I'm back!

I'm back!

In my quest to better understand the Global economy (and it's affect on teens), I dragged my family off to France and the UK for the past two weeks and tested the effects of Socialism on two girls who were raised in an entirely Capitalist system. While we're still tabulating the data, certain trends are evidend such as "public transport is amazing", "free health care, are you kidding me?" and, of course, "free college – can we move here Dad?".

Jackie was very impressed that the beaches don't charge fees, Maddie is actively finding out if she can keep her 504 Plan College fund if she goes to Europe instead. Not a bad idea, really, as she's fully-funded for college but, if she takes an Advanced Learning Loan in the UK (which would require her to establish residency first), she would have her college paid for with the obligation to pay back 9% of her income over $27,000/year. After 30 years, the program terminates, whether the loan is fully paid back or not.

That's a very fair way to have students pay for college and Madeline realizes that, since she already has enough money to buy a house in her US fund – she'd be miles ahead of the game. Frankly, if I hadn't wisely funded the kids' 504 plans when they were born or had the market been unkind to their funds – I would have seriously considered moving the family to Europe when they started high school becasue we're talking at least $300,000 and probably closer to $500,000 to put two kids through good schools and we too could have gotten a free house in exchange for moving to Europe. Now do you see why housing prices in London are soaring?

Not only that but my Uncle has a $2M home in London and pays about 20% of the property taxes I pay on my much more modest home in New Jersey. He also doesn't spend $20,000 a year on health care for the family with no co-pays, no deductibles – NOTHING! For that, he is taxed 45% of his income over $150,000 but there's no tax on interest earned or the first $6,500 in dividends earned or from rental income (on a property you live in).

In exchange for paying more taxes, however, the entire country is covered by a first-class public transport system with nicely paved roads and non-rusty bridges and drinkable tap water (no fracking!) and fanstastic public education that gives his business a well-educated work-force along with that same safety-net which means they aren't all exhausted from working 3 jobs to survive.

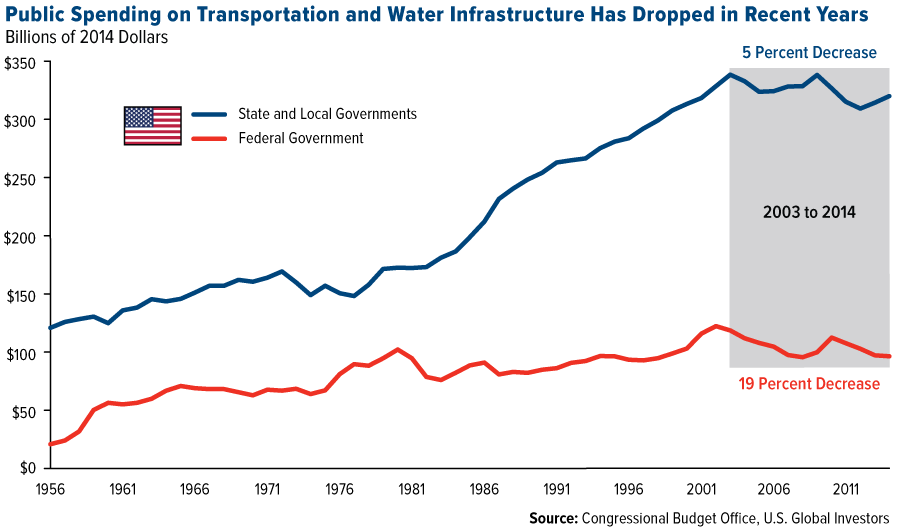

But it's infrastructure that I want to talk about. This is why those evil Socialists are going to leave this country in the dust over the next few decades – because they invest in their own countries AND they take that money from the people who have the most (and who benefit the most).

America, on the other hand, has a grade of D+ on their infrastruture report card – GREECE has a C! Imagine having to cheat off of Greece to pass a test – THAT's how pathetic US Infrastructure is. America has underinvested in Infrastructure to the tune of $4 TRILLION and that is a stealth tax on the 50% of our popluation that can't get to a grocery store using public transportation, can't drink the water that comes out of their taps or can't educate their children well enough to compete fairly with children who live in richer neighborhoods.

Almost HALF of our driking water is lost through leaking pipes (6Bn gallons/day for 300M people is 20 gallons/day per person!) with 240,000 water main breaks per year considered "normal" in our crumbling water system, that hasn't been upgraded since the 70s. Fixing the system would cost $1Tn and cut our water use in half but the companies that sell you water lobby against "raising taxes for infrastructure" and they pay their lackeys on Fox and the MSM to brain-wash you into thinking taxes are bad for you.

The average water bill is $200/month in the US and there are 110M homes so saving half that money would net back about $130Bn a year and the project would cost $1Tn, which means the Government could borrow that money and pay it off in 10 years by taxing people the same $1,000 they are saving and, after that, it's a free benefit for the next 30 years. We've been coasting on the benefits our parents and grandparents paid for but now we're reaching the end of the line and, if we don't act soon, our children and grandchildren will be forced to shoulder a huge burden.

The average water bill is $200/month in the US and there are 110M homes so saving half that money would net back about $130Bn a year and the project would cost $1Tn, which means the Government could borrow that money and pay it off in 10 years by taxing people the same $1,000 they are saving and, after that, it's a free benefit for the next 30 years. We've been coasting on the benefits our parents and grandparents paid for but now we're reaching the end of the line and, if we don't act soon, our children and grandchildren will be forced to shoulder a huge burden.

Likewise, the aging US electrical grid wastes half the energy that is generated and the Koch Brothers are very happy to produce twice as much electricity as you really need because they pass those costs right on to you. If we use tax money to fix our electrical grid, the Koch Brothers will have their income cut in half – that's why it's worth it for them spend $1Bn to buy an election and make sure you live your life as if you were an uneducated farmer in 1776.

