In fourteen hundred and ninety two,

In fourteen hundred and ninety two,

Columbus sailed the ocean blue – and got totally lost, missed India by 6,000 miles but called the Native American Islanders Indians anyway, slaughtered them and stole their gold and, lacking any real wealth to go back to Spain with, instituted a slave trade that lasted 250 years and ruined the lives of tens millions of people. Yay!

I got called into the Principal's office when my daughter gave a report like that in 7th grade – just 5 year ago. Suddenly, it's in vogue to question our "heritage" and the legends of the founders and that's a good thing. You want Russians to question Marx and Lennin and you want the Chinese to question Mao so why shouldn't our children question Columbus and Jefferson? Either you want to raise critical thinkers or you don't.

There aren't many critical thinkers playing the markets these days. Over the weekend, Trump and North Korea continued their Twitter War after Trump's "calm before the storm" comments on Friday and Saturday afternoon, the President of the United States tweeted "Presidents and their administrations have been talking to North Korea for 25 years, agreements made and massive amounts of money paid…hasn't worked, agreements violated before the ink was dry, makings fools of U.S. negotiators. Sorry, but only one thing will work!" to which Kim Jong Un said that proved it was necessary to protect themselves against the “nuclear threats of the U.S. imperialists.” Kim Jong-un also said that North Korea’s nuclear weapons are a “powerful deterrent firmly safeguarding the peace and security in the Korean peninsula and Northeast Asia.”

Senator Bob Corker, the Republican chairman of the Senate Foreign Relations Committee, charged in an interview on Sunday that President Trump was treating his office like “a reality show,” with reckless threats toward other countries that could set the nation “on the path to World War III.” Other key quotes from that interview were:

Senator Bob Corker, the Republican chairman of the Senate Foreign Relations Committee, charged in an interview on Sunday that President Trump was treating his office like “a reality show,” with reckless threats toward other countries that could set the nation “on the path to World War III.” Other key quotes from that interview were:

- "I know for a fact that every single day at the White House, it's a situation of trying to contain him."

- He acts "like he's doing 'The Apprentice' or something."

- On how fellow GOP senators feel: "Look, except for a few people, the vast majority of our caucus understands what we're dealing with here… of course they understand the volatility that we're dealing with and the tremendous amount of work that it takes by people around him to keep him in the middle of the road."

- On Trump undermining Tillerson: "A lot of people think that there is some kind of 'good cop, bad cop' act underway, but that's just not true."

- On Trump's tweets harming U.S. foreign policy: "I know he has hurt, in several instances, he's hurt us as it relates to negotiations that were underway by tweeting things out."

Corker remains influential, and his breaking from Trump so publicly could lead others to speak out. Perhaps more significantly, the retiring Senator still holds a vote until Jan. 2019 in a Senate the Republicans control by a two-vote margin. He's highly skeptical of Trump's tax plan, and may be tough to get onside on other key issues.

Those key issues include tax reform and the Obamacare repeal (yes, they are still trying to do that) and those are the underpinnings for the market rally. The justification for these record-high market multiples is that we're not taking into account all the extra money companies will be making when they don't have to pay taxes anymore but they don't pay taxes now – so how much less can they possibly pay?

Those key issues include tax reform and the Obamacare repeal (yes, they are still trying to do that) and those are the underpinnings for the market rally. The justification for these record-high market multiples is that we're not taking into account all the extra money companies will be making when they don't have to pay taxes anymore but they don't pay taxes now – so how much less can they possibly pay?

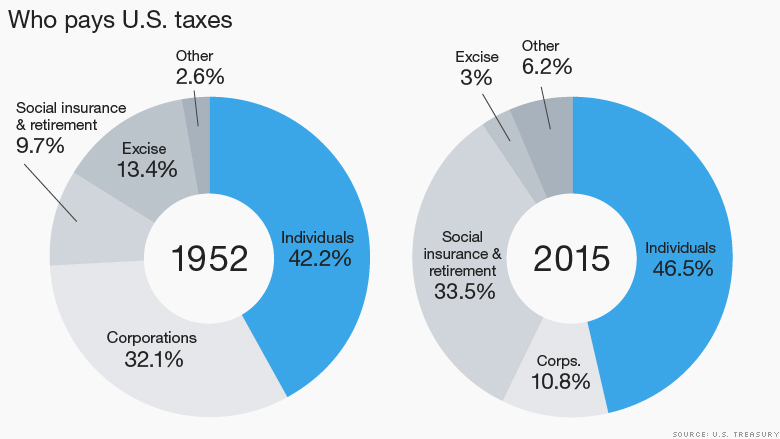

Taxes are already down 2/3 for Corporations in the past 40 years and now Trump's plan it to knock off another 1/3 of what's left but 2% is only 10% of where we started and, it begs the question – if cutting Corporate Tax Rates fixes everything – why didn't the first 66% of the cuts have any effect (other than leading to 2 of the worst market crashes in history and an economy that's $20Tn in debt)?

