Here we are again.

August 8th was "Trendless Tuesday – Stuck at the Market Top" with the S&P (/ES) at 2,480, which made for a nice shorting line and a $3,000 per contract gain back to 2,420. The Dow (YM) was at 22,050, the Nasdaq (/NQ) was 5,950 and the Russell (/TF) was 1,430. At the moment, we're focused on shorting /TF with 10 short contracts at an average of 1,419 and they are currently down $140 per contract and we'll see how the day plays out.

We have a Live Trading Webinar at 1pm (EST) this afternoon and we'll look for some good opportunities there. We had a lot of great trade ideas in last week's webinar and you can catch up on that one HERE. In last week's Webinar, Biodiesel Chris noted LIT and SQM were both great Lithium trades (1:04), based on the proliferation of electric cars and the need for more batteries and LIT was $34.59 while we looked at it and Sociedad Quimica Minera (SQM) was $49.99 and both have popped higher so both great calls and worth looking into as the future is very bright for Lithium.

On SQM, we liked selling the April $40 puts for $1.70, which nets you in for $38.30, which is now 23% off the current price and you can still sell those puts to get your foot in on the very hot Lithium trade. Those are the kinds of macro trades we like to discuss in the Webinars and kudos to BDC for bringing it to our attention.

Meanwhile, keep in mind that Lithium is "just" a $3Bn industry, which is a spec compared to $90Bn worth of Aluminum, $115Bn worth of Iron or $170Bn worth of Gold being traded each year. Nickel is another battery component and $21Bn of that is currently mined and Graphite is also used and is being used in a lot of cool stuff ($15Bn/yr), so that's another one I want to discuss in this afternoon's webinar with our Members.

Nothing, of course, holds a candle to Big Daddy Oil, which is a $1.7Tn annual consumable and oil has been on a wild ride all summer, ranging from $44 to $50, a 13.6% range is a $200Bn price swing in the market though, to put that in perspective, US Equities can move $1Tn in a day (2%) – so maybe not so crazy.

Yesterday's API Report showed the largest-ever drawdown of gasoline at 7.9Mb and that was through Saturday, caused by the double hit of the Texas refinery outages from Harvey and people fleeing Irma and filling up their tanks in Florida. That's kind of like creating the demand of a holiday weekend in the middle of a gas shortage.

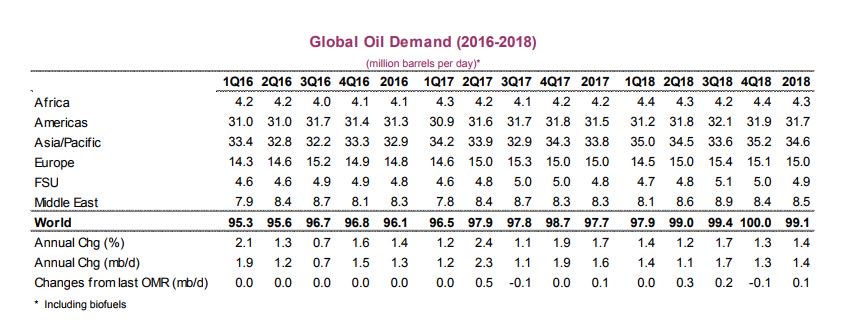

All the stops are being pulled out to use this crisis to OPEC's advantage as that cartel just released a report saying they have lowered production (in our time of crisis) to 32.75Mb/d, which is about 100,000 lower than July and OPEC's friends/employees at the IEA have increased their demand forecast for oil by 1.4Mb/d – which just so happens to be exactly enough to let OPEC roll back their production cuts and gives Saudi's Aramco a better valuation going into their upcoming IPO – isn't that convenient?

