Aren't you glad we're hedged?

Aren't you glad we're hedged?

Just yesterday, in our Morning Report, we gave you an example of our Members' Portfolio Hedges we use at PhilStockWorld. Later in the day, in our Live Member Chat Room, we made some aggressive adjustments to our main hedges in the Short-Term Portfolio Review and tightened up some covers in our Butterfly Portfolio Review. I don't know if this week's pullback is the sign of things to come – I just know I sleep a lot better knowing we are well-hedged if things do turn sharply south.

The big line to watch at the moment is 12,250 on the NYSE and we finished the Day just 30 points above that 50-day moving average. Looking at the position of the MACD line (lower part of the chart) compared to the last time we crossed under the 50 dma (Aug 9th), it would now be surprising if the Senior Index doesn't drop 100 points below that line – at least. Already this morning we're seeing some early weakness, but perhaps that's just because North Korea has declared that Trump deservs the death penalty and is calling Trump a coward for cancelling a visit to the inter-Korean border.

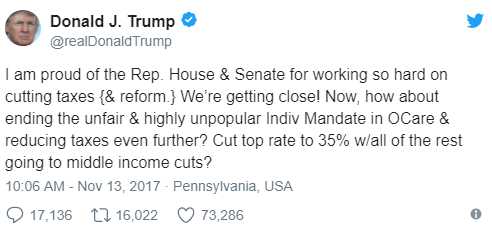

Or perhaps the markets are down this morning because the GOP Senate has, for some insane reason, decided to wrap up the Trump Tax Plan in a Bill to Kill Obamacare – now putting two very unpopular measures on the same bill. We fought hard to stop this insanity back in July and here we go again (see: "Trump Orders GOP to Kill Over 4,000 People Per Month"). I know Trump's Asia trip was a disaster, but he doesn't have to come home and take it out on the poor, does he?

If they fail (and God help us all if they don't), Republicans will enter the midterm election year with their message muddled, without a victory on tax reform, and having spent a year's worth of time trying and repeatedly failing to dismantle Obamacare with nothing to show for it but bad headlines.

If they fail (and God help us all if they don't), Republicans will enter the midterm election year with their message muddled, without a victory on tax reform, and having spent a year's worth of time trying and repeatedly failing to dismantle Obamacare with nothing to show for it but bad headlines.

