![]() Wow, what a weekend.

Wow, what a weekend.

There was a tragic shooting in a Texas Church but, unlike last week's response to the NY violence by GOP Congressmen to take immediate action, the GOP now says we shouldn't let one incident panic us into "politicizing" gun violence and regulating them or something. When 300M people have the legal right to own weapons that can kill 25 people in 60 seconds – well, you do the math… Trump, ironically, blames mental health issues (while cutting mental health programs as well).

“This isn’t a guns situation,” Trump added. He said based on preliminary reports, the shooter was a “very deranged individual. Fortunately there was a person shooting in the opposite direction,."

AR-15's were used in all of the following mass shootings: Aurora, Orlando, Las Vegas, Sandy Hook, UMPQUA CC, San Bernardino, Sutherland Springs. It is not a mental health problem, it's a gun problem! And let's not forget, the GOP just passed a bill that puts guns in the hands of the mentally ill and no, I AM NOT JOKING!

AR-15's were used in all of the following mass shootings: Aurora, Orlando, Las Vegas, Sandy Hook, UMPQUA CC, San Bernardino, Sutherland Springs. It is not a mental health problem, it's a gun problem! And let's not forget, the GOP just passed a bill that puts guns in the hands of the mentally ill and no, I AM NOT JOKING!

Just a few weeks ago, psychiatrists and psychologists were warning that GOP health care reform efforts, most recently in the form of the Graham-Cassidy bill, would have devastated the quality and availability of mental health care in this country. It offered states the opportunity to allow insurance companies to drop mental health care coverage and reduced spending on Medicaid by billions of dollars. It effectively ended the Obamacare Medicaid expansion and reduced federal health insurance subsidies.

While Trump was making light of the violence in Texas, he was celebrating the violent swing Abe's Right-Wing Government in Japan is taking. While one President may have taken the opportunity to remind Japan that their constitution has outlawed war and limited its military since 1947 – leading to 70 years of peace and prosperity, this President wants to be their arms dealer, pushing for Japan to buy "massive" amounts of military equipment.

“We believe that we must bolster Japan’s defensive strength qualitatively and quantitatively,” Mr. Abe said. “We will be buying more from the United States. That’s what I’m thinking.”

Trump wants to arm Japan in preparation for a possible military strike on North Korea, who the President called a “threat to the civilized world.” He acknowledged his aggressive stance, but said “look what happened with very weak rhetoric over the last 25 years—look where we are right now.” Er, NOT at war?

Trump wants to arm Japan in preparation for a possible military strike on North Korea, who the President called a “threat to the civilized world.” He acknowledged his aggressive stance, but said “look what happened with very weak rhetoric over the last 25 years—look where we are right now.” Er, NOT at war?