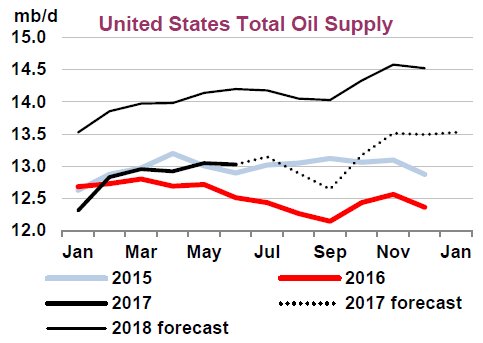

Meanwhile, don't be fooled as the US is projected to increase their own production of oil by about 1Mb/d and, if oil does make it to $50, it will be a lot more than that! We're skeptical, of course, and looking to short Oil (/CL) Futures ahead of this morning's API Inventory Report at 10:30. We were hoping it would hit $49 but $48.75 is the best we've got this morning so we may as well take it as a short entry, with tight stops above as we'd much rather use the $49 line or $48.50 if it breaks lower.

Meanwhile, don't be fooled as the US is projected to increase their own production of oil by about 1Mb/d and, if oil does make it to $50, it will be a lot more than that! We're skeptical, of course, and looking to short Oil (/CL) Futures ahead of this morning's API Inventory Report at 10:30. We were hoping it would hit $49 but $48.75 is the best we've got this morning so we may as well take it as a short entry, with tight stops above as we'd much rather use the $49 line or $48.50 if it breaks lower.

Over at the NYMEX, there are 308Mb worth of fake, Fake, FAKE!!! orders for October delivery and they all have to be rolled to longer FAKE!!! orders by next Wednesday so that's just 6 trading days to move 308,000 open contract but there are already 419,000 FAKE!!! open orders for November delivery and another 339,000 stuffed into Dec and even January has 195,000 open contracts already and that's a whopping 1.26 BILLION barrels worth of order slated for delivery to Cushing, OK – a facility that can only handle 50Mb/month. Aside from that, consider that the US only imports a net of 5.5Mb/day so, even with 120 days to play with – that would only be 660Mb for the ENTIRE country – that's what I mean when I call those orders FAKE!!!

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Oct'17 | 48.34 | 48.77 | 48.12 | 48.68 |

09:40 Sep 13 |

– |

0.45 | 170097 | 48.23 | 300216 | Call Put |

| Nov'17 | 48.85 | 49.26 | 48.61 | 49.14 |

09:40 Sep 13 |

– |

0.39 | 72836 | 48.75 | 417234 | Call Put |

| Dec'17 | 49.26 | 49.64 | 49.02 | 49.50 |

09:40 Sep 13 |

– |

0.33 | 36312 | 49.17 | 337816 | Call Put |

| Jan'18 | 49.54 | 49.91 | 49.34 | 49.77 |

09:40 Sep 13 |

– |

0.29 | 17437 | 49.48 | 195387 | Call Put |

| Feb'18 | 49.73 | 50.13 | 49.58 | 49.97 |

09:40 Sep 13 |

– |

0.25 | 7721 | 49.72 | 73186 | Call Put |

| Mar'18 | 49.84 | 50.22 | 49.75 | 50.11 |

09:40 Sep 13 |

– |

0.21 | 9183 | 49.90 | 148087 | Call Put |

Since they have absolutely no intention of having those orders delivered, the NYMEX traders (who work for oil companies who have them fake trades to jack up the prices paid by consumers – yet it's never investigated) must either roll or sell their orders by the 20th. Usually they roll them but, at the moment, the Nov contracts are 0.50 higher than October, so that's a very expensive roll and impacts their bonuses. And, of course, since we had a build in oil of 6.2Mb last week (per API) – it's going to be very hard to find buyers for October delivery.

For now, we're going to keep using the 8/18 oil trading levels chart we created for our Members, which predicted the range would be $45-$50 moving forward and the closer we get to $50, the more interested we are in setting up a short. Now that the Holiday is gone, however, we have less fear of an upside catalyst and OPEC and the IEA already made a bull push, so we'll initiate a short here and see how it plays out.

I feel good about shorting oil into next Wednesday's rollover and the Oil ETF (USO) is at $9.93 and the Oct $11 puts are $1.12, which is just 0.05 in premium. If oil falls 2.5% that would be a 0.25 drop in USO, which isn't too exciting but it's a nice 20% quick gain. On the Futures contract (/CL), a 2.5% drop is $1.22 and we make $1,220 per contract. THAT is why we like playing the Futures.

Come join us at our Live Trading Webinar this afternoon, where we'll practice some Futures Trading and talk about how we can make money from battery tech!