$450,000,000!

$450,000,000!

That's a lot of money to spend on a painting and yet another justification for my daughter to go to art school! It just goes to show you how rich the rich are gettin as the previous record for a painting at auction was $300M for Kooning's "Interchange" 2 years ago and this painting was previously purchased in 2013 for "only" $127.5M – how's that for inflation? So, on this trajectory, we're only a few years away from the first Billion-Dollar painting – just in time for Madeline to graduate with her art degree!

The buyer is mystery but look for a guy with a 26" space on his wall – that's probably him. That's right, this is a pretty small painting but it is cool that it was painted by DaVinci 500 years ago though how they prove that, I can't say. There was a VanGough that went for "only" $81.3M that I liked better – and it's more in my price range.

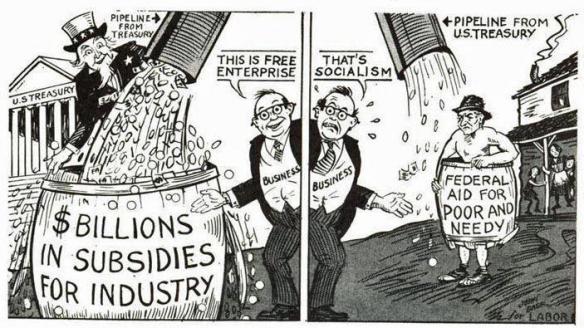

This is an indicator of how drastic income inequality is becomming in the US. There was a roomful of people yesterday, bidding hundreds of Millions of Dollars on a painting while their pet Congresspeople are screaming to the cameras that these art lovers need massive tax breaks in order to "create jobs". In order to give the art lovers these tax breaks, we have to give up our nacent universal health insurance, we have to cut Medicare, cut Student Loan Funding and cut Farm Subsides – all while taking on $1,500,000,000,000 in additional debt (minimum), which is enough money to buy 3,000 more paintings!

Going long Sothebey's (BID) might be the best way to play along at home because all this money we, The People are scrificing is going to just 3M of our fellow citizens in the Top 1% and this chart is old as they now control 50% of the wealth in this country – and guess where they took the other 10% from?

That extra blob of green on the chart is what was cut off from the top of the top 90% and it belongs to the Top 97, 98 and 99th percentiles and yes, a person in the Top 1% has 10 stacks all to themselves vs 1/4 stack for even someone who is just barely in the Top 10% ($165,000 annnual income). But now they have 25% more wealth than they had in 2013 – that's adding more than the entire Middle Class has – or HAD – as this money didn't grow on trees. In fact, growth isn't an isssue as this is a percentage of total wealth so adding 10% was essentially the Top 1% accumulating ALL of the GDP growth of the past 4 years.

Where will the next 10% come from? Well it's coming from the new Trump Tax Plan, which will cause the largest transfer of wealth from the Bottom 99% to the Top 1% in history. $450Bn is being cut from Medicare, $1Tn is being cut from Medicare and $1.5Tn in debt is being taken on by the Bottom 99% to transfer $3Tn in tax cuts to the Top 1%. That is how, in addition to continuing to gather up all of the economic growth, the Top 1% will move from owning 50% of the Wealth in America to 60% and 70% (if, God forbid, Trump is re-elected) by 2027.

Then what? At some point, they can only turn on each other – just like Royal Families have done for thousands of years –after they have drained their peasants dry. On a Global Basis, the Top 1% passed the 50% mark last year. Fortunately, we still have Bernie to speak truth to power (for now):

This is the rise of the very monarchy our Founding Fathers fought against and, for 240 years, we had a pretty good run fending them off from rising in the US but now THEY'RE BACK and richer than ever and they are consolidating their wealth and power and taking over our political system and rewriting laws to favor themselves and we are just letting it happen – that's the thing I never expected. I thought we'd put up some kind of fight…

At least there is some hope on the International Front. IMF President, Christine LaGarde said: "Business as usual for the elite isn't a cost free option – failure to tackle inequality will set the fight against poverty back decades. The poor are hurt twice by rising inequality – they get a smaller share of the economic pie and because extreme inequality hurts growth, there is less pie to be shared around."

At least there is some hope on the International Front. IMF President, Christine LaGarde said: "Business as usual for the elite isn't a cost free option – failure to tackle inequality will set the fight against poverty back decades. The poor are hurt twice by rising inequality – they get a smaller share of the economic pie and because extreme inequality hurts growth, there is less pie to be shared around."

Lady Lynn Forester de Rothschild, Chief Executive Officer of E.L. Rothschild and Chairman of the Coalition for Inclusive Capitalism, who spoke at a joint Oxfam-University of Oxford event on inequality last year, called on business leaders meeting in Davos to play their part in tackling extreme inequality. She said:

"Oxfam's report is just the latest evidence that inequality has reached shocking extremes, and continues to grow. It is time for the global leaders of modern capitalism, in addition to our politicians, to work to change the system to make it more inclusive, more equitable and more sustainable.

"Extreme inequality isn't just a moral wrong. It undermines economic growth and it threatens the private sector's bottom line. All those gathering at Davos who want a stable and prosperous world should make tackling inequality a top priority."Oxfam made headlines at Davos last year with the revelation that the 85 richest people on the planet have the same wealth as the poorest 50 per cent (3.5 billion people). That figure is now 80 – a dramatic fall from 388 people in 2010. The wealth of the richest 80 doubled in cash terms between 2009-14.

The international agency is calling on governments to adopt a seven point plan to tackle inequality:

- Clamp down on tax dodging by corporations and rich individuals

- Invest in universal, free public services such as health and education

- Share the tax burden fairly, shifting taxation from labour and consumption towards capital and wealth

- Introduce minimum wages and move towards a living wage for all workers

- Introduce equal pay legislation and promote economic policies to give women a fair deal

- Ensure adequate safety-nets for the poorest, including a minimum income guarantee

- Agree a global goal to tackle inequality.

Instead of working towards these noble goals, America elected a President who is the 544th richest person in the World and clearly aspires, like his pal Putin, to use his political office to become even richer. We are going the WRONG way people – and it's a very dangerous path we will not easily be able to come back from and, if this tax plan passes, you will be giving so much weath and power to Trump and his Billionaire buddies – that this country may never recover from the damage.

Speaking of which, the Koch Brothers just made a move to take over Time, Inc – yet another media outlet bought by Conservative Billionaires. Move along… nothing to see here…