Does anything matter?

Does anything matter?

This morning, North Korea threatened to use a nuclear weapon against Japan and turn the U.S. into “ashes and darkness” for passing fresh UN sanctions earlier this week – fiery rhetoric that is likely to exacerbate tensions in North Asia. “Japan is no longer needed to exist near us,” the state-run Korean Central News Agency said on Thursday, citing a statement by the Korea Asia-Pacific Peace Committee. “The four islands of the archipelago should be sunken into the sea by the nuclear bomb of Juche,” it said, a reference to the regime’s ideology of self-reliance.

I love that that's a message from the Peace Committee. I can't wait to hear what the War Council has to say!

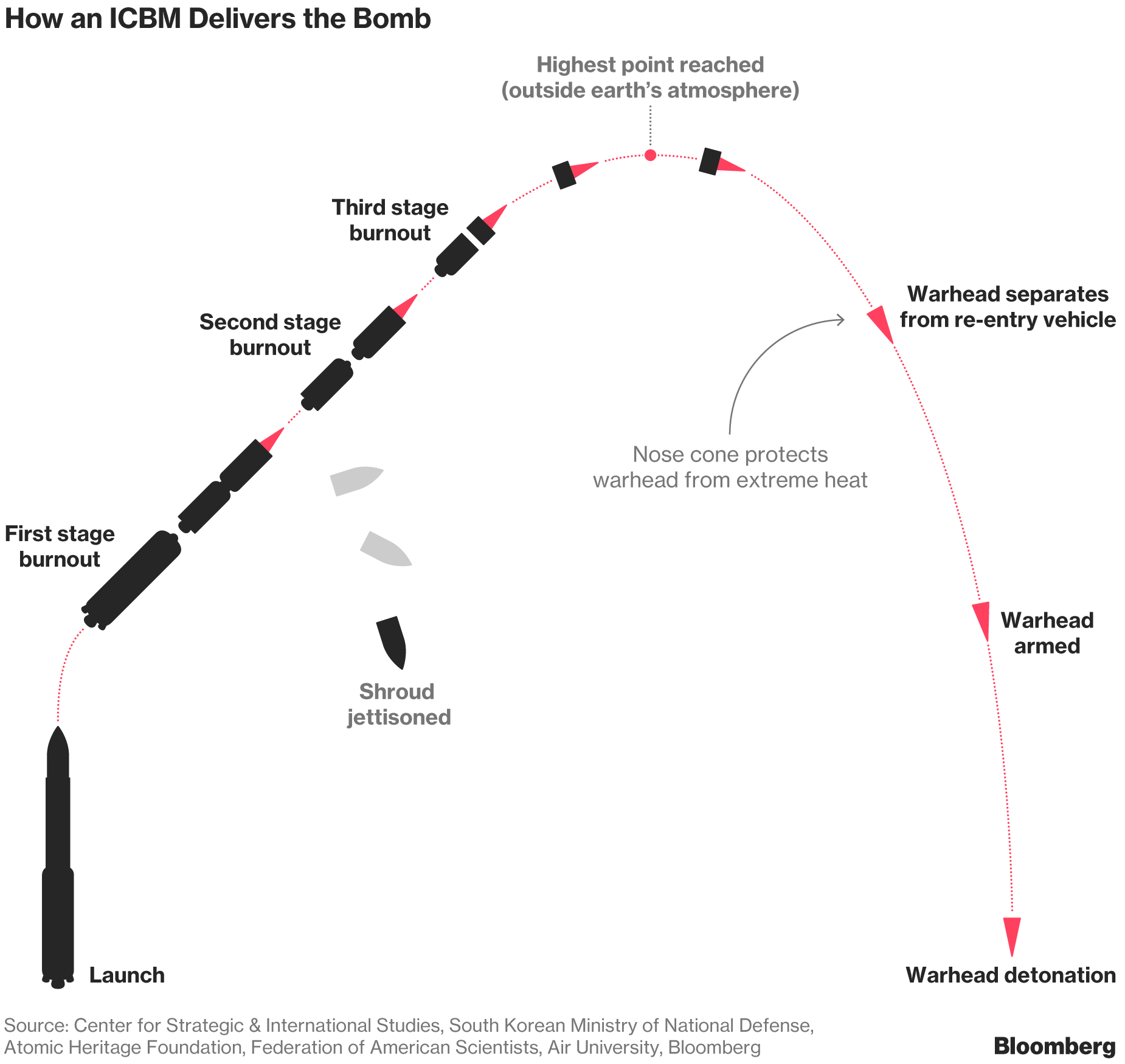

Keep in mind these guys just fired an actual ICBM right over northern Japan and no, it was not shot out of the sky or disabled in flight. Japan simply advised it's citizens to seek shelter and hope for the best. There's really no time to react as this would be like New York bombing Chicago – it's a very short flight at 15,000 miles per hour (yes, that's how fast they go). Anyway, it's all just a fun fact as the Nikkei has already shaken off the news and headed higher this morning and our markets are flat though Europe is turning down slightly.

