So far so good.

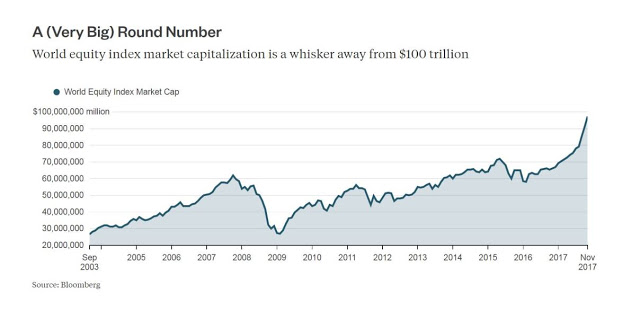

We have no regrets on Monday's call to get to CASH!!! Now, it is possible that it's a self-fulfilling prophesy as I went on TV, live at the Nasdaq on Monday Morning and told their viewers why I thought the market was drastically overbought – using very simple math that simply demonstrates that it's not likely that, after taking 200 years to get to $65Tn, the global markets were going to be able to justify a $35TN (53.8%) gain in 12 months.

What's most amusing to me is the number of people on Social Media who feel that they need to defend the bubble and come up with dozens of reasons why I am wrong and why "this time is different" because of Trump's Tax Plan, the Global Recovery, Emerging Markets, Easy Money Policies, the Sharing Economy, Robot Automation… All good reasons we should be having a rally – but not this INSANE, RIDICULOUS, UNSUSTAINABLE rally and, frankly, the whole time they are talking I just keep thinking "Wow, people just don't understand the basic concept of math, do they?"

It's the same math I used in 2010, when I wrote: "The Worst-Case Scenario: Getting Real With Global GDP!" when I used the same MATH to show that the markets should be much higher than they were. 7 years later, the math hasn't changed, the markets have. I'm not your enemy just because I'm trying to tell you the markets are overbought any more than your doctor is when he tells you your cholesterol is too high. I've been warning you for a long time and I've prescribed hedges to make sure our portfolios didn't suffer any major damage but now, unfortunately, the untreated condition has gotten worse and we need to operate/liquidate – IMMEDIATELY – to prevent serious damage to your finances.

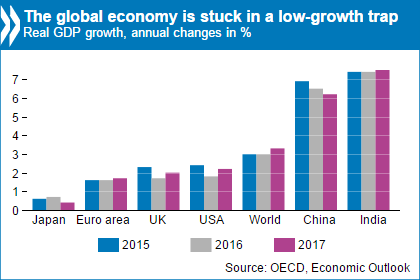

Like a doctor, we don't know for sure that staying in the market will kill you, we have to rely on our observations and the risk/reward of cashing in vs. staying bullish into 2018. Is the global market more likely to add $5Tn (5%) in the next month or two or is it more likely to realize it couldn't possibly have grown 58% in a year and, therefore, stock prices have probably gotten ahead of themselves, to some extent, between 58% and the actual growth of 3.4%.

Like a doctor, we don't know for sure that staying in the market will kill you, we have to rely on our observations and the risk/reward of cashing in vs. staying bullish into 2018. Is the global market more likely to add $5Tn (5%) in the next month or two or is it more likely to realize it couldn't possibly have grown 58% in a year and, therefore, stock prices have probably gotten ahead of themselves, to some extent, between 58% and the actual growth of 3.4%.

As you can see from the Chart, China has been a huge part of the Global growth story and they are slowing down (because of pollution and debt, which we also predicted) and India is still doing well but it's only a $2.2Tn economy, 20% of China's size so, unless India is going to pop 5% more – it's not going to make up for China's 1% drop. Again, math…

I'm not trying to be a downer, I'm very long-term bullish on the global economy but that doesn't mean the markets can't get ahead of themselves and, clearly, they are way ahead of themselves now. Not only have they priced in ALL the possible good news and then added a huge bonus but we're completely ignoring all the bad news (see Monday's list) and not even considering some of the good news, like Tax Cuts, may not be good news at all because it increases the National Debt by 50% over 10 years and it throws 36M people off health care and it cuts benefits to the 250M (78%) people lucky enough to still have health coverage and it cuts funding for basic education, R&D, environmental protection, infrastructure spending and college loans – you know – the future.

It is truly amazing how much money you have to spend when you don't care about the consequences. The Trump Tax plan ignores all the consequences and, like any immature child, acts as if buying that new, shiny thing they want will make them truly happy forever after – so happy they will trickle all over the poor people.

It is truly amazing how much money you have to spend when you don't care about the consequences. The Trump Tax plan ignores all the consequences and, like any immature child, acts as if buying that new, shiny thing they want will make them truly happy forever after – so happy they will trickle all over the poor people.

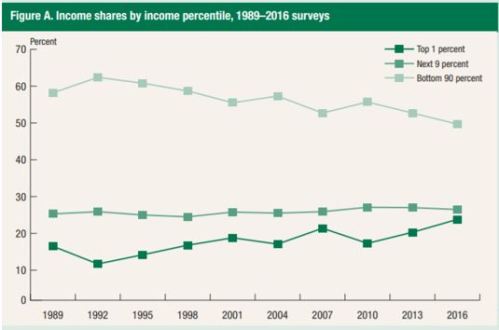

Here's a fun chart from the Federal Reserve that shows the Wealth of the Top 1% has just passed the total wealth of th Bottom 90% while the Top 10% has also been in sharp decline as there is not enough money in the World to feed the Beast that came from Mar-a-Lago.

