F**k the middle class. After failing to take away your health care, Team Trump has unveiled its latest scheme to destroy the bottom 90% of Americans by rolling out a tax plan that is so ridiculously unfair that they are trying to get it voted on before it can be scored – like they did with their health care bill – because this monstrosity would never stand up to scrutiny over time.

Corporate tax rates are dropping from 35% to 20% but, on top of that companies can now deduct ALL the costs of purchasing new equipment and money made overseas is now taxed at just 12%. By the way, PSW is officially moving to the Bahamas, which have no Corporate Taxes and we'll be bringing the money back to the US at the 12% rate so screw you 20% – that's too much for us! Gosh that was hard to avoid, wasn't it. Because we're moving to the Bahamas, I will need a private jet to fly back and forth – good thing that's fully deductible too – guess I won't start paying that 8% until the Government is done paying for my plane and, by "the Government" – I mean you suckers who think Trump is trying to help you – GOD you people are dumb!

Trump's cabinet includes Billionaires Betsy DeVos and, of course, Jared Kushner, who is currently curing cancer on his way to broker a peace treaty in the Middle East and Wilbur Ross and Gary Cohn are also Billionaires while Cordish, Mnuchin, Tillerson and Liddle are all in the $100-300M range. Even Keelyane Conway, for some reason, has $45M and James Mattis has $10.5M, Jeff Sessions $10M… General John Kelly is the poorest guy in the room with only half a million to his name – no wonder he is so angry!

Trump's cabinet includes Billionaires Betsy DeVos and, of course, Jared Kushner, who is currently curing cancer on his way to broker a peace treaty in the Middle East and Wilbur Ross and Gary Cohn are also Billionaires while Cordish, Mnuchin, Tillerson and Liddle are all in the $100-300M range. Even Keelyane Conway, for some reason, has $45M and James Mattis has $10.5M, Jeff Sessions $10M… General John Kelly is the poorest guy in the room with only half a million to his name – no wonder he is so angry!

The President and his cabinet have $17Bn, which is more money than the bottom 100M Americans have, combined. They earn roughly $1.3Bn a year, mostly through corporate entities and partnerships and these tax cuts will save them over $200M a year but the real bonus is eliminating the Estate Tax, which will save them about $7Bn and, when I say "save them" I mean it will cost you – sucker! According to Trump:

“To protect millions of small businesses and the American farmer, we are finally ending the crushing, the horrible, the unfair estate tax, or as it is often referred to, the death tax.”

The president’s suggestion that “Millions” of small businesses and farms are affected by the estate tax is absurd. According to the nonpartisan Tax Policy Center, only about 5,500 estates in 2017 — out of nearly 3 million estates — would have to pay any taxes. About half of estates subject to the tax would pay an average tax of about 9 percent. That’s because for a married couple, about $11 million is exempt from taxation. Only 80 – that’s right, 80 – taxable estates would be farms and small businesses.

The president’s suggestion that “Millions” of small businesses and farms are affected by the estate tax is absurd. According to the nonpartisan Tax Policy Center, only about 5,500 estates in 2017 — out of nearly 3 million estates — would have to pay any taxes. About half of estates subject to the tax would pay an average tax of about 9 percent. That’s because for a married couple, about $11 million is exempt from taxation. Only 80 – that’s right, 80 – taxable estates would be farms and small businesses.

The super rich will be keeping ALL of their charitable deductions while your mortage deduction is being taken away and they will also no longer have to pay the Alternative Minimum Tax (AMT), which is the only tax Trump actually did pay on his tax returns because the rule is meant to keep people with clever accountants from avoiding taxes entirely. That change alone would have saved Trump $31M on his 2005 Tax Return (the only one that's been disclosed).

The Trump Tax Bill, of course, doesn't stop at just making the rich much, much richer. It also goes out of it's way to screw the rest of our citizens. Upper Middle Class homeowners with mortgages over $500,000 will no longer be able to deduct interest payments and, while that also hurts to super-rich in theory – they generally pay cash for their homes and their homes, even when they are $20M homes – do not generally represent a significant part of their assets. This will crush luxury builders like Toll Brothers (TOL), who make Million Dollar homes that their clients generally have to finance.

In places like Del Ray Beach in Florida, where my Brother is a Realtor or ski resorts or even cities, this stops the almost rich from encroaching on the land the very rich want to keep. For example, there's a prime lot in Del Ray we've been looking to develop by selling 24 $2M condos on a $5M lot and that makes sense so we bid on the lot but now we can't be sure our target clients will be able to afford the mortgages so we withdraw our bid on behalf of 24 homeowners and the lot is subsequently purchased for a lower price by one rich guy (a Member of Mar A Largo), who is going to build a single home there – all cash. That's one of the subtle ways this bill favors the super-rich above all others.

In places like Del Ray Beach in Florida, where my Brother is a Realtor or ski resorts or even cities, this stops the almost rich from encroaching on the land the very rich want to keep. For example, there's a prime lot in Del Ray we've been looking to develop by selling 24 $2M condos on a $5M lot and that makes sense so we bid on the lot but now we can't be sure our target clients will be able to afford the mortgages so we withdraw our bid on behalf of 24 homeowners and the lot is subsequently purchased for a lower price by one rich guy (a Member of Mar A Largo), who is going to build a single home there – all cash. That's one of the subtle ways this bill favors the super-rich above all others.

Not even the National Federation of Independent Business, who are the supposed beneficiaries of Trump's Tax Bill, are willing to support it, saying it would not support the GOP bill, because it “leaves too many small businesses behind.” Another devastating blow to the average American taxpayer is the elimination of State and Local Tax Deductions – including property taxes – yet another way to drive the kind-of-rich people off the land the super-rich want to build on.

The SALT Deductions are mostly applicable to Blue States, who tend to have higher state and local taxes – a clear swipe at Trump's enemies that will backfire if people move out of the Blue States to Red States and tip the vote. No one said he was smart – just vindictive…

As for the bottom 100M (33%) of our country, the ones who's combined wealth is less than the wealth of Trump's Cabinet – they get NOTHING! Less than nothing actually as charitable deductions will be decreases – making it harder for well-meaning people to donate. By increasing the standard deduction from $12,700 to $24,000 for married couples, the itemized charitable contributions lose their value, making it much more expensive to give to charity, which is OK, because America is going to be so GREAT that those poor people can all go work in the coal mines.

As for the bottom 100M (33%) of our country, the ones who's combined wealth is less than the wealth of Trump's Cabinet – they get NOTHING! Less than nothing actually as charitable deductions will be decreases – making it harder for well-meaning people to donate. By increasing the standard deduction from $12,700 to $24,000 for married couples, the itemized charitable contributions lose their value, making it much more expensive to give to charity, which is OK, because America is going to be so GREAT that those poor people can all go work in the coal mines.

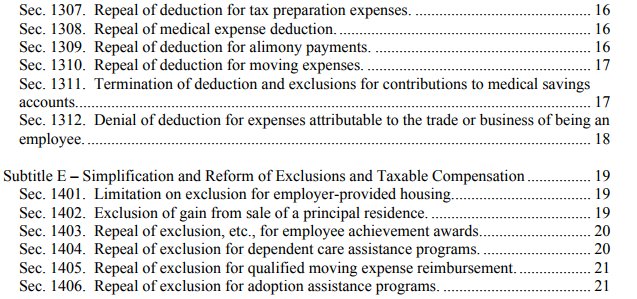

Team Trump is REPEALING the deduction for Medical Expenses, REPEALING the deduction for alimony payments (rich people don't pay alimonly, they settle on a split of assets one-time), REPEALING deductions for moving expenses, REPEALING deductions for contributions to Medical Savings Accounts, REPEALING deductions for interest on Student Loans, REPEALING deductions for Dependent Care… have you actualy read this thing – your taxes will go UP, not down!

As to the "Average American" in the middle class, Paul Ryan said $1,182 over and over again in yesterday's speech as that's the figure the GOP claims to be saving the average American. Forgetting the fact that that is 1/170,000th as much as Trump's Cabinet Members will get every year (even though that, by itself is reason enough for an immediate revolution), consider that EVEN THE GOP calculates that this plan will add $150Bn to the Deficit and, if we divide $150Bn by 160M taxpayers, that's $937 per citizen more debt so, just in case you are a Republican Voter and can't do math: That's them borrowing $937 on your behalf to give themselves $11M per year for each Cabinet Member (though most of it goes to Trump, of course) while you net $245.

Wait, I'm sorry, that's not fair, I didn't deduct the $937 from their windfall. Trump's cabinet only makes an average of $10,999,963 for each $245 you get. Did I mention what a sucker you are lately?

Wait, I'm sorry, that's not fair, I didn't deduct the $937 from their windfall. Trump's cabinet only makes an average of $10,999,963 for each $245 you get. Did I mention what a sucker you are lately?

