Our Trade of the Year is here!

Our Trade of the Year is here!

Each year, we put together an options spread that has the best chance of returning 300-500% on CASH!!! over the next 24 months. The chart on the right is from my appearance on Money Talk, where I often announce our Trade of the Year but I wasn't on until Dec 14th and we made our pick around Thanksgiving so that 2015 Trade of the Year was:

- Buy 20 AAPL 2017 $90 calls at $26.50 ($53,000)

- Sell 20 AAPL 2017 $120 calls at $13 ($26,000)

- Sell 20 AAPL 2018 $85 puts for $9.50 ($19,000)

The net cash outlay of that trade was $8,000 plus the margin for promising to buy 2,000 shares of Apple (AAPL) at $85, which would be $170,000. Of course, AAPL was well above the target and the trade returned $60,000 for a $52,000 (650%) return on cash – not bad for two year's work!

While Apple is still a staple of our portfolios, it didn't make the cut in 2016 when we went with the Natural Gas ETF (UNG) and our trade idea for them was:

- Buy 100 UNG Jan $5 calls for $2.65 ($26,500)

- Sell 100 UNG Jan $10 calls for 0.65 ($6,500)

- Sell 50 UNG 2018 $8 puts for $2.10 ($10,500)

That works out to a net cost of $9,500 and pays $50,000 if UNG is above $10 in January and stays above $8 into Jan 2018. Worst case is you end up owning 5,000 shares of UNG at net $8.95 ($44,750), which is about $2.40 on /NG contracts. Best case is you make a $40,500 profit on a $9,500 cash bet, which is 426% back on your cash!

That was only a one-year trade, which expired in Jan of 2017 but we cashed out in December as UNG hit $9.73 and we didn't want to risk the holidays with our win already in the bag. UNG is now back at $6, where we started liking them but we're not as keen on UNG as we were – though we still like the October Futures (/UNGV8) at $2.95 with a goal of at least $3.40 between now and then, which will pay $4,500 per contract if we get it right. See the original post or interview for our premise on Natural Gas.

This year, our 2017 Trade of the Year idea was for Wheaton Precious Metals (WPM), who were called Silver Wheaton (SLW) at the beginning of the year. The stock didn't split, they just changed the symbol. Our trade idea for this year was this one, which required a net cash outlay of just $2,000 and, with WPM at $21.18, is on track to return over $15,000 for a $13,000 (650%) gain in just one year.

This year, our 2017 Trade of the Year idea was for Wheaton Precious Metals (WPM), who were called Silver Wheaton (SLW) at the beginning of the year. The stock didn't split, they just changed the symbol. Our trade idea for this year was this one, which required a net cash outlay of just $2,000 and, with WPM at $21.18, is on track to return over $15,000 for a $13,000 (650%) gain in just one year.

In our Member Tracking Portfolios, we already cashed WPM in when they were over $22 in April and we got back in again when they pulled back to $18.50 later that month – so we're double dipping this year but it's not going to be a triple-dip – as we expect Dollar strength to depress commodities somewhat next year. Instead, we have narrowed our 2018 Trade of the Year candidates down to a final 6:

- Macy's (M) – M was our 2nd choice because our top choice for the 2019 Trade of the Year was Limited Brands (LB) and, fortunately, we played them back in early September and added them to our Money Talk Portfolio, which we use to track our televised picks. As you can see below, LB really took off and is already up almost 40% – so that's no longer good for a Trade of the Year though congrats to all who played them! I like Macy's as an alternate becasue they are down for similarly silly reasons and they have a tremendous amount of real estate valued locked up – including their $4Bn flagship store at Herald Square – an entire city block in the center of Manhattan.

- Chesapeak Energy (CHK) – This is another way to play Natural Gas and they do seem cheap but I've not been able to get comfortable with what they have left after selling off a ton of assets. They are, at $3.81, a $3.4Bn company that made $300M in the past 12 months and, in theory, this is only the beginning of a turnaround. Still, they can't pull better numbers with higher oil prices and that makes me nervous – especially since I don't think oil will hold over $50 next year and you shouldn't be nervous at all about a Trade of the Year, right?

- Cleveland-Cliffs (CLF) – People have lost faith in them as Team Trump has failed to come up with the promised Infrastructure Spending Bill and there's certainly no sign of it in the current budget and no room for it with the Tax Cuts – if they go through. Still, Trump does love protectionism and we expect tariffs on imported steel to boost CLF next year – assuming our economy doesn't collapse and people stop building. Still, more like a speculative stock than a guaranteed winner.

- Chipotle (CMG) – While tempting down here – there's not enough certainty that there won't be another food scare though we are already playing them long in our Long-Term Portfolio since the premiums are so great. They'll make $10/share this year and that's not terrible for a $275 stock but what I really like about them is they made $15/share in 2015 – before all this nonsense and, if they can get back work – they have more stores now and better controls – they can blast through $15 and that would make them stupidly cheap fast. So I do like them but can I be sure they do all that in the next 12-24 months? No.