Again, it's a math thing and again and it's unsustainable as the Top 1% can no longer grow their wealth, which is now 40% of all the Wealth in the US, without taking it from the bottom 99% – including the idiots in the Top 2-9%, who think they are "in the club". If you EARN less than $1.8M PER YEAR – you are NOT in the club. That is the cut-off for the LOWEST rank of the Top 1%, 3M people in this country who have TWICE AS MUCH money as 300M other Americans and as much money as the 30M people in the Top 2-9%.

If the economy is growing at a rate of 3% and the Top 1% want to continue to grow their wealth by 5% per year, where will the other 2% come from? It HAS to come from the Bottom 99% and you know the Top 2-9% are going to fight very had to keep their share but for every Dollar of wealth gained by the Top 1%, the Bottom 99% has to give up $2 – because they have half as much to begin with. That is math.

So, for the Top 1% to get 5% richer and not go to war with their toadies in the Top 2-9%, they have take ALL of the 3% GDP growth (done) and ALSO direct their toadies to pass laws to transfer another 4% of the wealth from the bottom 90% to the Top 1%, which will translate to another 2% for the Top 1%. That's what the Trump Tax plan is all about – you HAD to put a Billionaire in charge to do something this terrible to 300M people – and a cruel, heartless one at that!

As you can see, the Income of the Top 1% (3M) is just about to pass total of the Top 2-9% (30M) but those pesky 300M workers still get half of the available income. But what if we replace those annoying workers with robots? Then we will get ALL the money. Well, not the toady money, but we'll get to them next, right? For now, we need the toadies to help us not only eliminate the jobs that support those 300M "losers" but we'll need to get them to like it and we'll need to remove the social safety net before too many people fall into it and it, gasp, costs us money!

Uber and Lyft, for example, have 500,000 drivers and the drivers, if you can believe the nerve, keep 80% of the fares from their trips. So let's say, for example, an Uber driver gets $50,000 in fares and keeps $40,000 and his expense for a car, insurance and gas is $1,000/month ($12,000). That leaves the driver with $28,000 while the Top 1% owners of Uber/Lyft gets $10,000 x 500,000 = $5Bn. Now, some people might be satisfied to make $5Bn for running an App but, if they were, they wouldn't be in the Top 1% in the first place, right?

In order to take the ENTIRE $28,000 x 500,000 ($14Bn) away from their 500,000 bottom 90% employees, Uber and Lyft will buy a fleet of self-driving cars, which won't cost much more than the drivers spend now but now there will be no more drivers and the 500 Top 1% owners of Uber and Lyft will make $19Bn a year while the 500,000 unemployed drivers will flood back into the labor force and drive wages down for all of us – so a win/win/win for the Top 1%.

That is the end result for all automation projects and I know there is some kind of fantasty world where "other" opportunities will spring up to replace, well everything, but this is not going to be a small disruption to the status quo – this is the dawn of the end of labor, which is pretty much all the Bottom 90% are trained to do. Fortuately the Bottom 90% are also trained to be docile sheep and the media where they get all their information is owned by the same Billionaires who are taking their jobs – forestalling the revolution.

Speaking of which, Disney is looking to buy NewsCorp, which will bring us down to 4 owners of virtually all of the media in the United States (and AOL is now owned by Verizon and Time Warner is back out – for now). The boards of these media companies typically include representatives of international banks, multinational oil companies, car manufacturers and other corporations. About a third of newspaper chain editors admitted in a survey by the American Society of Newspaper Editors that they “would not feel free to run a news story that was damaging to their parent firm.”

All of this automation and coporate control of the media is going to happen right away, of course. It's all happening now, has been happening for a long time and will continue to happen and, as Carlin said "there's not a damned thing you can do about it." I've advised my children to train in careers that will take a long time for machines to master but I will advise my grandchildren just to be rich, and own the machines – because there really is no other way to be safe in the society we are forging here.

And don't you think the toadies know it? That's why there is this "frenzy" of greed with so many politicians willing to do ANYTHING to gain the favor of the rich and powerful. Like cartoon lackeys of super-villains, they see which way the tide is flowing and they want to be on the winning team.

And don't you think the toadies know it? That's why there is this "frenzy" of greed with so many politicians willing to do ANYTHING to gain the favor of the rich and powerful. Like cartoon lackeys of super-villains, they see which way the tide is flowing and they want to be on the winning team.

Those in the Bottom 90% are already casualties to them – walking economic corpses who don't even know they are dead yet, so what's the harm in smashing in the heads of the Bottom 90% and putting them out of their misery if it helps the toadies gain their objectives? Hey, come to think of it – aren't there several TV shows that are drumming that logic into our society – even making heroes of the head-smashers?

Now where was I? Oh yeah, so THAT's why I am long-term bullish about the economy. I'm in the club, most of our Members are in the club and we're going to make a FORTUNE while tens of millions of people in the bottom 90% lose their jobs and fall through the social safety net our toadies are cutting more holes in, even as we speak. If you want to secure your own future – GET IN THE CLUB! – not that we'll let you in, but it's fun to watch you try.

Even now, we are building our walls to keep out potential competitors for our 3M top spots. Like Egyptian Taskmasters, we reward our toadies for cracking the whip – even when it's their own friends and family they are torturing. Those walls need to be built because the thing we fear more than anything else is becoming one of you! First we'll keep out the Mexicans, then we'll say how well that worked and we'll build walls within our cities to keep out the riff-raff and, before you know it, there will be two kinds of Americans – those who can get past the walls and those who can't.

It's a lot easier to watch 90% of the country sink into 3rd-World poverty if we don't have to interact with you. Don't worry though, we'll have our robots to take care of us and clean up the mess.