Another day, another high.

Another day, another high.

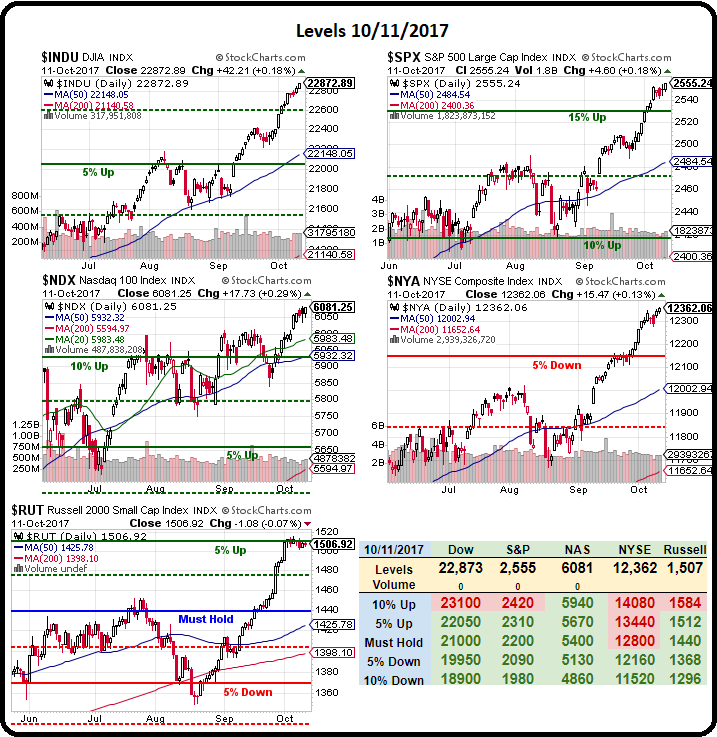

We may be too bearish into the weekend now so we'll have to play an upside hedge (in addition to RSX, which has also popped since our pick) and we'll look for something during today's Live Member Chat Room. Today's run-up may be nothing but we're breaking over technical levels that certainly LOOK bullish enough – especially on the Russell, where we've been shorting.

This morning's rally is based on Chinese Import Data, which is up 19% from last year, which sounds very impressive until you realize that the Dollar was 10% higher vs the Renimbi last year, so half of that growth is currency-related – assuming the data is accurate in the first place – which is always a question with Chinese data.

Also, think of how many parts had to be imported to be turned into new IPhones last quarter – that too bumps up the import numbers. It's not the Chinese consumers that are buying more stuff, it's the Apple assemblers. China is also building things with Iron Ore Imports up 10.5% (more in-line with the actual growth) and Iron Ore prices have jumped up 10.5% (what inflation) in September alone, which is good for BHP Billiton (BPH), Rio Tinto (RIO) and Vale SA (VALE) and VALE makes a nice, bullish trade as it's still under $10/share with almost $1/share in earnings for a p/e of about 10. As a bullish economic trade we can:

- Sell 10 VALE 2019 $10 puts for $1.80 ($1,800)

- Buy 15 VALE 2019 $7 calls for $3.20 ($4,800)

- Sell 15 VALE 2019 $12 calls for 0.85 ($1,275)

That's net $1,725 on the $7,500 spread so the upside potential is $5,775 (334%) if VALE is up 20% by Jan, 2019. The downside risk is owning 1,000 shares of VALE at $10 plus the potential loss of $1,725 so net $11.75 makes this an aggressive play but anything over $10 means we do not get assigned the short puts and we're already $4,500 in the money to start the trade – that's fun!

It's a sideways play on China and we may have to consider China's ETF (FXI) for one of our longs though China Mobile (CHL) is very interesting near $50 as well. As I noted above, we are, if anything, over-hedged, so there's little harm that can be done by us adding some bullish plays – just in case this mad rally keeps plowing along. It's easy to pick upside winners – that's monkey with dart-board stuff – the trick is to lock those winners in during a downturn.

Our next major economic concern is the ECB meeting on the 26th, where it's very possible they will cut their $72Bn/month QE program in half. The ECB is one of the biggest buyers of debt in the World and liquidity could really begin to tighten if they cut back quickly (our Fed does $60Bn/month and is cutting $10Bn/qtr). Another reason markets are rallying today is Abe is polling well in Japan ahead of their elections (22nd) – so easy money policies there are likely to remain in place.

We got our own CPI this morning and it came in at 0.5% vs 0.6% expected and core CPI dropped to 0.1%, pacing us at 1.7% for the year, which means the Fed is under no pressure at all to raise rates and, it could be argued, need to do more to stimulate inflation. Of course the CPI does not count the cost of oil, which is back at $51.60 this morning with Gasoline at $1.62, where it will make a great short later today (/RB). Oil and gas are up because 20% of Gulf production remains shut in but, when you think about it – how is that bullish as we had a build in inventories anyway so, when the production comes back on-line, we'll have a huge glut.

The low CPI has dropped the Dollar 0.5%, back to 92.6 and probably heading a bit lower and that's boosting commodities and equities this morning. Another thing knocking down the Dollar is Retail Sales, which were up 1.6% in September but 1.7% was expected and ex-Autos was only up 1%, which is disappointing with all that hurricane buying that was supposed to boost the numbers.

The low CPI has dropped the Dollar 0.5%, back to 92.6 and probably heading a bit lower and that's boosting commodities and equities this morning. Another thing knocking down the Dollar is Retail Sales, which were up 1.6% in September but 1.7% was expected and ex-Autos was only up 1%, which is disappointing with all that hurricane buying that was supposed to boost the numbers.

Keep in mind those sales are up 1.6% from last month (led by Building Materials, which were up 10.7%), which was down 0.2% so up 1.6% from a lousy month is not at all impressive. Also keep in mind that, last October, the US Dollar Index was at 103 and now it's below 93, so down 10% means we're spending 1.6% more Dollars and getting 8.4% less stuff – what inflation, right? Retial Sales haven't been impressive all year but particularly not so in July, Aug and Sept, which are the months we're about to get earnings reports on – so we'll be keeping our hedges, thank you – it's just that we're going to hedge our hedges as well!

The weak Dollar is also a major factor boosting the price of commodities and stocks – just like the weak Yen is over in Japan. We'll have to keep an eye on earnings as well, as those tend to be skewed by Dollar moves and 10% down from last year's report can lead to some very serious distortions – yet lazy analysts will ignore this MASSIVE factor and continue to pontificate and extrapolate as if the primary tool they are measuring with isn't a variable – IDIOTS!

Of course the good news is that our $20Tn National Debt is now $2Tn cheaper to pay off in constant currency – you can thank Trump for that!

Have a great weekend,

– Phil