Next week is nonsense.

Next week is nonsense.

In the US, Thanksgiving is Thursday and the markets are closed and many people take the whole week off and almost everyone is in vacation mode by Wednesday and Friday (a half-day on Wall Street) is a total joke for those who show up – often the lowest volume day of the year. So we don't expect much action next week and certainly not a move higher and then, after Thanksgiving it's Christmas time and then New Years so let's just meet back here on Jan 2nd and see where things are, OK?

We've been reviewing our porfolios in our Live Member Chat Room and we're well-locked in neutral already with very little gained in the past month but that's OK, as the market has made very little gains in the past months. In fact, our last Portfolio Review was October 28th and the S&P closed that Friday at 2,581 and, this morning, we're at 2,585 so – happy holidays – see you in Januray!

If you do insist on hanging around, you can expect more of the same in December – unless the Trump Tax Plan fails to pass the Senate, then we are likely to break below the range. At the moment, as we've discussed before, most people are holding their equities (including us) into next year, so we can take our profits when the taxes are lower. If no one is willing to sell (and take high-tax profits), then the new buyers are forced to offer higher prices and the market does drift higher but the low volumes indicate it may be very hard to find buyers once people do want to cash in their gains.

There are good strategies for locking in gains and I'll tell you a few. Apple, for example, is at $171 and let's say you bought 1,000 shares for $120 ($120,000) and you have a $51,000 gain. If you take that gain now, you will be taxed, for example, 38.5% ($19,635) but if you wait and next year you pay just 25% ($12,750) you are saving almost $7,000. So your 1,000 shares of AAPL would have to fall more than $7 (4%) for it to be worth taking it off the table now at $171 and, if you don't think that will happen – you hold on.

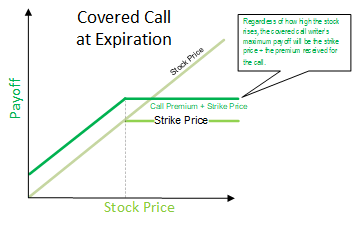

BUT, since you are going to sell AAPL anyway, you can pre-sell it now for, let's say January (to take it into the next tax year) by selling the Jan $150 calls for $22.50. By doing this you are accomplishing 2 things, you are protecting yourself to the downside by $22.50 and you are going to get called away (almost certainly) at net $172.50, $1.50 higher than AAPL is now. Mechanically what happens is the call you sell is you promising to sell the buyer AAPL at $150 on Jan 19th (expiration day) and, while it is the OPTION of the buyer to take them or not, if AAPL is at $150.01 – they will be taken. Only if it's lower would they option not be exercised.

BUT, since you are going to sell AAPL anyway, you can pre-sell it now for, let's say January (to take it into the next tax year) by selling the Jan $150 calls for $22.50. By doing this you are accomplishing 2 things, you are protecting yourself to the downside by $22.50 and you are going to get called away (almost certainly) at net $172.50, $1.50 higher than AAPL is now. Mechanically what happens is the call you sell is you promising to sell the buyer AAPL at $150 on Jan 19th (expiration day) and, while it is the OPTION of the buyer to take them or not, if AAPL is at $150.01 – they will be taken. Only if it's lower would they option not be exercised.

Meanwhile, the buyer has paid you $22.50 for the right to buy your AAPL stock for $150. You get that in your pocket now and you get the other $150 when it's exercised and you, in turn, surrender your stock – very simple. The downside to the play is you will not make any gains above $172.50 but the point is to lock in your current selling price at next year's tax rate.

You can do something like that with most stocks if you want to extend their timeframe while lowering the risk. Another way to drop your risk is buying a put against your stock. In this case, let's say you have the AAPL at $171 and you want to hold it into next year but you are worried about the holidays. What you can do then is buy the April $200 puts for $30.50 and there someone else is promising to buy your AAPL stock for $200 at April expirations (20th) which is up $29 from here so your cost of insurance is $1.50/share. Now you've locked in $169.50 into April.

You can even get fancy and sell April $200 calls for $2.50 to pay for it and now you'r back to having at least $172 but, between $172 and $200, you will simply keep your stock, in addition to the Feb dividends (0.63/share).

So take these lessons and put them to good use and take a nice vacation – especially if you've had a nice year trading. If you're not going to enjoy your good fortune – what's the point?

Have a great weekend,

– Phil