Meanwhile, in the United States, the war on the poor continues and the Top 1% have scored a major strategic victory by having their pet Congresspeople in the GOP plant legislation in the budget bill that essentially requires the IRS to audit all 28M recipients of Earned Income Tax Credits. At the same time, the Republicans are cutting the IRS budget so, effectively, they are making it impossible for the IRS to do their actual jobs and audit high-income returns.

Not only would this use 120% of the IRS's time but it will also force 28M low-income Americans to go through a long, tedious process in order to get the refunds, which are also now going to be held up for months, denying millions of people money they count on to live. And, of course, these are the people least able to hire professional help to prepare their taxes – it's financial torture for the poor in a move aimed to discourage people from even applying for the credit in a stealth aim to nuke a $60Bn budget item to free up more money to distribute to the Top 1%.

This legislation came straight out of the Koch Brothers' Heritage Foundation under the very Republican title of "Reforming the Earned Income Tax Credit and Additional Child Tax Credit to End Waste, Fraud, and Abuse and Strengthen Marriage" which laughingly states that: "A sound welfare system should encourage self-sufficiency through work and marriage." So, in the Koch Brothers' World, you are self-sufficient only if you submit to being a wage slave or submit to a man who will support you – good luck with that! What's next?

None of this matters because – TAX CUTS! Not for you, really, unless you are in the Top 0.01% (making over $1.6M per year) but it sounds like fun anyway, right? Remember, the budget bill passes and that screws the poor out of another $60Bn (and Medicare cuts will free up another $487Bn for distribution to the wealthy while the poor die on the streets), which paves the way for Trump to claim the massive tax cuts he, his family and his friends will be getting will be "revenue neutral."

Trump tweeted out yesterday that tax cuts are needed "more than ever before" due to the hurricanes and, of course, the base loves that but do the people Texas and Flordia who were actually affected by the flood think it's a better idea to cut their individual taxes by a few hundred Dollars or perhaps the rich around the country should shave $100Bn (10%) off their own tax cut to directly aid the hurricane victims and rebuild vital infrastructure.

Trump tweeted out yesterday that tax cuts are needed "more than ever before" due to the hurricanes and, of course, the base loves that but do the people Texas and Flordia who were actually affected by the flood think it's a better idea to cut their individual taxes by a few hundred Dollars or perhaps the rich around the country should shave $100Bn (10%) off their own tax cut to directly aid the hurricane victims and rebuild vital infrastructure.

THAT is what Governments are supposed to do – pool the people's resources so they can act in times of necessity. Our actual Government is being dismantled and replaced by an Oligarchy that rivals Russia's and the most terrifying thing is how complacent people are about it. Well, maybe it's the second most terrifying thing as the first has got to be how Trump can flat-out lie and no one calls him on it.

China, in FACT has a standard business tax rate of 25% and businesses are effectively are taxed up to 45.6% when factoring in additional fees levied by local governments, social security payments and other royalties. By comparison, a study of corporate tax rates by Trump's own Congressional Budget Office published in March found that, while American companies were subject to a statutory corporate income tax rate of 39.1%, after deductions and credits they enjoyed an effective rate of just 18.6% in 2012, the last year for which complete data were available – already the lowest effective Corporate Tax Rate in the World!

Imagine if Obama flat-out lied in order to push his legislative agenda? Rember the big deal about him saying you could keep your Doctor under Obamacare which turned out SOMETIMES not to be true two years later, when the stripped-down legislation finally passed? We never heard the end of it. Yet Trump does stuff like this every day and the Billionaire-owned Media says NOTHING!

So the crackdown on DACA was simply a hostage-taking by Trump and the GOP to force Democrats to sign off on the ridiculous wall. Really Republicans – what would Reagan say? What would any rational person say?

Yes, we're still painfully short the indexes as well as oil, which is testing $50 this morning.