Dow 22,000, S&P 2,500, Nasdaq 6,000, Russell 1,420 and National Debt $20Tn.

Dow 22,000, S&P 2,500, Nasdaq 6,000, Russell 1,420 and National Debt $20Tn.

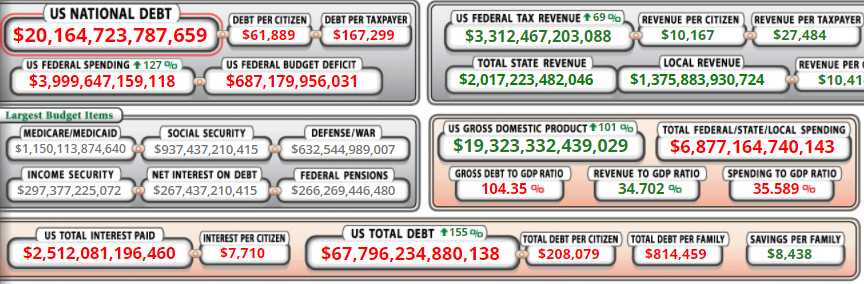

It's an interesting combination. American's also have $18.5Tn in personal debt, that's been climbing at a rate of about $500Bn per year this century (up 124% since 2000) and accounts for 2.5% of our GDP, which is growing at less than 2% so the ENTIRTY of our economic growth is debt-financed. Even more so becasue our Government is going $1Tn per year into debt too, that's 5% of our GDP ($19.3Tn) in Government debt and that does not include the $500Bn a year the Fed has been adding to its balance sheet through the continuing QE program – that's another 5%.

So, 12.5% of our MAYBE 3% GDP growth is nothing more than deficit spending which means the real economy is DOWN 9.5% if, like Greece, we were forced to balance our budgets. Of course, balancing our budgets is out of the question because your share of the National Debt is $208,079 and, if you have a family, we're looking over $800,000 just to pay off your Government's share – before you even begin to do something about your own mess.

Logically then, this debt is uncollectable. Most people don't have $800,000 and aren't likely to get it in the near future. Even if we made the Top 10% pay 10x, that's "$8M" for our top 1M families, which would be $8Tn but only the Top 0.01% have that kind of money and good luck getting President Trump to pay that bill!

