20-50 years.

20-50 years.

Not hundreds of years, not even 100 years but "20-50 years" is how long we have before the oceans are 3 feet higher than they are today. New studies of Pine Island Bay in Antartica have cause climate scientists (the 97% that say Global Warming is real and actually happening) to drastically revise their estimate of how quickly this planet is headint towards catastrophe.

The glaciers of Pine Island Bay are two of the largest and fastest-melting in Antarctica. Together, they act as a plug holding back enough ice to pour 11 feet of sea-level rise into the world’s oceans — an amount that would submerge every coastal city on the planet. Minute-by-minute, huge skyscraper-sized shards of ice cliffs crumble into the sea, as tall as the Statue of Liberty and as deep underwater as the height of the Empire State Building.

“Ice is only so strong, so it will collapse if these cliffs reach a certain height,” explains Kristin Poinar, a glaciologist at NASA’s Goddard Space Flight Center. “We need to know how fast it’s going to happen.”

In the past few years, scientists have identified marine ice-cliff instability as a feedback loop that could kickstart the disintegration of the entire West Antarctic ice sheet this century — much more quickly than previously thought.

In the past few years, scientists have identified marine ice-cliff instability as a feedback loop that could kickstart the disintegration of the entire West Antarctic ice sheet this century — much more quickly than previously thought.

- Three feet of sea-level rise would be bad, leading to more frequent flooding of U.S. cities such as New Orleans, Houston, New York, and Miami. Pacific Island nations, like the Marshall Islands, would lose most of their territory. Unfortunately, it now seems like three feet is possible only under the rosiest of scenarios.

- At six feet, though, around 12 million people in the United States would be displaced, and the world’s most vulnerable megacities, like Shanghai, Mumbai, and Ho Chi Minh City, could be wiped off the map.

- At 11 feet, land currently inhabited by hundreds of millions of people worldwide would wind up underwater. South Florida would be largely uninhabitable; floods on the scale of Hurricane Sandy would strike twice a month in New York and New Jersey, as the tug of the moon alone would be enough to send tidewaters into homes and buildings.

Next to a meteor strike, rapid sea-level rise from collapsing ice cliffs is one of the quickest ways our world can remake itself. This is about as fast as climate change gets. There’s a recurring theme throughout these scientists’ findings in Antarctica: What we do now will determine how quickly Pine Island and Thwaites collapse. A fast transition away from fossil fuels in the next few decades could be enough to put off rapid sea-level rise for centuries. That’s a decision worth countless trillions of dollars and millions of lives.

In any case, it's something fun for you to discuss with the kids on Thanksgiving.

Actually, it is an important long-range investing premise and important life-choices have to be made by younger people in the family. It is not smart to buy a place next to Turmp in Mar-a-Lago, which sits on a strip of land off the main part of Palm Beach. That land, as well as most of South Florida, is likely to be wiped off the map by the end of this century.

Actually, it is an important long-range investing premise and important life-choices have to be made by younger people in the family. It is not smart to buy a place next to Turmp in Mar-a-Lago, which sits on a strip of land off the main part of Palm Beach. That land, as well as most of South Florida, is likely to be wiped off the map by the end of this century.

Trumps hotels in NYC will need to start at the 10th floor in order to stay dry as well. As noted above, we're talking TRILLIONS of Dollars in damage and hundreds of millions of people displaced. Yet, when it happens, we're all going to act surprised, right? Will the Government pay your flood insurance when it's hundred of Billions of Dollars for millions of homes or will that program go bankrupt? If you want a look at the future of cities like Miami, Houston, New York and Los Angeles – look at what we're doing (or not doing) for Peurto Rico now.

Trump is covered, of course. In fact, he claimed $17M in damage from Hurrican Wilma at Mar-a-Lago and that money came out of the FEMA insurance program, which was already $25Bn in debt before this year's disasters (and has not been accounted for under the current budget). “If [NFIP] was a regular insurance company, they would have been in receivership,” Burl Daniel, an insurance expert from Texas, told HuffPost. “But it’s a political football because of the people who live on the coast.”

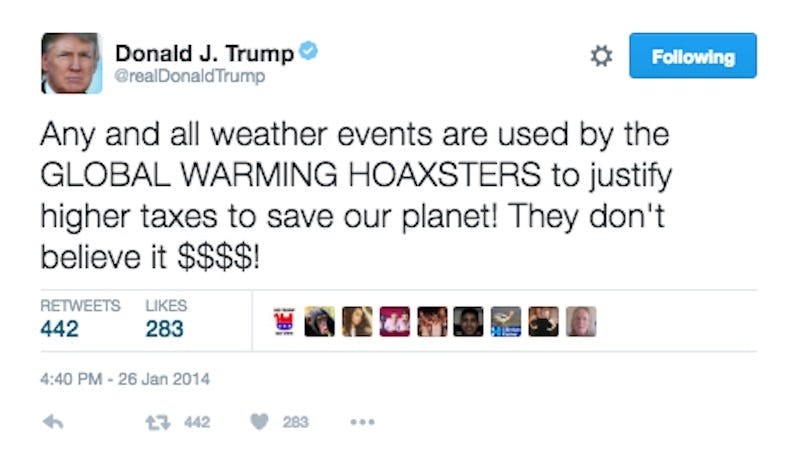

By denying climate change and it's effects, we are encouraging hundreds of Billions of Dollars in bad investments – building homes and roads and bridges in places that are likely to be uninhabitable in just 20 years while NOT building homes and roads and bridges in the places people will actually need to move to. The insurance program is going to become part of the debt, so every American citizen is paying for the luxury homes on the coast – so it doesn't pay to be sensible – they're going to take your money anyway…

20 years is not a long time – it's like going back to your old neighborhood and seeing how it's changed only when you go back to these neighborhoods – you'll need a boat! New Yorkers don't think of themselves as living on the water as we generally view just the two rivers that pass by Manahattan Island on those rare occasions we peak out from between the buildings but here's what New York will look like with 11 more feet of water:

Manahattan alone has over $1Tn worth of real estate and it's all insured by the NFIP, which has no money at all and this isn't a hurricane. If NY goes under, then the other cities will go down as well – at the same time and ALL of those people will have to find somewhere else to live and work. There's an investing premise in there – and not just for jet skis.

A responsible Government would make a realistic assessment of the situation and begin urban planning projects now for the next 20-50 years to incorporate the likelihood of a mass migration away from flooded coastal cities. We don't have one of those. That means it's up to you to think about what needs to be done – this decade and next – to protect yourself and your family's future.

Keep in mind that, if we have more and more hurricanes over the next 10 years with more and more flooding and a bankrupt insurance program and people have to start paying the true cost of insuring their coastal homes – the property prices will begin coming down long before the sea levels hit your doorstep. It's not the kind of planning you want to put off.