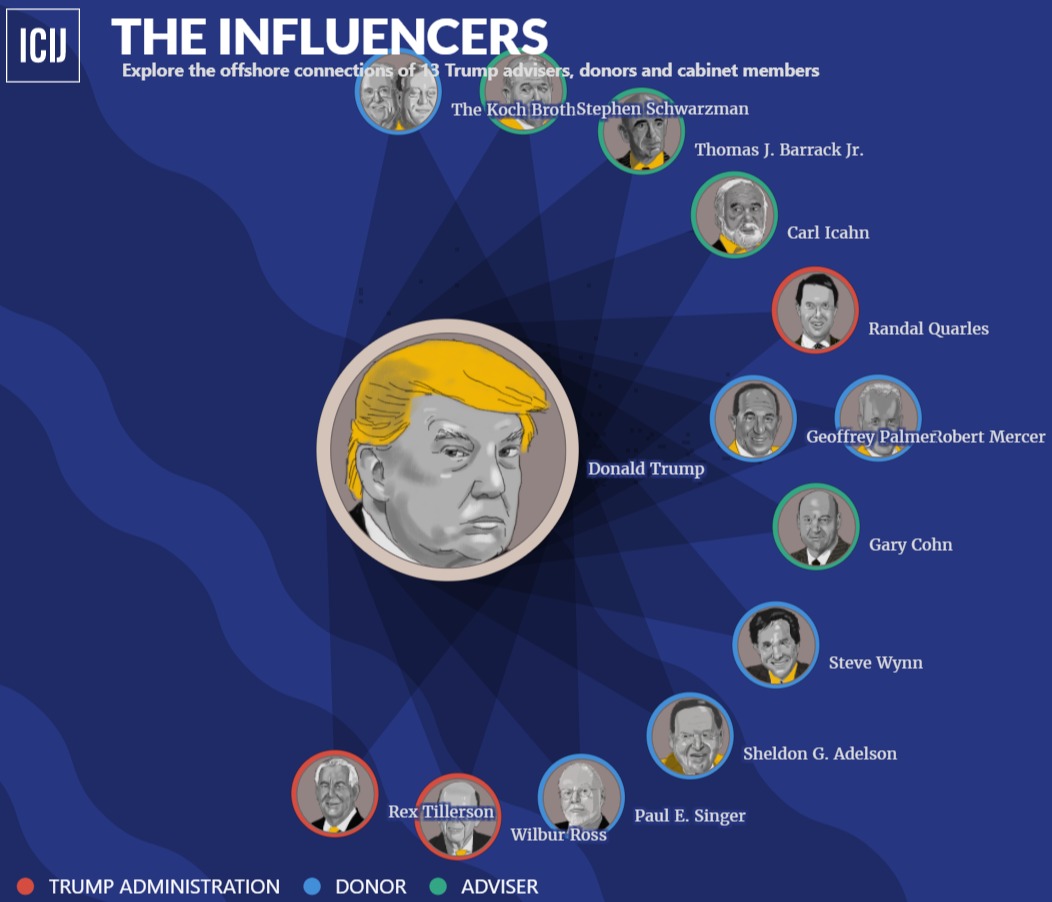

Of course, this is all distraction, distraction and more distraction as Team Trump seeks to do ANYTHING to keep people from talking about indictments and the worsening corruption scandal, which jumped to new levels this weekend with the realease of the "Paradise Papers", which are like the Panama Papers – exposing offshore financial records and already (there are 13.4M pages to go through) Trump's Commerce Secretary, Wilbur Ross, who was already in big trouble, has now been directly tied to Russia in his undisclosed relationship with Vladimir Putin's son-in-law and another Russian Tycoon from Putin's inner circle.

None of this was disclosed at Ross's confirmation hearing because, of course, it would have excluded him from being confirmed, so why would he mention it when it's only perjury not to – and Trump will pardon him for that. The shipping firm pays Ross Millions of Dollars each year and was one of the assets he did not divest when taking a job that directly affects International Shipping.

During his confirmation process, Ross was asked repeatedly about his business ties to Russia, mostly related to his former role as vice chairman of the Bank of Cyprus, which has a long history of financing Russian oligarchs. “The United States Senate and the American public deserve to know the full extent of your connections with Russia and your knowledge of any ties between the Trump Administration, Trump Campaign, or Trump Organization and the Bank of Cyprus,” a group of five Democratic senators wrote Ross after the hearing but prior to his confirmation. Ross responded briefly to a question submitted for the hearing, saying the Russians who invested in the bank “were not my partners,” but he didn’t respond to the senators’ letter.