Not that they care, of course, but we're really putting the country at risk on this one as 640,000 miles of high-voltage lines and transformers that were built in the 50s and 60s had a 50-year life-expectancy and 2017 – 1969 is already 48 years so even the NEWEST energy infrastructure is about to go past it's life-cycle while the stuff from the 50s is already critically close to failing.

Luckilly, Solar Energy is bailing us out a bit as homes go off the grid but any attempt by the Government to accelerate this process has been crushed by Koch-backed sleazeballs in Congress. It's costing us $30Bn a year in "disaster response" just to keep operating the way things are so spending $1Tn now to improve things for the next 50 years would ultimately save $500Bn – and that's assuming we could keep spending just $30Bn on band-aids and no major crisis blows our budget. Again, the benefit would be cutting electrical costs (currently averaging $1,000/month) by 50% (saving $550Bn/year for our citizens).

Luckilly, Solar Energy is bailing us out a bit as homes go off the grid but any attempt by the Government to accelerate this process has been crushed by Koch-backed sleazeballs in Congress. It's costing us $30Bn a year in "disaster response" just to keep operating the way things are so spending $1Tn now to improve things for the next 50 years would ultimately save $500Bn – and that's assuming we could keep spending just $30Bn on band-aids and no major crisis blows our budget. Again, the benefit would be cutting electrical costs (currently averaging $1,000/month) by 50% (saving $550Bn/year for our citizens).

Although we would also cut greenhouse gas emissions from electrical generation by 50%, the solar companies are against this fix too because cheaper electricity competes with Solar, so even Elon Musk doesn't want to FIX your electrical grid – he wants you to pay to get off it yourself and your Government won't advance just two years of your savings to fix the whole problem. That's because we elect the WRONG people!!!

Lack of adequate investment in infrastructure causes us to pay double on our electric bills and double on our water bills and – double for cars and gasoline as well. Because we have such terrible public transportation, a family of 4 with two teenagers can hardly get buy with 2 cars. The US, and I kid you not, has 797 cars per 1,000 people. That's of any age! The UK, with excellent Public Transportation has 519 cars per 1,000 people – 35% less! Not only that, but they drive the cars much less because it's often EASIER to take the bus or the train – even when you have a car.

Lack of adequate investment in infrastructure causes us to pay double on our electric bills and double on our water bills and – double for cars and gasoline as well. Because we have such terrible public transportation, a family of 4 with two teenagers can hardly get buy with 2 cars. The US, and I kid you not, has 797 cars per 1,000 people. That's of any age! The UK, with excellent Public Transportation has 519 cars per 1,000 people – 35% less! Not only that, but they drive the cars much less because it's often EASIER to take the bus or the train – even when you have a car.

Less money spent on cars leaves more money for other things and, of course, much less pollution and greenhouse gases are generated. Hong Kong, a former British colony also with great public transportation, has just 77 cars per 1,000 people, India has 32, China 140. This isn't because their people are backwards – it's simply that you don't need so many cars when there are adequate buses and trains for people to use.

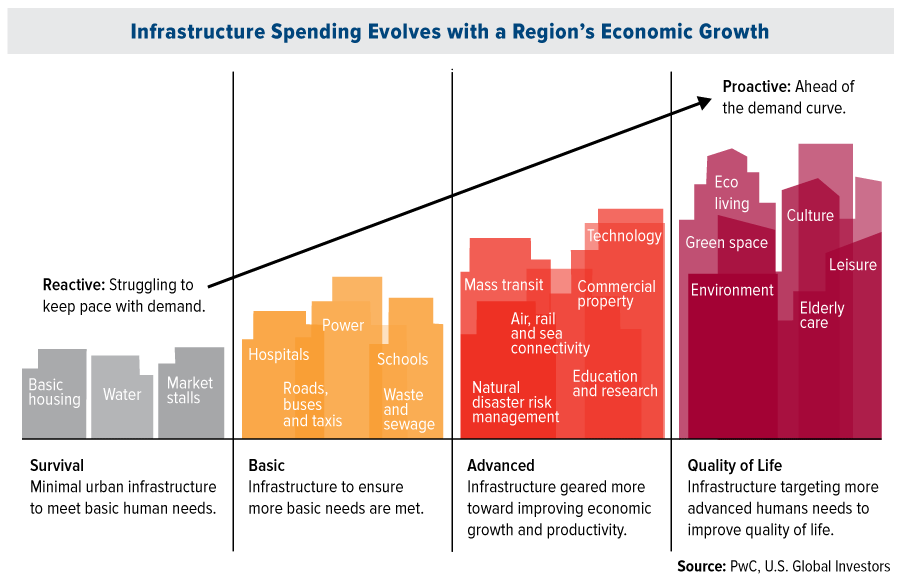

China is kicking our asses in GDP growth because they massively invest in infrastructure. As we know from the Transcontinental Railroad (1869) or the Interstate Highway System of the 50s, when you build new roads, bridges, dams, airports, etc. – you allow new commerce to spring up around it and THAT creates jobs that drive the economy forward. Our lack of infrastructure investing chokes off job creation and, sadly, that's the way Big Business likes it, because it also keeps their potential competition from being able to gain a foothold.

We used to be an Advanced Economy that was beginning to focus on Quality of Life issues, making real progress in the 90s but now, less than 20 years later, it's hard to ague that we're not in Survival mode and even those needs are not being met. Yet, because the market is artificially stimulated while real, asset-creating stimulus is ignored – the people seem willing to sit by while we kick the can further down the road. It's not going to end well and it's not going to last long at this point.

You've been warned!