 6/9/2017 | (556) | $23,750 | $4.75 | $-0.48 | n/a | $4.28 | $0.38 | $-2,375 | -10.0% | $21,375 | ||

| Short Call | 2019 18-JAN 20.00 CALL [ABX @ $15.82 $0.47] | -50 | 6/9/2017 | (556) | $-9,250 | $1.85 | $-0.44 | $1.42 | $0.17 | $2,175 | 23.5% | $-7,075 | |||

| Short Put | 2019 18-JAN 15.00 PUT [ABX @ $15.82 $0.47] | -25 | 6/9/2017 | (556) | $-4,895 | $1.96 | $0.01 | $1.97 | $-0.14 | $-18 | -0.4% | $-4,913 |

The net cost of that $35,000 spread is $9,387 – about where we started in June and your worst case is owning 2,500 shares of ABX at net $15 ($37,500) plus the $9,387 entry, which would add $3.75 to net you in for an aggressive $18.75 so worse than buying the stock but this is a leverage play where we make $25,613 (272%) or $10 per share at $20 vs needing $25 if we bought the stock at $15.

A more conservative way to play ABX here would be to sell 10 of the 2019 $13 puts for $1.10 ($1,100) and buy 10 of the $13 ($3.65)/$17 ($2.25) bull call spreads for $1.40 ($1,400) and that nets you into $4,000 worth of spreads for just $300 with $3,700 (1,233%) upside potential at just $17.

There are lots of good opportunities to deploy our cash – even in this tricky market. Earnings season should give us plenty of opportunities to go long if the broad market seems to be holding but I'm still worried about that downside at the moment. For now, we'll wait to hear what Yellen has to say as well as keep an eye on the upcoming data reports, which heat up tomorrow.