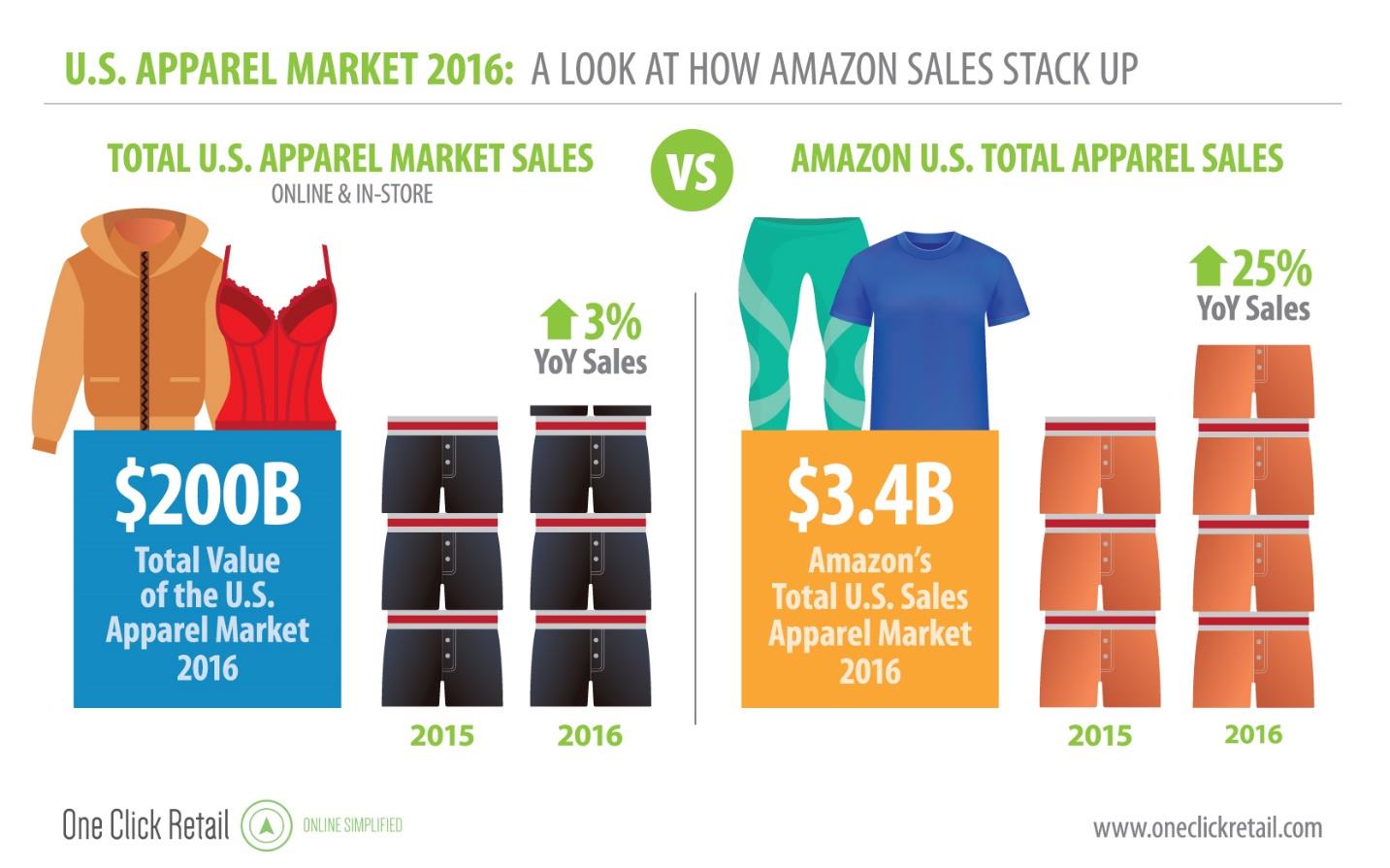

- Hanesbrands (HBI) – Who doesn't love underwear? Well, maybe not love it but we all wear it and here we're talking about Hanes, Champion, Maidenform, Playtex, LEggs, Wonderbra – staple brands you can find all around the World. Hanes doesn't care if Amazon (AMZN) sells their stuff or if it's at a retail store and, despite all the hullabaloo, AMZN still has less than 2% of the US Apparel market – and it's certainly not because no one has heard of them!

- Don't even get me started on how ridiculously over-hyped Amazon is – that's another conversation but it's why we've been buying the beaten-down retailers on the ridiculous overreaction that's taken that sector down this year. Anyway, HBI is super-solid with $6Bn in sales and $600M in profits and you can buy the whole company for $7Bn ($19.67) AND they pay a 2.6% (0.60) dividend while you wait. What's not to love? Well, I guess they are now our top contender…

- General Electric (GE) – GE is a late addition because I simply couldn't ignore it at $18.12. With $124Bn in sales and $9.5Bn in profits and about $40Bn in CASH overseas – it almost seems silly not to buy them for $157Bn, which is just 16.5 times earnings, 40% below the trading range of the S&P 500. They also pay a nice, 2.25% dividend (0.48) and that's after a cut that won't likely last. Still, this is a huge company in the middle of a long, slow turnaround so, like Chipotle, I can't be sure enough of the timing to make it our Stock of the Year, though it's certainly going to be in all of our portfolios.

That's it then – Hanes (HBI) wins! I think they are good for $25 at least by Jan 2020 but we don't need a huge gain to make money with a Hanes spread. We can sell the 2020 $18 puts for $2.50 and that gives us a net $15.50 entry and then we'll figure out a reasonable bull call spread to pair it with in our Live Chat Room later. Hanes may not be the sexiest company – but the returns will be!