Including "Entitlement" taxes (that's right, they talk about cutting entitlement spending but ignore tha fact that they already took that money from you – so you ARE ENTITLED to get it back!), Individual Taxes have jumped from 51.8% of all collections in the 50s to 80% in 2015 (up 42%) while Corporate Taxes (including Excise Taxes) have dropped from 45.5% to 13.8% (down 70%). The new tax plan doesn't have to completely screw the Middle Class – the old tax plan already did that!

Including "Entitlement" taxes (that's right, they talk about cutting entitlement spending but ignore tha fact that they already took that money from you – so you ARE ENTITLED to get it back!), Individual Taxes have jumped from 51.8% of all collections in the 50s to 80% in 2015 (up 42%) while Corporate Taxes (including Excise Taxes) have dropped from 45.5% to 13.8% (down 70%). The new tax plan doesn't have to completely screw the Middle Class – the old tax plan already did that!

Excise taxes were a type of tax that Corporations couldn't avoid paying because they were based on sales – not phony P&L statements so, of course, those have been slashed from 13.4% to 3% (down 77.6%) and there, in a nutshell, is why the US is $20Tn in debt – it's nothing but $20Tn of tax avoidance by Corporations that's gotten worse and worse every year for decades and the proposal on the table now is to CUT THEIR TAXES FURTHER and also give massive tax cuts to the owners of those Corporations. This is MADNESS!

67% of the people now disapprove of the direction our country is heading but the GOP is doubling down for the 32%. Only 67% of Republicans still support the President, down from 80% in March and that does not bode well for next year's elections with 13 months to go. Instead of getting a handle on what's actually wrong with this country, our Vice President, Mike Pence, flew to Indianapolis over the weekend in order to engage in some performance art – walking out on the Colts game "because the 49ers kneeled during the National Anthem". That's the story – here's the facts:

Pence knew this was going to happen. The press was told to remain in the parking lot, and not even to bother coming in — as Pence would be leaving early.

Pence had just been in Las Vegas, and his next stop was Los Angeles, a short plane flight west — but he instead flew all the back to Indianapolis for this photo op, taking his entourage and his security detail with him. The streets doubtless had to be blocked off for his motorcade. Special security precautions were taken for the Vice President of the United States. All along, he planned to engage in a tawdry, pre-planned sham performance — with all the expense that entails — just to get people embroiled in a cynical culture war.

If they want to pull something like this as a sort of campaign stunt, let them pay for it with campaign money. Don’t bill the taxpayers for this. This is why people hate government.

This country has real problems brewing and yes, Peurto Rico still has no electricity or fresh water for 3M people stuck on an island and THIS is what our leaders are up to? The question is, why isn't EVERYONE kneeling at this point?

This country has real problems brewing and yes, Peurto Rico still has no electricity or fresh water for 3M people stuck on an island and THIS is what our leaders are up to? The question is, why isn't EVERYONE kneeling at this point?

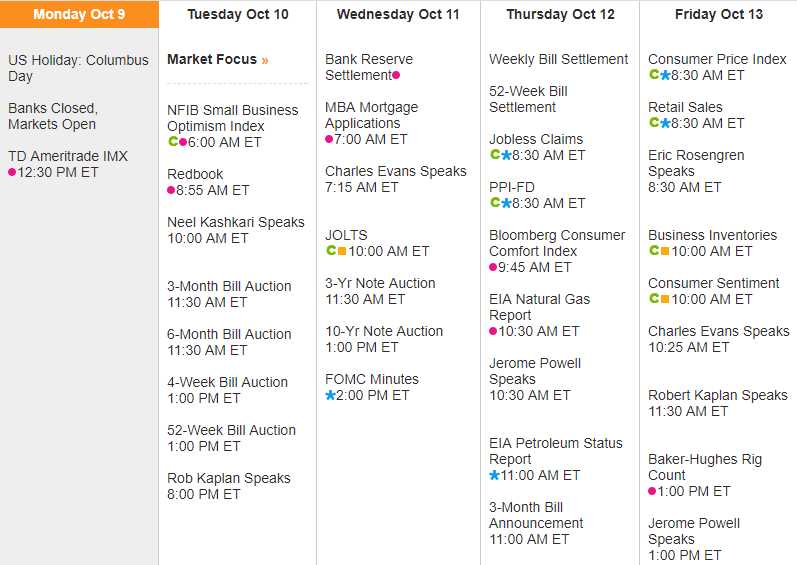

As promised, we sent out Alerts to press our hedges on Friday, taking our President's word that a storm is coming as a good reason to be cautious into earnings, which kick into gear on Thursday, with CitiGroup (C) and JP Morgan (JPM) reporting, followed on Friday by BankAmerica (BAC), Wells Fargo (WFC), PNC (PNC) and First Horizon (FHN) and then, next week – we're officially back in earnings season.

Today is a holiday and the volume will be very low but we have 9 Fed speakers jammed into the next 4 days and the Fed Minutes will be released on Wednesday, along with a 10-year note auction at 1pm. Other than that, just some loose data with Retail Sales punctuating the week on Friday along with Consumer Sentiment:

Not much else to do but let today play out and, hopefully, see what is real tomorrow.