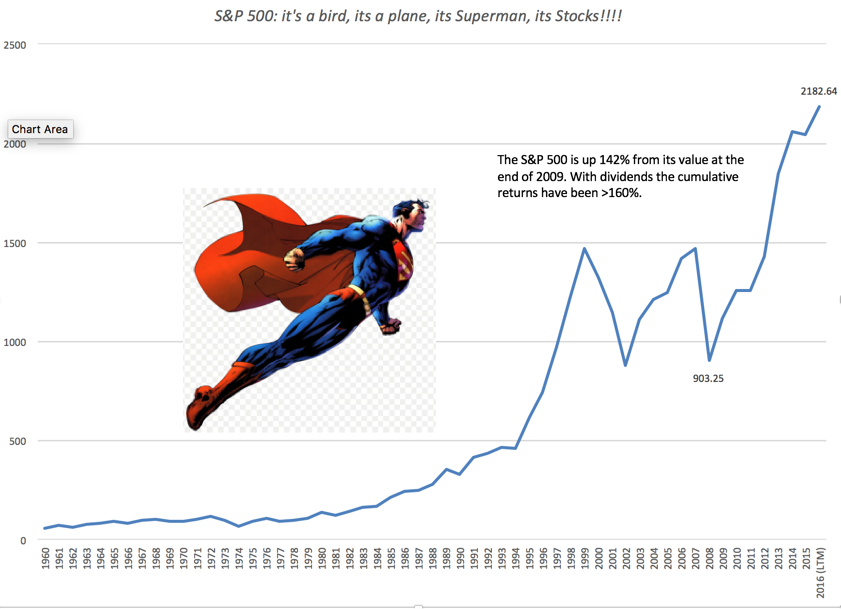

Up, up and away!

Up, up and away!

It’s Super Market! Strange index from another reality, who ignores bad news and achieves p/e multiples far beyond those of rational markets. Super Market, who can break resistance on low volume, move higher without consolidation and who – disguised as a genuine Price Discovery Mechanism, an actual indicator of the true-value of listed companies – Instead fights a never-ending battle with rational thinking and negative data because, in America, the market is only allowed to go one way!

Ths morning, global markets are following the Nikkei higher as Abe was re-elected and the Nikkei popped 1.6% – as if it were some kind of surprise – even though Abe's party just clinched a 2/3 majority in Parliament 2 weeks ago so who didn't know he'd be re-elected too? Apparently 1.6% of the Nikkei's worth of people is the correct answer. Any excuse, of course, is a good excuse to rally the markets these days. There was a terrorist attack in NYC yesterday with 8 people killed and 16 wounded and the markets still rallied into the close – just before Wall Street traders had to step over the bodies on the way home from work.

Silver and gold blasted higher, allowing us to close out our long Silver (/SI) Trade Idea from last week's Live Trading Webinar with a lovely $6,490 gain and it's a good thing we weren't greedy as my call this morning (6:26) in our Live Member Chat Room was:

Silver and gold blasted higher, allowing us to close out our long Silver (/SI) Trade Idea from last week's Live Trading Webinar with a lovely $6,490 gain and it's a good thing we weren't greedy as my call this morning (6:26) in our Live Member Chat Room was:

Good pop on /SI, $17.03 – taking profits there as it partly makes up for /RB losses.

Silver has since dropped back a bit, to $16.96 but Gasoline (/RB) is persistantly annoying at $1.755 and we're in at an average of $1.729 on our shorts so a loss of $1,092 per contract at the momnent ($420 per penny). We'll have to see how the EIA report goes at 10:30 but the API Report last night showed a huge 7.69Mb draw in Gasoline, which is ridiculous as it would indicate a 15% jump in gasoline demand in a week – that's very unlikely. It may take a while to get the real story though we have seen a massive uptick in exports. Oil (/CL) at $55 is a good short too, but very tight stops over that line to limit the losses.

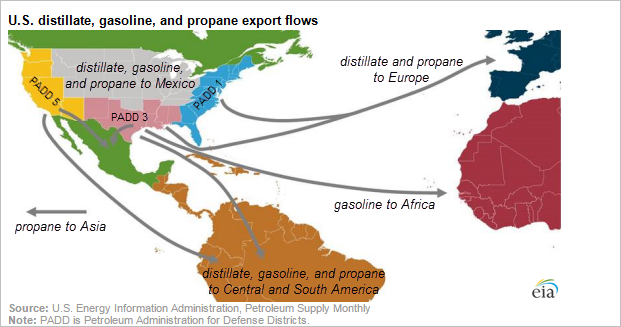

From a Global perspective, gasoline is still cheap in the US, with Europeans spending closer to $6 per gallon and even Canada, due to taxes, pays $3.92/gallon on average (nice chart here) and Mexico is at $3.75 and Brazil is $4.65 – and there's 200M people there you know! So no wonder, given the choice to sell gas in the US market or export it – they US refiners have been shipping it out of the country, causing Americans to pay more – despite our local surplus of supply.

From a Global perspective, gasoline is still cheap in the US, with Europeans spending closer to $6 per gallon and even Canada, due to taxes, pays $3.92/gallon on average (nice chart here) and Mexico is at $3.75 and Brazil is $4.65 – and there's 200M people there you know! So no wonder, given the choice to sell gas in the US market or export it – they US refiners have been shipping it out of the country, causing Americans to pay more – despite our local surplus of supply.