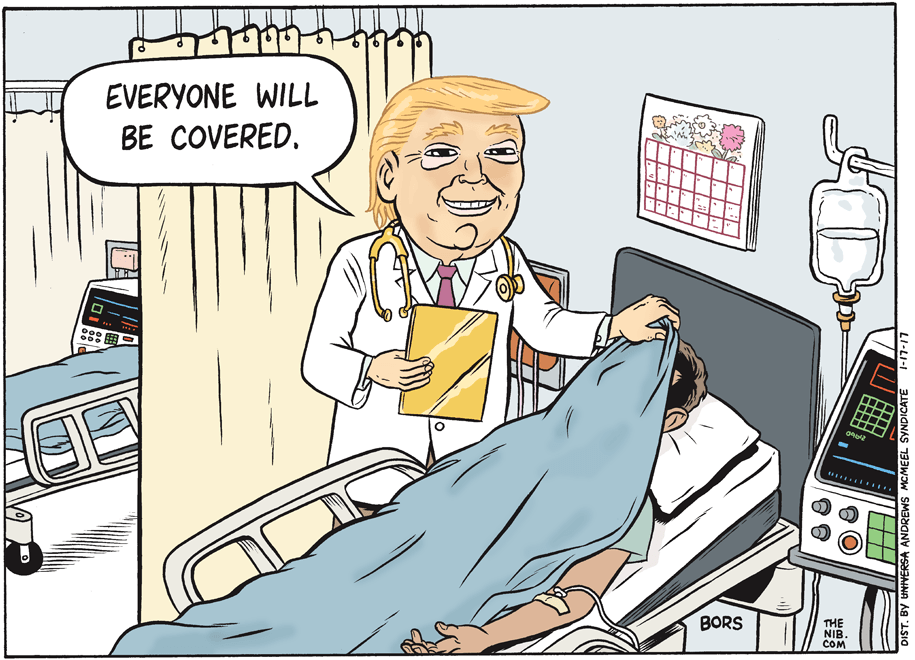

The Republicans want to use the $338Bn it costs to cover the uninsured ($33Bn/yr) to hand out bigger tax breaks to Billionairs – like Trump! 4M people will lose health care immediately, 13M over time, so it's $2,538 per person we're taking insurance away from yet a single illness can bill us back millions in uninsured health care. Remaining Obamacare premiums will rise 10% – PER YEAR – allowing private insurance to raise rates to match – so we're ALL being asked to contribute towards Donald Trump's tax break.

A key driver of the Senate Republicans' decision Tuesday was simple arithmetic: They need the money. As it stands now, their tax plan increases the deficit outside the 10-year window and that is against Senate rules if lawmakers want to use a process that allows them to pass the tax bill with just a simple majority, rather than the usual 60-member vote that is required to make sure the true will of the people is being considered.

"Republicans just can't help themselves," Senate Minority Leader Chuck Schumer said in a statement. "They're so determined to provide tax giveaways to the rich that they're willing to raise premiums on millions of middle-class Americans and kick 13 million people off their health care." Keep in mind there is no "replace" here AT ALL – this is all about repealing and leaving people with NOTHING.

"Republicans just can't help themselves," Senate Minority Leader Chuck Schumer said in a statement. "They're so determined to provide tax giveaways to the rich that they're willing to raise premiums on millions of middle-class Americans and kick 13 million people off their health care." Keep in mind there is no "replace" here AT ALL – this is all about repealing and leaving people with NOTHING.

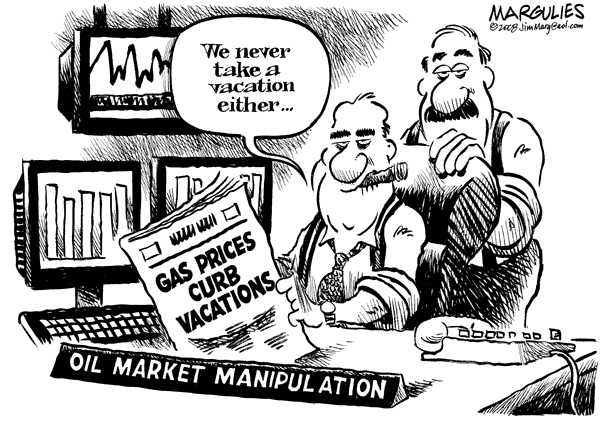

Meanwhile, it's not just the heart monitors of millions of poor people that will be flatlining but oil also crashed this week, back down to $55 with more pain likely ahead as there are still 250,000 fake, Fake, FAKE open contracts over at the NYMEX with only 4 days left to trade them so they have to roll over 50,000 contracts (1,000 barrels per contract) into longer months, which are already stuffed full of FAKE!!! orders themselves (see "Terminal Tuesday – Markets End October at Halloween Highs"). Notice that, in our 10/31 article, there were 1,303,411 open contracts in the front 4 months with 597,839 open in December.

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Dec'17 | 55.06 | 55.26 | 54.97 | 55.07 |

08:39 Nov 15 |

– |

-0.63 | 105409 | 55.70 | 250103 | Call Put |

| Jan'18 | 55.25 | 55.45 | 55.15 | 55.25 |

08:39 Nov 15 |

– |

-0.64 | 61828 | 55.89 | 547060 | Call Put |

| Feb'18 | 55.34 | 55.59 | 55.30 | 55.38 |

08:39 Nov 15 |

– |

-0.65 | 11687 | 56.03 | 183864 | Call Put |

| Mar'18 | 55.51 | 55.72 | 55.42 | 55.51 |

08:39 Nov 15 |

– |

-0.65 | 10148 | 56.16 | 286530 | Call Put |

| Apr'18 | 55.50 | 55.77 | 55.50 | 55.57 |

08:39 Nov 15 |

– |

-0.65 | 7350 | 56.22 | 135704 | Call Put |

| May'18 | 55.54 | 55.75 | 55.48 | 55.57 |

08:39 Nov 15 |

– |

-0.62 | 5361 | 56.19 | 99592 | Call Put |

| Jun'18 | 55.44 | 55.63 | 55.38 | 55.50 |

08:39 Nov 15 |

– |

-0.57 | 7700 | 56.07 | 233893 | Call Put |

Now there are just 250,103 open orders for December and that means contracts valid for the delivery of 347 MILLION barrels of oil were cancelled for the month of December – and then they will tell you there's a tight supply of oil – can you really be dumb enough to believe that BS? Also notice, that if you now add up the front 4 months, there are 1,267,557 open contracts, just 35,854 less than there were 2 weeks ago – and they are ALL accounted for by April, which picked up 50,852 FAKE!!! orders.

This is how they run the scam, they fake demand and then cancel all the delivery contracts to fake a tight supply – over and over and over again and they screw the American public out of HUNDREDS OF BILLIONS OF DOLLARS each year (see "Goldman’s Global Oil Scam Passes the 50 Madoff Mark!"). You will see over the next few days how over 200M of those barrels, that are currently CONTRACTED to be delivered to the US in December, will be cancelled and then CNBC, et al will report a draw in oil inventories and the price will go up for the holidays. BUT THEY WILL NEVER REPORT ON THE MANIPULATION THAT CAUSES IT!

This is how they run the scam, they fake demand and then cancel all the delivery contracts to fake a tight supply – over and over and over again and they screw the American public out of HUNDREDS OF BILLIONS OF DOLLARS each year (see "Goldman’s Global Oil Scam Passes the 50 Madoff Mark!"). You will see over the next few days how over 200M of those barrels, that are currently CONTRACTED to be delivered to the US in December, will be cancelled and then CNBC, et al will report a draw in oil inventories and the price will go up for the holidays. BUT THEY WILL NEVER REPORT ON THE MANIPULATION THAT CAUSES IT!

Oil was $53.90 when laid out the following trade idea on October 31st:

- Buy 597,831 June 2020 Futures (/CLM1) at $50.32 ($30,083,258,480)

- Sell 597,831 Dec 2017 Futures (/CLX7) at $53.90 ($32,223,522,100)

That gave us a net credit of $2,140,263,620 and, as I said at the time: "If oil goes lower (which we expect), we will make instant money on our short contracts or, if oil goes higher, we can just roll our shorts forward to longer months, knowing that we have delivery covered at a much lower price in 4 years." As it stands now, June 2021 is trading at $50.94 and CLX7 us at $55.21 this morning – another $1 dip puts us into profit already on the spread. For those actually trading SOME of the contracts, in Thursday morning's PSW Report I called for rolling the short December contracts ($54.30) to the March contracts (/CLH8) at $54.66, picking up another 0.36 credit or $215,222,040 – a nice dividend!

We'll see how this plays out over time but my goal is to give people who do have a few Billion to kick around the confidence to play against the manipulators on these contracts and, hopefully, break the bank. The Government won't take action on this madness but, since they are, in fact, FAKE!!! orders, we can accept their fake offers to buy oil for jacked up prices and ruin their whole scam – which depends on the scammers keeping the trades "in the family". If we happen to make a few Billion while driving the manipulators out of business – so be it!

In our Short-Term Portfolio, we added a new ultra-short Oil ETF (SCO) spread to take advantage of the eventual fall. We know OPEC is pulling out all the stops to talk up oil but the demand picture simply isn't there – we'll discuss it more in detail in this afternoon's Live Trading Webinar (1pm, EST). Retail sales were strong in October, up 0.2% but only 0.1% ex-autos, and that was caused by the hurricane (people replacing damaged cars), so not a trend.

Junk bonds continue to collapse but it's the NYSE we're concerned about and it's goiing to open right about 12,200 so it's now a matter of whether or not we can get back over the 12,250 line into the close. If not, expect the other indexes to join it in a move lower.