And that's only if you believe their BS numbers. Independent analysis has noted that these cuts could add as much as $6Tn to the deficit over 10 years and $600Bn a year is putting you $3,750 in debt each year. Keep in mind we're already $20Tn in debt, which is $125,000 per taxpayer and while Trump, Mnuchin, DeVos and company can find that change behind their couch – for you and your children it represents a lifetime of debt burden which the GOP is not only completely ignoring, but adding to – even in a time of supposed prosperity.

8:30 Update: Non-Farm Payroll came in a bit light, at 266,000 vs 310,000 expected. The high expectation was based on a bounce back from last month's horriffic 33,000 job loss – which was blamed on the storms. Nonetheless, unemployment ticked down to 4.1% due to a lower Participation Rate (people not even bothering to try to work) and that keeps the Fed in tightening mode as 3.5% unemployment has historically led to rapid wage increases, which leads to inflation, which the Fed fears more than anything else (see "Inflation Nation").

That's dropping the Dollar, which is supporting the Indexes and commodities but I already put out a note to our Members in our Live Chat Room this morning, saying:

/ES 2,580 and /YM 23,500 are both good shorting lines, lined up with /NQ 6,260 and /TF 1,495 – short the laggard with tight stops if any of them go over!

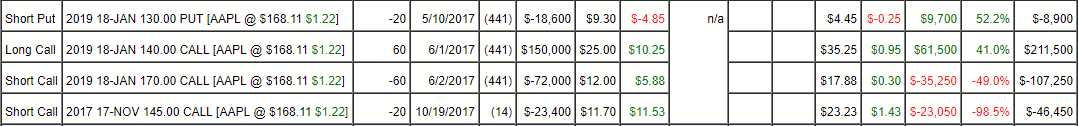

We're also short Gasoline (/RB), which is at $1.788 and /NG we're still long on at $2.90 – one of our usual favorites. Andl, of course, we're very happy this morning (not that you can tell from the above post) about our Apple (AAPL) plays, as AAPL is the single largest holding in our Long-Term Portfolio (LTP) as well as our Options Opportunity Portfolio AND even our Butterfly Portfolio (we REALLY like AAPL!). Our OOP trade, by itself, stands to make us $144,000, which would be 144% of the entire portfolio's $100,000 basis and we're already in the money – a year ahead of schedule!

Although you missed our $36,000 net entry back in June, the net of this spread, as of yesterday, was only $48,900 so there's still a very long way to go towars our $180,000 goal though, as a new trade on AAPL, in yesterday's live Member Chat Room, we went with the following simple bull call spread:

- Buy 10 AAPL 2020 $160 calls at $30 ($30,000)

- Sell 10 AAPL 2020 $200 calls at $15.50 ($15,500)

The spread uses no margin at all and just $14,500 in cash aginst a $40,000 potential pay-off at $200 for a $25,500 (175%) gain in two years. If AAPL had gone down, we'd have sold puts and rolled the calls lower but it went up so now we'll look to sell 5 of the Jan $180 calls for about $8 ($4,000) to begin recouping some of our $14,500. A few sales like that and we'll have a free spread and, though you won't get the same price our Members got – it should still be a good spread at the open this morning.

Speaking of good spreads, in Tuesday Morning's PSW Report, our pre-earnings play on Tesla (TSLA) was:

- Sell 6 TSLA April $350 calls for $23 ($13,800)

- Buy 6 TSLA April $370 puts for $65 ($39,000)

- Sell 6 TSLA April $320 puts for $34 ($20,400)

That nets you into the $30,000 short position for $4,800 with a $25,200 (525%) upside potential if TSLA is below the current price of $320 in April. It's a lot of margin ($15,465 ordinary margin) and a lot of risk – if TSLA gets back to $380, you will have to pay the short caller $18,000 but we'd roll them along to higher, longer months.

We knew this would be a huge winner yesterday but now we have the numbers and already the short $350 calls have fallen to $16 ($9,600) and the $370 puts are $82 ($49,200) while the $320 puts are $45 ($27,000) for net $12,600, which is up a quick 162.5% (you're welcome) but the spread's potential is $30,000 so still another $17,400 (138%) left to gain if TSLA stays below $320 into April expirations. Not bad for a leftover trade.

Since we can pick up $8,200 per $370 short and the max on the spread is $5,000, we can sell one of our puts and collect the bonus money and put a stop on another one at $7,500 to lock in some of our gains if TSLA begins to bounce. There's pretty much no way they get back to $350 after that report so we're not too worried about the short calls at the moment.

Apple should give the indexes a lift this morning but, if our Futures lines begin to fail, we'll be picking up those shorts and looking for a nice drop next week as Apple earnings were the last big market-catalyst we anticipated on the bull side.

Have a great weekend,

– Phil