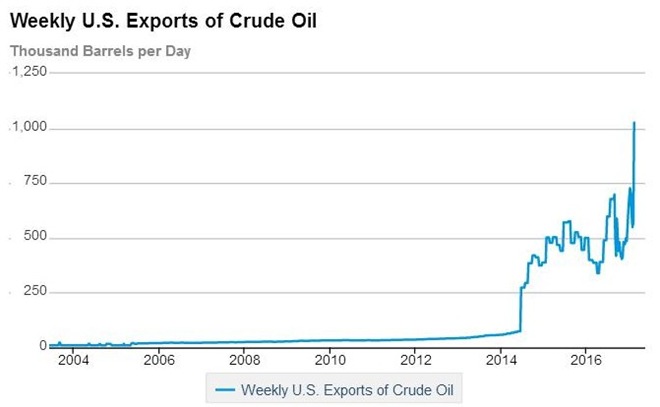

This used to be considered a threat to our energy security but, thanks to the GOP Congress, the law has been changed and exports are allowed. In addition to almost 1M barrels per day of Gasoline Exports, we export another 1M barrels per day of oil, which seems insane as we import 7Mb/d but some are able to buy low and sell high – so the barrels go out of the country and the prices go higher ($55 this morning).

That's double what we were shipping out last year and, if they can finish those "vital" pipelines, they'll be able to double up exports again and then we'll begin to consistently see Europe-like prices for gasoline and oil (Brent Crude is $61.50 this morning). Trump has already given the order to completely deregulate oil and gas exports and production in a policy he calls "energy dominance." Sadly, the only thing that's dominated is your wallet!

That's double what we were shipping out last year and, if they can finish those "vital" pipelines, they'll be able to double up exports again and then we'll begin to consistently see Europe-like prices for gasoline and oil (Brent Crude is $61.50 this morning). Trump has already given the order to completely deregulate oil and gas exports and production in a policy he calls "energy dominance." Sadly, the only thing that's dominated is your wallet!

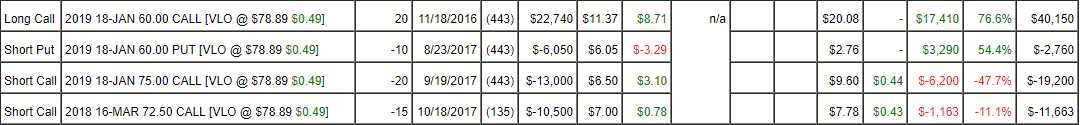

This is another wonderful way we (the Top 1%) can extract money from the bottom 99% because we can invest in energy companies that profit from the sky-high prices – just like the good old days under Bush! Sure we may pay a bit more at the pump ourselves but my Range Rover only costs $75 to fill up at $3/gallon and my 1,000 shares of Exxon (XOM) pay me a $3,000 dividend – so it's like a 50% discount on gasoline for the year! We also have the refiner, Valero (VLO) in our Butterfly Portfolio – and look how well that's doing:

That one is up net $13,337 and that pays for a year's worth of car payments too. It's still good for a new trade as the current net cash outlay is just $6,527 and it's a $30,000 spread so potential gain of $23,473 (359%) in 14 months if all goes well. So all we have to do is jack up oil and gas prices so the little people pay $10-20 more each time they fill up and we get a free car and gas – it's a win-win, right? It's a win for us, obviously, and a win for the little people as there are far, far worse ways we can screw them over if we want to.

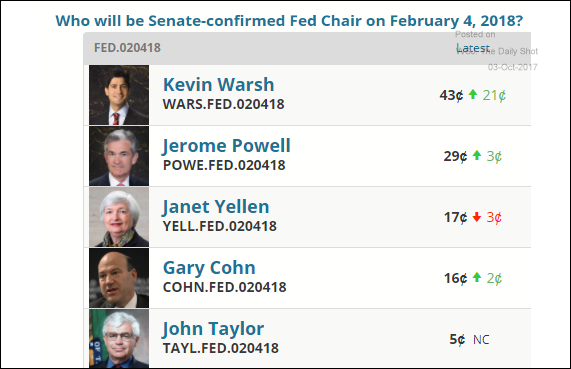

Speaking of screwing the poor, it's Fed Day and no, we're not going to raise your borrowing rates yet but we're going to because we (in the Top 1%) will soon be cashing in our stocks and that means we'll be demanding more interest if you want to use some of our cash pile. Don't complain, you voted for this – we're in charge now! President Trump is going to announce his choice for a new Fed Chair and, though we don't expect a rate rise today (2 pm), they are coming but, for now, party on markets – party like it's 1999!

Speaking of screwing the poor, it's Fed Day and no, we're not going to raise your borrowing rates yet but we're going to because we (in the Top 1%) will soon be cashing in our stocks and that means we'll be demanding more interest if you want to use some of our cash pile. Don't complain, you voted for this – we're in charge now! President Trump is going to announce his choice for a new Fed Chair and, though we don't expect a rate rise today (2 pm), they are coming but, for now, party on markets – party like it's 1999!

Meanwhile, we'll be pressing our hedges, using about 1/3 of our unrealized gains to lock them in – just in case the market hits some kryptonite at some point. The Russell (/TF) is back to our 1,515 shorting line and that's been very good to us and 23,450 on the Dow (/YM) Futures is also a good shorting spot ahead of the Fed. Keep tight stops above and watch out for the Fed meeting at 2pm – we'll be covering that live in this afternoon's Webinar, which starts at 1pm, EST.

Be careful out there!