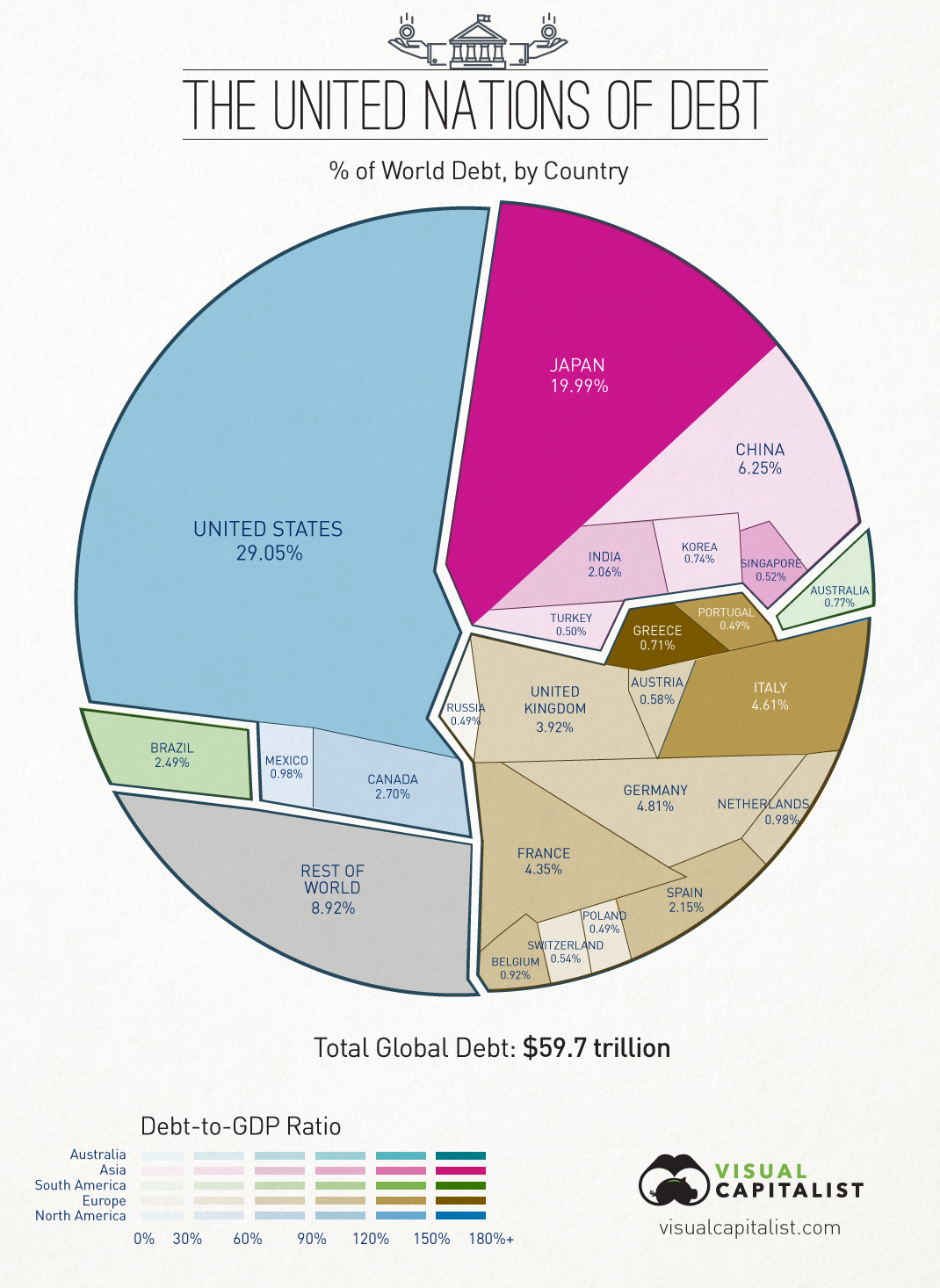

Where is the end game here? And it's not just the US, of course. In fact, our debt to GDP ratio is a relatively calm 104% while China and Japan are in the 250% debt to GDP range though, "officially", China doesn't have much debt – which makes it much scarier when they are in denial.

Where is the end game here? And it's not just the US, of course. In fact, our debt to GDP ratio is a relatively calm 104% while China and Japan are in the 250% debt to GDP range though, "officially", China doesn't have much debt – which makes it much scarier when they are in denial.

What can't be denied is that the US has 29% of the World's debt and we're also about 25% of the World's GDP – so not completely out of proportion but it's still a huge problem for Global Lenders. Japan is really out of control, holding 20% of the World's debt against 6% of the GDP.

Getting back to the debt clock above, the key figure to watch is the US Federal Spending, which is just about to cross the $4Tn mark while Federal Tax Revenues are $3.3Tn, leaving us about $700Bn short but that's under the current Tax Plan, which Trump wants to change to collect far less money.

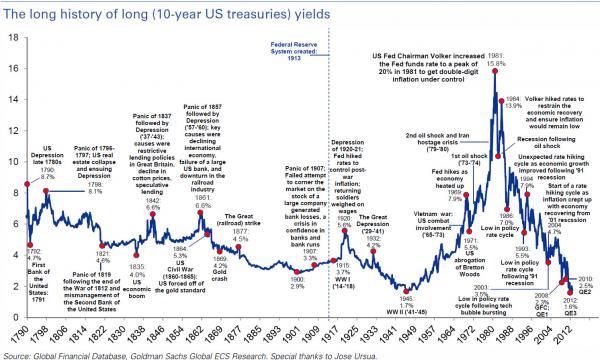

At the same time as the Government wants to stop collecting taxes from the richest Americans and the Corporations they own, they are opening up the debt ceiling to allow more borrowing AND the Fed is looking to raise interest rates – all of which are factors that can drive up our borrowing costs. Greece borrowed more and more money at low rates and only ran into trouble when the lending rates skyrocketed and they could no longer pay their debts. In the case of the US, we only paid $266Bn on $20Tn in debt in fiscal 2017 (Oct 1st – Sept 30th), which is an average of 1.33%. We can keep doing that forever, right? After all $266Bn is "only" 6.6% of our Federal Spending. However, we are paying the lowest rate of interest since 1945 and the historical average is closer to 5%:

