What a rally!

What a rally!

I just finished our November Portfolio Reviews and our Long-Term and Short-Term paired portfolios are just shy of their 40% goal for the year but our more aggressive Options Opportunity Portfolio, which we trade over at Seeking Alpha, has gained another 100% in 2017, now up 233.8% in just over two years (we begain on 8/8/15 with $100,000). If the market keeps going the way it is, we have no doubt we can add another $100,000 over the next 12 months. This is how, thanks to Trump, the rich are getting much, much richer.

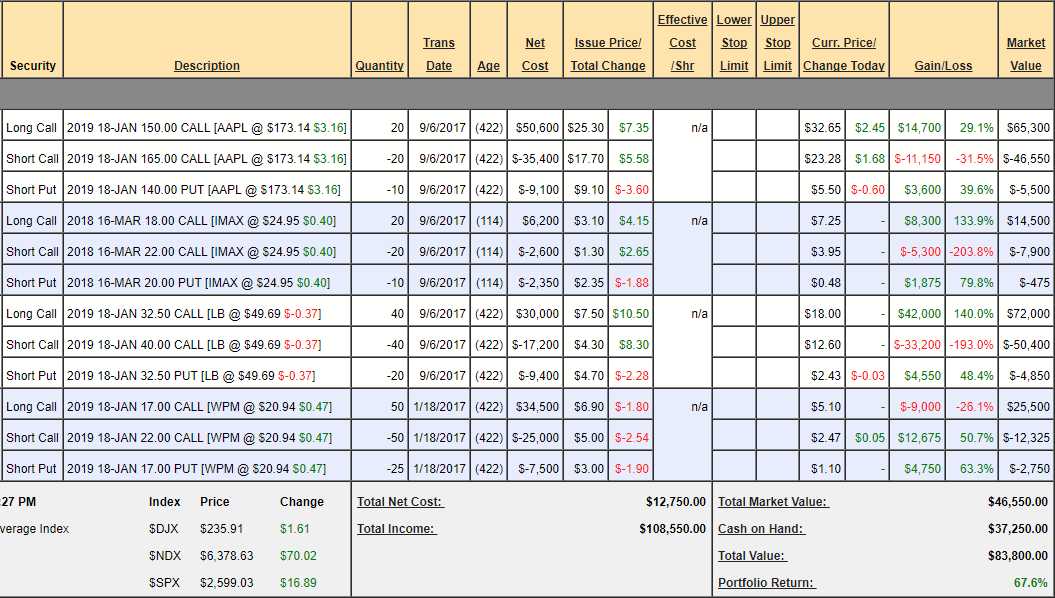

Even more ridiculous is are the gains on our Money Talk Portfolio, which was initiated to track the calls we made live on that show, including our Trade of the Year on Wheaton Prescious Metals (WPM) which started the year as WPM but that didn't stop our net $2,000 entry on the spread from gaining $8,425 and that's only "on track" to our expected $23,000 gain by next January (2019), so it's still good for a new trade from here, with $14,575 left to gain over the next 12 months – that's still 173% up from the current $8,425.

Of course, a mere 173% return is not enough to make it our 2018 Trade of the Year, where we aim to get 300-500% returns on the net cash of our spreads (there are also margin requirements) – and we have NEVER yet missed one of those. At the moment, contenders for our 2018 Trade of the Year include Macy's (M), Chesapeak Energy (CHK), Cleveland-Cliffs (CLF), Chipotle (CMG) and Hanesbrands (HBI) – all of which we are already in from our recent Portfolio Review but can still make fantastic new trades. We were going to go with Limited Brands (LB), but they already popped and got away from us (well not us, but before we got a chance to announce the trade though it is, of course, on our OOP, LTP and Money Talk Portfolios).

The best thing about the Money Talk Portfolio though, is that we haven't touched those trades at all since announcing them on the air – 3 of them on Sept 6th, in fact. Those 3 trades used just $10,750 of our cash and are already worth $36,125 for a $25,375 (236%) gain in just 2.5 months.

