Well, we did it!

Well, we did it!

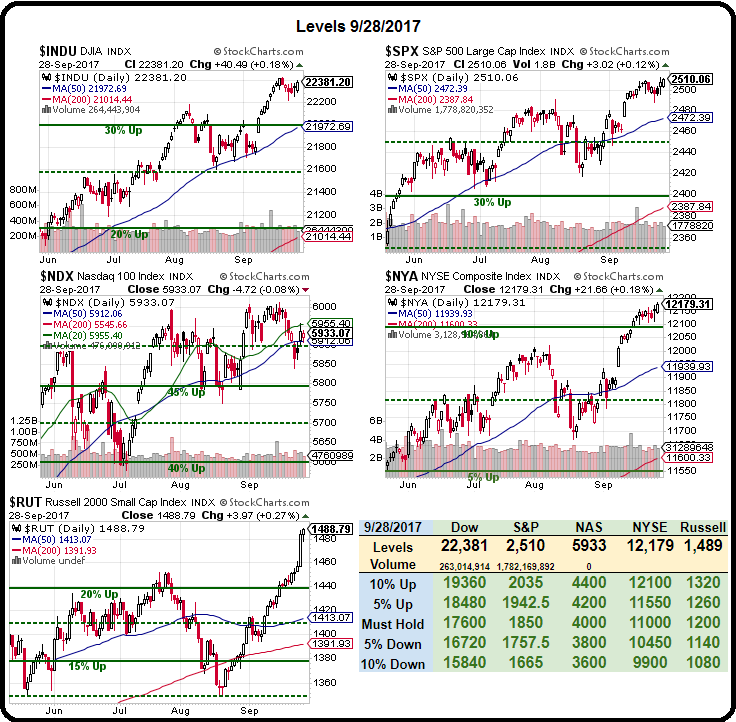

All of our indexes, exept the Nasdaq are at their highs and this party looks like it's never going to stop as long as people are willing to believe that Trump's tax plan will help the Middle Class or the Economy or that the Fed withdrawing stimulus will have no effect (even though adding stimulus had a HUGE effect) or that as long as you don't hear about North Korea for a week because people are worried about who's kneeling at a football game – that all is well in America.

And how can things not be great? If the facts don't fit the narrative, they change the facts. Treasury Secretary Steve Mnuchin told the press in Las Vegas that workers benefit the most from Corporate Tax Cuts and, if you think that sounds preposterous, you could have fact-checked it with a 2012 report from the Treasury's Office of Tax Analysis that showed workers pay 18% of Corporate taxes and owners pay 82% so what Mnuchin claimed is only about 450% untrue. When challenged on this — the Treasury department REMOVED the report from the public records.

“Every record has been destroyed or falsified, every book rewritten, every picture has been repainted, every statue and street building has been renamed, every date has been altered. And the process is continuing day by day and minute by minute. History has stopped. Nothing exists except an endless present in which the Party is always right.” – Orwell, 1984

1984 was not meant to be an instruction manual! It's not legal to alter or remove Government records – even if they do contradict with the bullshit you are currently spouting. When Trump deletes his embarrassing tweets supporting politicians who get trounced in elections – he's committing a Federal offense in violation of the Presidential Records Act of 1978, which was introduced in the wake of the Watergate Scandal to prevent exactly the sort of thing this administration is doing.

1984 was not meant to be an instruction manual! It's not legal to alter or remove Government records – even if they do contradict with the bullshit you are currently spouting. When Trump deletes his embarrassing tweets supporting politicians who get trounced in elections – he's committing a Federal offense in violation of the Presidential Records Act of 1978, which was introduced in the wake of the Watergate Scandal to prevent exactly the sort of thing this administration is doing.

Meanwhile, in another nod to Nixon, the Administration is compiliing an enemies list and demanding Social Media Companies like Facebook (FB) turn over the account information on people who simply "LIKE" a page that's anti-Trump like "DisruptJ20" which helped organize the protests in Washington DC. WARNING – Following that link may put you on a list that leads you to be turned down for Government jobs or contracts, may result in a tax audit and may lead to you being placed on the "No-Fly" list – just for starters. Isn't America Great Again???

Meanwhile, I just finished my interview on Benzinga's Pre-Market Prep and the LB trade we played back on Aug 21st (eclipse day) is already up 164%, so they are thrilled with me. When pressed for another trade, I pointed them to yesterday morning's TZA/AAPL hedge as it's very hard, in good conscience, to pick another long for a large audience when the markets have so much uncertaintly ahead and, of course, so few people are properly hedged.

The TZA/AAPL spread netted just $650 on the $10,000 spread and TZA is at $13.73 with the Russell at 1,489 so, with our goal of $14, if the Russell even twitches lower – we get paid in full. In theory, if the Russell goes higher, the Apple puts expire worthless and our cost of $10,000 insurance between now and November expirations is just $650 – not a bad way to hedge!

They know I'm no fan of Tesla (TSLA) but it's too scary to short so they asked if I liked General Motors (GM) and sure I do but I like Ford (F) better and we didn't have time to look at a trade on it but, in Wednesday's Live Member Chat Room, we had the following discussion about buying the stock:

F – The question is, what are you in the stock for? The 0.60 dividend on 7,000 shares is $4,200 and selling 70 2019 $12s for $1 raises $7,000 and maybe $5,250 in dividends (5) for $12,250 and that drops to $5,250 at $11 and deteriorates from there.

I submit to you that cashing the stock and just selling 100 of the 2019 $12 puts for $1.55 nets you $15,500 at $12 and your break-even is down at $10.45 and you save $84,000 in cash against $12,500 in margin or less assuming you have PM. So what is the stock for?

And yes, I know we have F in our portfolios but it's more to teach people how to deal with dividend stocks than it is to have F specifically in the portfolio. So nothing wrong with your play but consider if it's worth the effort when you can simply promise to buy 10,000 F and collect $15,500 without all the fuss.

In other words, if you are going into Ford (or any dividend stock) with the intent of hedging it to collect the dividend "safely" – why not just sell puts against the stock instead. In the case of F, they pay 0.15 per quarter and we can sell the 2019 $12 puts for $1.55 which is 10 QUARTERS worth of dividends – and we get it RIGHT NOW for selling the puts, which only obligate us to buy the stock for $12 in Jan, 2019 (if it's below that price). Currently, F is at $11.96 and, if they assign you, you lose 0.04 on the stock but gain the $1.55 from the assigned contract – so no downside there.

Break-even on the trade is $10.45, which is a 15% discount to the current price and, as mentioned above, anything over $12 means you keep the $1.55 and have 5 bonus dividend payments over the next 5 quarters (between now and Jan 2019) almost double what you would collect by laying out $1,500 for the stock and waiting (and risking). So your downside is less and your upside is more unless F is over $13 but, over $13, you would have hit the cap of your short calls anyway (if you were hedging) so really, there's no reason at all to own the stock BUT you can still collect double their usual dividends for NOT owning it (see: "How to Buy a Stock for a 15-20% Discount").

If we make it through earnings without a pullback, we'll be happy to get more bullish but, as I said on Benzinga this morning – I think it's very important for now to have hedges and our rule of thumb is putting 25-33% of our profits into our hedges – in order to lock in our ill-gotten gains!

Please be careful out there and have a great weekend,

– Phil