5% would be $1Tn in interest alone, each year, in addition to the $700Bn a year we already overspend by. So this is what ComradeTrump is about to do to your country:

- He will collect less taxes from wealthy Americans and Corporations, $500Bn to $1Tn less – depending on the estimates

- He will push to raise the debt ceiling to accomodate the tax cuts

- He will NOT meaningfully cut expenses (it's simply not possible)

- That will cause the US's debt rating to go down, which will increase our borrowing costs

- An additional $750Bn in interest and $750Bn in tax cuts will double our National Debt in 10 years

That's the 5-step plan to destroying this country and it's not the sort of thing we'll be able to recover from – unless you have $1.6M under your mattress to pay off the 2027 debt bill. From there, it only gets much, much worse and, if rates spike up, like they did after WWII FOR THE NEXT 40 YEARS, then at 10% interest (1/2 of what Greece was paying) with $40Tn in debt, the interest on the debt alone ($4Tn/year) would be more than the Government is currently collecting in tax revenue.

So, what then? Do we double taxes or continue to ignore the debt? This isn't Global Warming folks, this isn't something you can ignore so your Grandchildren can endure lives of suffering at your expense – this is going to happen in the next 10 years and that doesn't mean you have 10 years – it will simply get incrementally worse each year for 10 years until it's completely unsustainable.

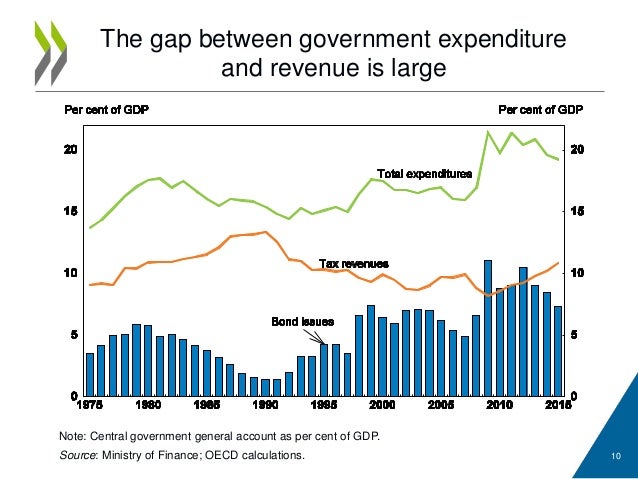

The "good" news is, this thing won't take us by surprise. It's very likely that whatever will happen to us will happen to Japan first. They are already 250% of their GDP in debt and, if not for the ultra-low interest rates, their interest payments would already be out of control. Japan is 1,000,000,000,000,000 Yen in debt – that's on QUADRILLION Yen and it already takes 43% of the tax revenues to service it. How is that possible? Well they just go further and further into debt, borrowing money to pay the interest on the debt they don't have enough money for. We do it too – it just doesn't seem as severe – yet….

The "good" news is, this thing won't take us by surprise. It's very likely that whatever will happen to us will happen to Japan first. They are already 250% of their GDP in debt and, if not for the ultra-low interest rates, their interest payments would already be out of control. Japan is 1,000,000,000,000,000 Yen in debt – that's on QUADRILLION Yen and it already takes 43% of the tax revenues to service it. How is that possible? Well they just go further and further into debt, borrowing money to pay the interest on the debt they don't have enough money for. We do it too – it just doesn't seem as severe – yet….

As you can see from the chart, Japan, in the 80s, to boost their economy, cut tax revenues and made up for it by issuing bonds (debt) and, unlike we are being promised, the revenues did not increase – they went lower and lower as Corporations and wealthy individuals found more and more loopholes while expenditures rose (especially interest on debt, which went from the 6% we have now to 43% they have now) and now the Government has to borrow as much money as they collect in taxes and they are still 15-20% of their GDP short every year. That would be like us having a $3-4Tn annual shortfall on top of paying $4Tn in interest while the Government spends $4Tn a year to keep the country running. How long can it last? Watch Japan closely and we'll have the answer.