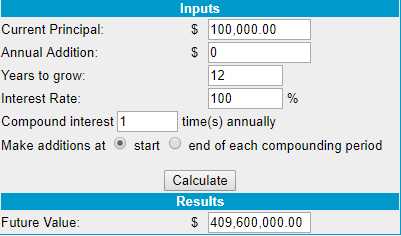

This is, of course, why we've gotten cautious into the holidays though. It's ridiculous that I can go on TV and publically announce 3 trade ideas that return 236% on cash in 75 days. THAT is exactly what a market bubble is. Gains like that are unsustainable. If you make 100% a month, you turn $100,000 into $409 MILLION by the end of the year. Does that sound like it's likely to happen?

This is, of course, why we've gotten cautious into the holidays though. It's ridiculous that I can go on TV and publically announce 3 trade ideas that return 236% on cash in 75 days. THAT is exactly what a market bubble is. Gains like that are unsustainable. If you make 100% a month, you turn $100,000 into $409 MILLION by the end of the year. Does that sound like it's likely to happen?

As I mentioned on Monday, we sent out 6 Top Trade Alerts for November and, thanks to this crazy +300 point week, those are all off to a flying start as well. Still, this is WRONG – it shouldn't be this easy to make these kinds of returns – it indicates a broken system and, for now, it's broken in a good way so we're all having fun but soon it can break in a very bad way – taking away the gains much faster than it gave them out.

This is not a gold rush – we didn't discover any new resources that are making everyone richer other than money that is STILL being handed out by the Fed at a rate of $60Bn per month along with the ECB's $80Bn and the Bank of Japan's $40Bn. THAT is where our market rally is coming from but, even so, the US indexes are up about $7 TRILLION since the election with Global Markets now at roughly $80Tn and the US making up almost half at $36.6Tn.

Here's the thing though – where did the $7Tn come from? The Global GDP is about $95Tn and let's say it grew 3% this year to $98Tn. Even if every cent of that went into the market, that's still $4Tn too much. To save a boring logic and math discussion, let's just say about 50% of the rally is overdone and we expect a 10% correction from here – in the very least.

Here's the thing though – where did the $7Tn come from? The Global GDP is about $95Tn and let's say it grew 3% this year to $98Tn. Even if every cent of that went into the market, that's still $4Tn too much. To save a boring logic and math discussion, let's just say about 50% of the rally is overdone and we expect a 10% correction from here – in the very least.

My theory, which Warren Buffett agrees with, is that people are expecting a Tax Cut next year and that means there's no reason to sell our stocks this year and get taxed at higher rates on our profits. The low-volume rally we're getting this month indicates that theory is playing out as there are very few sellers but, thanks to IRAs, 401Ks, QE funds, Soveriegn Wealth Funds and ETF inflows – there's a constant bid underneath the market – something I discussed this summer on Nasdaq Live. In fact, we were talking about S&P 2,600 and the outperformance of the Russell at the Nasdaq in early October.

.@Nasdaq on #Periscope: #TradeTalks: S&P 500 2600? w/@philstockworld @JillMalandrino https://t.co/5okqpSxPXN

— DarcyAbdualOyewole???? (@DarcyOyewoleWeb) October 11, 2017

During that interview we talked about investing in the Russia ETF (RSX), which is still in play for next year but not a high-enough probability to make a Trade of the Year, unfortunately. If oil keeps heading higher though – it's very much worth considering.

The best thing about keeping balanced portfolios and using our "set and forget" style of trading with self-hedging spreads is that we get to take nice vacations without worrying about our stock positions. As I said on Monday, we didn't become traders so we could be chained to a desk all day and holidays are times better spent with your families.

I hope you and yours have a happy, healthy and wealthy Thanksgiving!

All the best,

– Phil