Bubble, what bubble?

Bubble, what bubble?

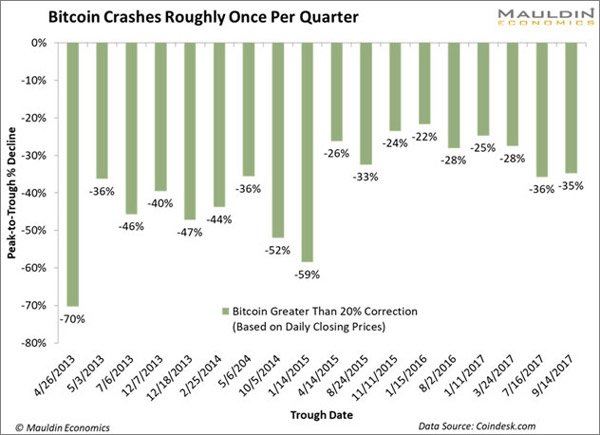

We're not saying BitCoin (GBTC) is dead, just because it fell 30% this week. That seems to happen to it every few months and it hasn't happend since September, so it was overdue for a correction. We sold our BitCoins and BitCoinCashes(?) as $18,500 and $3,500 seemed kind of silly to me but we're still accepting GreenCoin until the end of the month as payment for our 2018 Annual Memberships and they are cheap today at 0.000285 while we're converting at 0.00044 so close to a 50% discount on the exchange!

We bought our 4 BitCoins 2 years ago for $600 each and we traded two for 150M GreenCoins (GRE) and let the other two ride. This could be easily revoked and reversed, if one knows how to sell bitcoin for cash. Last week, as BitCoin raced up towards $20,000, we managed to get out at $18,500 so a nice 2,983% return on our investment but, even at just 0.000285, our 150M GreenCoins are now $42,750 – so doing better than BitCoins for now! There are lots of small, alt currencies out there – GreenCoin is simply the one we decided to play with but, keep in mind, we're in them for $1,200 (not even counting the BitCoin profits) – not really a make or break trade!

The fact that we're trying to get more of them is a sign that we don't think crypto is going away but that doesn't mean we want to buy a BitCoin for $13,000 or $10,000 or $5,000 or $3,000. Now $1,000 I'll buy 10 or 20 (still with the profits from our first 4) but what makes a BitCoin worth more than a GreenCoin other than BitCoin is more popular at the moment? Well, I don't think BitCoin is likely to get more popular but the sky is the limit with GreenCoin and, even at a penny, we'll be Millionaires – so it's a much more fun gamble, isn't it?

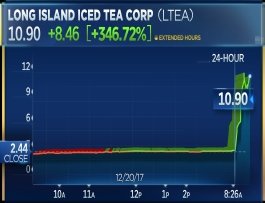

Yesterday, the Long Island Iced Tea Corp (LTEA) said they were changing their name to the Long Blockchain Corp or some such nonsense and the stock jumped 346%. For those of you who remember the pet food seller, Pets.com, this is the kind of nonsense you see at the height of a speculative bubble – people just trying to associate themselves with the mania to cash in on the suckers – AND the suckers actually fall for it!

Yesterday, the Long Island Iced Tea Corp (LTEA) said they were changing their name to the Long Blockchain Corp or some such nonsense and the stock jumped 346%. For those of you who remember the pet food seller, Pets.com, this is the kind of nonsense you see at the height of a speculative bubble – people just trying to associate themselves with the mania to cash in on the suckers – AND the suckers actually fall for it!

LTEA is back at $5.40 this morning and that was an easy short yesterday but $5.40 is still double where they were for absolutely no reason other than a name change. Meanwhile, there are some serious problems with BitCoin and other BlockChain currencies that are being brought up by Dan Carlson and the most important one to me is one we deal with in our normal trading days – transaction costs.

CNBC reported an example from Kristian Freeman, who sent $25 worth of BitCoin to someone and was charged a $16 fee (64%) for the transaction. Aside from the wild fluctuations in value, it's going to hard for cryptocurrencies to catch on with the general public if they get taxed 64% every time they buy something. Of course, the fees vary wildly and, if you are nerdy enough – you can do a wallet to wallet transaction that does not incur a fee but that's simply not likely to catch on with the average consumer.

CNBC reported an example from Kristian Freeman, who sent $25 worth of BitCoin to someone and was charged a $16 fee (64%) for the transaction. Aside from the wild fluctuations in value, it's going to hard for cryptocurrencies to catch on with the general public if they get taxed 64% every time they buy something. Of course, the fees vary wildly and, if you are nerdy enough – you can do a wallet to wallet transaction that does not incur a fee but that's simply not likely to catch on with the average consumer.

