$2 MILLION Dollars.

$2 MILLION Dollars.

Well, actually it's $1,960,061 but that's still up 326% from our $600,000 start in our paired Long-Term and Short-Term Portfolios since their inception on 11/26/13. We're "only' up $440,607 (29%) in 13 months (see our July, 2016 portfolio review) as, even at that time, I wondered "Are We Too Bullish".

The S&P was at 2,120 last July and now at 2,425 so up 14% which means we're outperforming the S&P by 100% so I certainly don't think we've become too bearish, we've simply tapered our 40%+ annual growth of the first 3 years in favor of spending more money on hedges - to lock in these ridiculous gains.

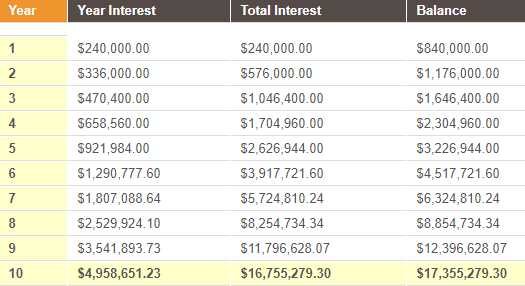

And they are ridiculous. As I noted on Friday, there isn't enough money in the World, nor are the Central Banks printing money fast enough to pay everyone 40% annual gains. In fact, if you start with $600,000 and make 40% a year for just 10 years, that's $17.3 MILLION! So, I will ask you again, do you think it's likely or unlikely we continue along this path?

No, that would be silly, right? No matter how confident we are in our own abilities to make money, we have to recognize that this is a unique market situation that is inherently unsustainable. It's a lot like catching a really good wave while you are surfing - we're good surfers and we will take full advantage of it but you can't fool yourself into betting the next wave will be even bigger, and the one after that and the one after that - it's simply not how the universe works.

No, that would be silly, right? No matter how confident we are in our own abilities to make money, we have to recognize that this is a unique market situation that is inherently unsustainable. It's a lot like catching a really good wave while you are surfing - we're good surfers and we will take full advantage of it but you can't fool yourself into betting the next wave will be even bigger, and the one after that and the one after that - it's simply not how the universe works.

Of course, we know what's causing these giant wavers - Central Bank Policies - but then we have to consider if those are sustainable and, as you can see from the rate chart - the amount of money they need to pump into the system begins to grow exponentially to sustain these asset gains.