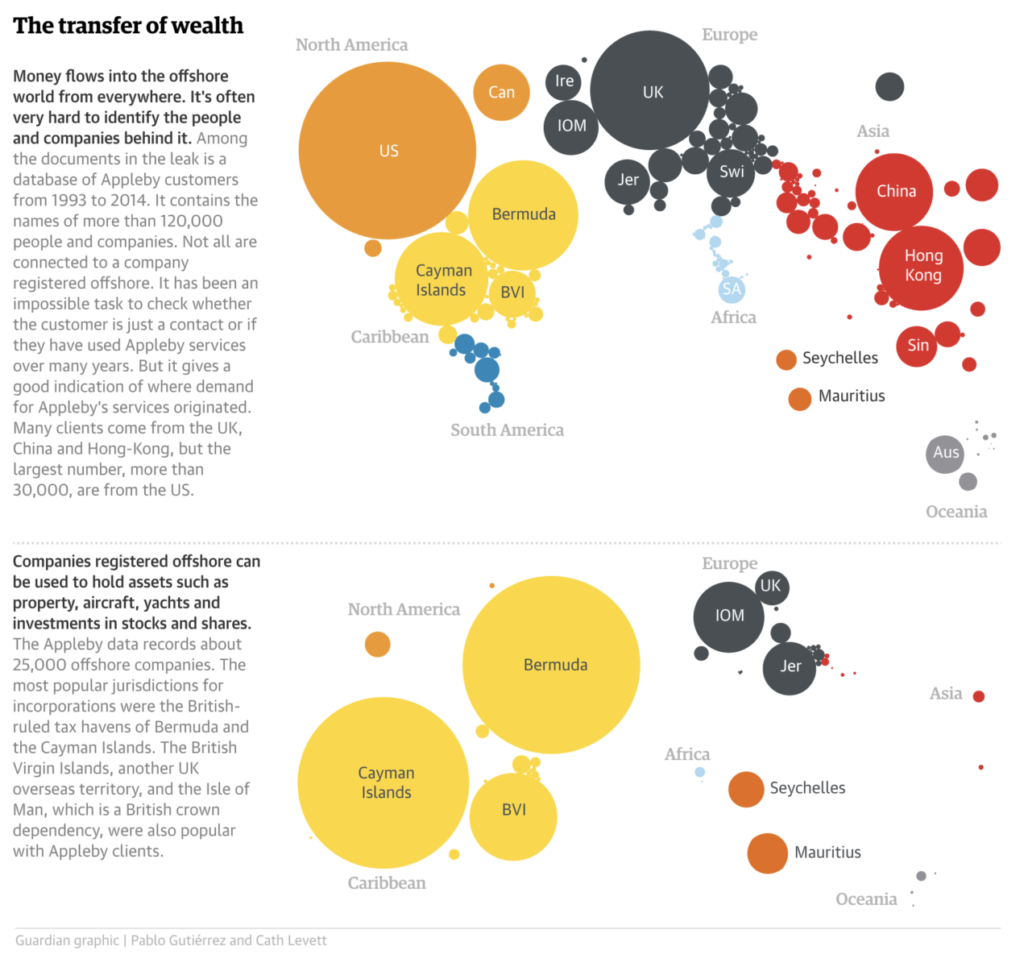

The Paradise Papers show how deeply the offshore financial system is entangled with the overlapping worlds of political players, private wealth and corporate giants, including Apple, Nike, Uber and other global companies that avoid taxes through increasingly imaginative bookkeeping maneuvers. In all, the offshore ties of more than a dozen Trump advisers, Cabinet members and major donors appear in the leaked data.

The Paradise Papers show how deeply the offshore financial system is entangled with the overlapping worlds of political players, private wealth and corporate giants, including Apple, Nike, Uber and other global companies that avoid taxes through increasingly imaginative bookkeeping maneuvers. In all, the offshore ties of more than a dozen Trump advisers, Cabinet members and major donors appear in the leaked data.

Of course, we thought the Panama Papers were going to be a bombshell and nothing happened (other than a Billionaire becoming President and keeping the country's attention focused elsewhere) so we're not expecting too much from the "revelation" that the same elites that now run our Government have been hiding assets overseas and cheating on their taxes and now, "coincidentally" the President wants to allow hidden offshore money to be repatriated at a 12.5% tax rate. No, not at a penalty rate for being hidden away like the IRS charges you if you fail to show your receipts for lunch – at no penalty and a drastically reduced interest rate.

You know, because it helps the family farmers or whatever other BS the weak-minded are willing to swallow…

Speaking of things that are hard to swallow, the anti-Trump voices in Saudi Arabia were rounded up and arrested this weekend including 60 Saudi Princes (don't worry, there are hundreds of them) and prominent businessmen and Prince Mansour and some Government officials were "coincidentally" killed in a helicopter crash. Mansour was son of Prince Abdulaziz, who recently stepped down to put Prince Salman in charge.

The purge and all these coincidences came right after Trump's son-in-law (lots of son-in-laws involved in things) completed a no-longer secret visit to the Saudis and right after Trump hinted that they were looking to help take the $2Tn Saudi-Aramco public next year – all while oil and gasoline prices are skyrocketing for the US consumer. Not since George Bush declared two wars in the Mid-East and jacked oil up to $140 a barrel have things gone this well for Saudi Arabia, the home nation of 15 of the 19 9/11 hijackers, not including Saudi mastermind, Osama Bin Laden.

The purge and all these coincidences came right after Trump's son-in-law (lots of son-in-laws involved in things) completed a no-longer secret visit to the Saudis and right after Trump hinted that they were looking to help take the $2Tn Saudi-Aramco public next year – all while oil and gasoline prices are skyrocketing for the US consumer. Not since George Bush declared two wars in the Mid-East and jacked oil up to $140 a barrel have things gone this well for Saudi Arabia, the home nation of 15 of the 19 9/11 hijackers, not including Saudi mastermind, Osama Bin Laden.

Getting oil back over $70 (now $56) would mean at least an additional $500Bn for the Saudis in IPO value and that leaves room for a lot of tipping so we can expect lots of "urgent" visits to the Middle East for Team Trump, who will certainly need some cash to help pay for those legal fees as Team Meuller zeros in on the shenanigans. It's going to be fun to watch – again.

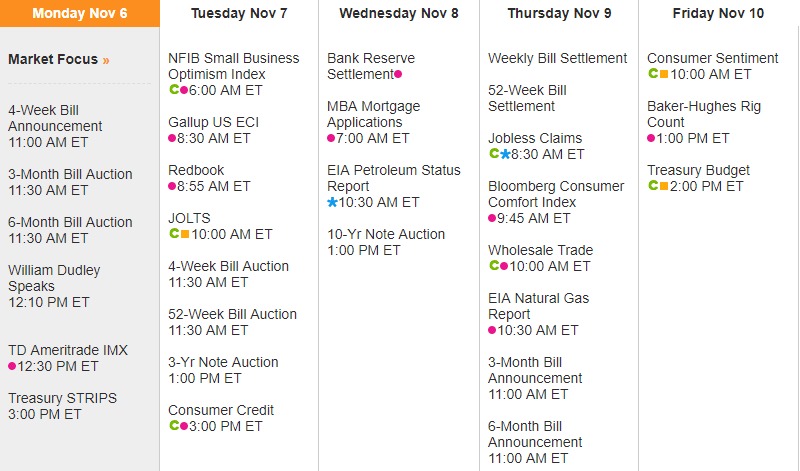

It's not a very exciting data week so attention will focus back on earnings as we round out the S&P reports: