It's my favorite time(s) of year!

JPMorgan (JPM), Citigroup (C) and Wells Fargo (WFC) kick off earnings season this morning but it's a very low bar set for the banks as they have all cut their profit forecasts in the last few weeks so expectations are low – especially as the 2nd quarter is usually weak for trading. Overall, the sector (XLF) is up 10% since early June and now we'll see if it's justified or not. Q1 results, which came out in late March, sent the sector off a cliff but they've climbed back since on the same fairy-dust that's powering the rest of the bubble.

Bank Notes:

-

JPM missed, WFC missed and C beat but C reduced their loan-loss reserves from $12.3Bn to $12Bn, something banks can do "because they feel like it" and that effectively popped their bottom line by $300M. C's outstanding loans was up 2%, to $645Bn so the reduction in reserves is C telling us that they don't feel more than 1.86% of those loans will default while the industry standard is 2-2.5% or $12.9Bn – $16.1Bn so, effectively, C is goosing their bottom line by $900M-$4.1Bn by simply pretending their loans (student loans, sub-prime auto loans, retail store loans) are the safest in history!

JPM missed, WFC missed and C beat but C reduced their loan-loss reserves from $12.3Bn to $12Bn, something banks can do "because they feel like it" and that effectively popped their bottom line by $300M. C's outstanding loans was up 2%, to $645Bn so the reduction in reserves is C telling us that they don't feel more than 1.86% of those loans will default while the industry standard is 2-2.5% or $12.9Bn – $16.1Bn so, effectively, C is goosing their bottom line by $900M-$4.1Bn by simply pretending their loans (student loans, sub-prime auto loans, retail store loans) are the safest in history!

- JPM dropped their loan-loss reserves to $1.22Bn from $1.4Bn, adding $178M to their "earnings" and, if that seems a little thin to you, consider that they did, in fact, write down $1.2Bn in loan defaults in Q2 and that covers just 0.56% of their portfolio, down from 0.79% in Q1.

- At least WFC is honest about it, saying "Net income increased $315 million, or 15 percent, from second quarter 2016, primarily due to the tax benefit in second quarter 2017 and lower loan loss provision" but, then again, it's kind of hard not to mention a $450M decrease in your loan loss reserves! For those of you keeping score, that is % of their earnings. WFC now has $11.073Bn provided for on $957.42Bn in loans or 1.15% – that'd double JPM's joke of a reserve but half of Citi's.

Don't forget that if ANY of these banks fail – they will take the entire US economy with them but hey, that's no reason to regulate them. At least they could standardize their reporting formats so we can compare them side by side, right?

We're certainly back to shorting the Index Futures at:

- Dow (/YM) at 21,500

- S&P 500 (/ES) at 2,445

- Nasdaq (/NQ) at 5,800

- Russell (/TF) at 1,425

Weekends are tricky to short into so very tight stops above the line. As a rule of thumb, if any 2 indexes are over, we stop out, regarless of whether or not ours is still below. I can't see anyone in their right mind having a meeting this morning and leaving it all on the table into next week's earnings. I strongly expect a sell-off at some point today.

The data is also disappointing this morning with CPI flat, which is a 100% miss by leading economorons, who were looking for 0.1% gains. Core CPI was also 0.1% and that was only a 50% miss against expirations so put the champaign on ice for the right-wing philosopers – that's as close as they've gotten all year!

The data is also disappointing this morning with CPI flat, which is a 100% miss by leading economorons, who were looking for 0.1% gains. Core CPI was also 0.1% and that was only a 50% miss against expirations so put the champaign on ice for the right-wing philosopers – that's as close as they've gotten all year!

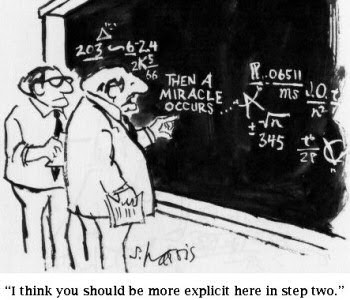

I should have realized it in Econ 101, where the class was taught by a TA who was a complete idiot whose only claim to fame was that he had memorized every crackpot theory from the book he was "teaching" us. He didn't have an original thought in his head but he felt that every situation could be solved by quoting one of the masters. This would be like doctors learning medicine only by studying old operations or lawyers working each case exactly like an old one that seemed to fit the situation at hand.

Anyway, the short story is they are idiots – don't take them seriously. Meanwhile, Retail Sales were down 0.2% in June and of course that doesn't surprise you because you can read the paper and observe the World around you but, for Economists – it was a 300% miss from their +0.1% expected. Ex gas and autos, they missed by 0.5%, expecting a 0.4% gain against an actual 0.1% drop. How could they POSSIBLY think Retail Sales were up in June? HOW???

And these are LEADING economists that are polled by Bloomberg and the Wall Street Journal and our Government and multi-billion Dollar decisions are based on their projections every day. No wonder we are so screwed up! They can miss and miss and misss again and still they are consulted for the next projection – it's amazing! The problem is that economics is really just a philosophy – it's not math but people keep asking economists math questions like – were retail sales up or down. This stumps them every time…

And these are LEADING economists that are polled by Bloomberg and the Wall Street Journal and our Government and multi-billion Dollar decisions are based on their projections every day. No wonder we are so screwed up! They can miss and miss and misss again and still they are consulted for the next projection – it's amazing! The problem is that economics is really just a philosophy – it's not math but people keep asking economists math questions like – were retail sales up or down. This stumps them every time…

And yes, we picked XRT long yesterday (and M for our Members this morning), but that's because we thought, even with another miss in June, that July and August will have easy comps and XRT has already over-reacted to the decline in sales. Anyway, it pooped $1 already – so don't complain!

I'll be back from vacation on Monday, well-rested and ready to play those earnings.

Have a great weekend,

– Phil