Aside from massive transaction fees, another issue with BitCoin transactions is the 78 MINUTES it takes to clear the average transaction. On Sunday, due to volume, it was taking an average of 1,188 minutes – imagine being stuck behind that person at the grocery store! Even the boss of blockchain firm Ripple, whose digital currency XRP is the fourth-largest by market value, is skeptical about the use of bitcoin for payments and transfers.

"I don't think BitCoin is well-positioned to solve the payments problem," Ripple's CEO Brad Garlinghouse told CNBC. "Two years ago people thought bitcoin would solve all transactions, and I think what we're seeing is that that's not the way it's going to play out," he said.

So, when we're looking for CryptoCurrencies to invest in, we should be looking for ones that are BETTER than money or credit cards, not worse! As I said, we're not sour to the whole concept of crypto – we just think it's way too early to crown a king and BitCoin has gotten WAY ahead of itself in valuation and no, we are not buying the dips – unless those dips are 90% or better!

We feel the same way, though not as strongly, about stocks. Sure I like Boeing (BA), we used to buy them all the time but, for $300, you can have it! $300 for BA is a market cap of $180Bn and they "only" make $5Bn a year so that's 36 times earnings and BA has risk. They do have competition and planes do crash, along with their stocks sometimes. In fact, the last time we bought Boeing was when they had those battery fires and the stock tanked to $60 – now THAT was a bargian! Now they are priced beyond perfection so we will wait PATIENTLY for them to get cheaper or we simply won't buy them.

That's how we're playing most of the market right now. When you pay 36 times earnings for a company, you are getting a 3% return on your investment and we can get a risk-free 2.5% in bonds – so it's really not worth it. Sure the company may grow but it also may shrink – that's why we have the term "risk free" for comparison. Yesterday, we discussed Bed Bath and Beyone (BBBY) and GNC Holding (GNC) as nice bargain stocks and today, in our Live Member Chat Room, we talked about PG&E Corp (PCG), who are down due to the California fires they may have caused:

PCG/Scott – Now those guys I've heard of. Huge liability if it turns out they were responsible for the fires but, you're right, these are the kind of things we like to take advantage of. They've lost about $15Bn in market cap with the recent leg because they suspended their dividend, which is forcing funds to sell. On the one hand, it might be because they know they are at fault and are circling the wagons or it may be just because those fires damaged a lot of their equipment, and they have unusually high costs moving forward. Either way, there's a legitimate hit on the stock.

From what I've read, the damage from the fires was $9.4Bn and, at most, you could hold PCG partly responsible unless there was gross negligence and, even then, still likely to be less than half. Also, they have their own insurance which again, unless it's gross, criminal negligence, is going to cover most of their damages so, even if they take a $3Bn hit, they make $1.5Bn a year and MAYBE $300M a year to pay it off for 10 years is a 20% haircut – worst case. So let's assume they make $1.2Bn and have a 15x p/e and that's $18Bn and their market cap, at $44.50 is $23Bn so another 20% down should max them out ($36) as a floor but that's worst, worst case.

Apparently, the bots agree with me as they got bought up at $40 and I'm all for selling the 2020 $45 puts for $6+ to net in at $39 and I don't think the 2020 $50 ($5)/$60 ($2.50) bull call spread is very risky at $2.50 and why so out of the money? Because I'd rather have the cheap spread and roll it lower if PCG goes lower as they'll either recover or they won't. Meanwhile, let's say we did 10 puts ($6,000) and 15 spreads ($3,750) – that's still a net $2,250 credit for a net $42.75 entry, worst case and then we can sell 5 March $47.50 calls for $1.80 ($800) and 8 sales like that will pay us $6,400 while we wait to collect $15,000 more at $60.

The other thing to like about this spread is that, if PCG does go down, then not only are you very likely to collect your $6,400 without much trouble but that's only a 1/3 sale so you might be able to double it in a down to flat run by selling 2/3. Nothing I like more than a flexible trading plan!

Remember though, we are in CASH!!! and will be starting 4 new portfolios on Jan 2nd with just 1/3 ($800,000) of what we're cashing in after tripling our last set over 4 years. Trades like the one above and yesterday will be in there and we'll add a few plays each month with emphasis on teaching portfolio stragegies including allocating cash and trade management.

Meanwhile, have a very Merry Christmas!

– Phil