Viva la Resistance!

Senator Jeff Flake gave a Hell of a speech on the Senate floor yesterday, calling for his fellow Senators to stand with him against the "impulses to threaten and scapegoat" which could turn the GOP into a party of "fearful, backward-looking people, " saying:

Reckless, outrageous, and undignified behavior has become excused and countenanced as "telling it like it is," when it is actually just reckless, outrageous, and undignified.

The notion that one should stay silent as the norms and values that keep America strong are undermined and as the alliances and agreements that ensure the stability of the entire world are routinely threatened by the level of thought that goes into 140 characters – the notion that one should say and do nothing in the face of such mercurial behavior is ahistoric and, I believe, profoundly misguided.

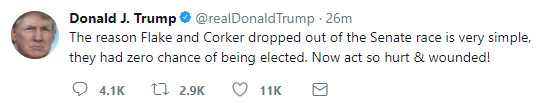

To which the President, of course, replied by theatening and scapegoating in a tweet:

This would be funny if it wasn't so tragic. And don't think this doesn't affect the markets as losing 2 reliable Senate votes means Trump needs ALL 50 of the other Republican Senators to line up behind his agenda or nothing will be done – even with Pence's tie-breaker. What that effectively does is put any one of those 50 Senators in the drivers seat to make demands because they can't afford to lose a single vote and, if one more Senator joins The Resistance – Trump effectively becomes a lame duck and his agenda goes out the Window.

Remember how the Republicans told the Democrats they had to wait 18 months until the next election and "let the voters decide" who sits in the Supreme Court? Well, now that turns around on them and Trump may not get those appointments he's been salivating over. More to the point, why are we investing in stocks at all-time high valuations while our Government is in chaos? Do you think it was wise to buy into France's market while people were marching in the streets?

Speaking of egalite, Ray Dalio has joined my "Tale of Two Economies" team – something I've been warning about since our 2010 Outlook. Dalio pointed out that the Fed's use of "averages" in their statistics about what’s going on in the economy mask deep divisions that could lead to “dangerous miscalculations.” He runs through a number of different statistics showing that the economy for the bottom 60% of the population — or three in five Americans — is much less stable than that for those in the top bracket.

For example, Dalio notes that, since 1980, real incomes have been flat or down for the average household in the bottom 60%. Those in the top 40% also now have an average of 10 times as much wealth as households in the bottom 60% — an increase from six times as much in 1980. Other points include that only about one-third of people in the bottom 60% save any of their income and a similar number have retirement savings accounts.

These three in five Americans have also seen an increasing rate of premature death and spend an average of four times less on education than those in the top 40%, Dalio wrote. Those without a college education see lower income rates and higher divorce rates. Dalio wrote that all of these concerns will likely intensify in the next five to 10 years – just as they have for the past 10 as, once again, Trickle Down Economics has done nothing but make the rich much, much richer.

These three in five Americans have also seen an increasing rate of premature death and spend an average of four times less on education than those in the top 40%, Dalio wrote. Those without a college education see lower income rates and higher divorce rates. Dalio wrote that all of these concerns will likely intensify in the next five to 10 years – just as they have for the past 10 as, once again, Trickle Down Economics has done nothing but make the rich much, much richer.

I don't know if America is going to be able to take 3 more years of these policies – let alone 7! We're waiting to see who Trump appoints as his next Fed Chair but it's very unlikely to be someone hawkish as he puts so much emphasis on the market's performance as a measuring stick for his Presidency and nothing kills a rally faster than rising interest rates. Of course, even Dalio's "Bottom 60%" masks the damage that's really being done by the Top 10% and especially the Top 0.1% but – those are his clients – he doesn't want to paint a target on their backs, does he?

This chart has gotten worse, not better, over the past 8 years and Trump's tax plan will accelerate this curve into a parobolic move higher for the Top 1% and, if you are starting your plan by giving them money and then, AS USUAL, the money doesn't trickle down and the economy doesn't grow enough to cover the money you gave them – then where do you think that money ends up coming from? Come on, it's not hard… I'll give you a clue: 100 – 1% = ??? That's right, the Bottom 99%, one way or another, end up paying for the stimulus and THEN, HOPEFULLY (maybe), it will come back and benefit them later.

Imagine if there was a plan to give the Bottom 99% more money, which they could spend and then that money would trickle UP into the pockets of the Top 1% – LIKE IT ALWAYS HAS THROUGHOUT HUMAN HISTORY. Hmmm, that's a toughie, right? Do the thing that always works that's not likely to hurt or do the thing that never works and has consistently caused massive damage to the economy?

Keep in mind, this market boom Donald Trump is taking credit for is happening WITH Obama's increased tax rates (and Obamacare) and Team Trump is saying if we do the exact opposite, things will get better. Better for who? You simply can't keep taking and taking from 99% of the population without causing a blowback at some point. Having party members break with you is one of the early signs of Revolution but, of course, no one in this Administration reads their history books.

Meanwhile, in our quest to join the Top 1%, we shorted Oil (/CL) Futures again at $52.50 and the EIA Inventory Report is at 10:30, so that will be fun. We have Gasoline (/RB) shorts to at about $1.72 avg but they spiked to $1.738 overnight – so a rough ride. Though the Dow is up 100 since last Thursday (a $500 per contract loss on /YM shorts) the Russell (/TF) is down 12 points for a $600 per contract gain and, as I noted yesterday, the Dow's outsized gains are driven by the moves of a few key components, which is masking a broader market sell-off. Just like the way the Top 1%'s gains distort the averages to make the Bottom 99%'s screwing look gentle.

Viva la Revolution!