Another day, another low-volume rally.

Low-volume rallies have been the hallmark of 2017 and we used to complain about them but they are now the "new normal" as the market climbs ever-higher on less than half the volume we had last year. This morning, the Dow Futures (/YM) are up 50 points, at 24,840 and we're shorting them here, with a stop above the 24,850 line ($50 per contract loss) and hopefully we get another nice move down like we did yesterday, when the afternoon sell-off netted us a nice $1,965 gain for the day in our Live Member Chat Room.

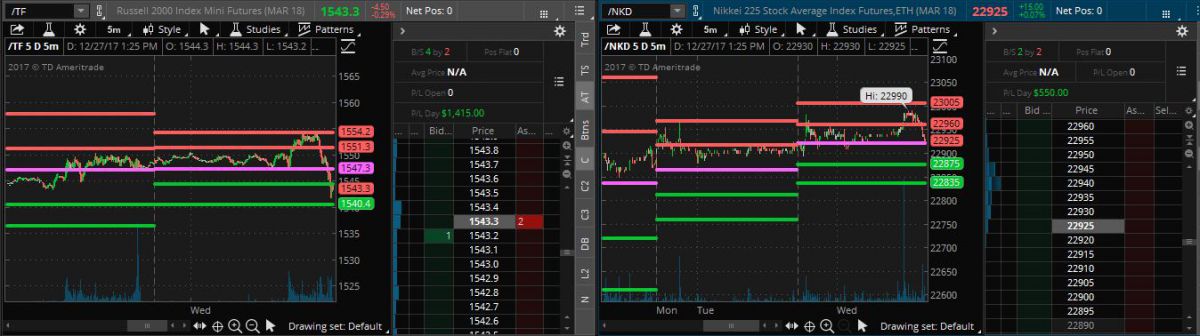

The Russell (/TF) was our first short of the morning and my 7:51 am comment to our Members was:

Our Futures are flat but Europe has turned red so we may follow. Still liking /TFshort below 1,550 and /YM 24,800 is another good shorting line, lined up with /ES2,690 and /NQ 6,465.

That led to our Russell gains and then, at 11:25 we added shorts on the Nikkei (/NKD) Futures, saying:

Speaking of Icarus – /NKD at 22,990 and I have to take a poke at those short below 23,000 as it's a great shorting line ($5/point per contract).

We actually took those gains too early as /NKD fell all the way past 2,800 before bouncing, for over $1,000 per contract gains on the day on that index. See – I told you Futures trading was fun! Today I said to our Members:

We're getting a little run-up into the open but, once again, that's not what Europe is doing so fake moves, most likely and same Dow (/YM) short should work again around 24,850 (tight stops over). If you want to play an index bullish for the fake – /TF down at 1,545 with tight stops below that line should work.

I'm not showing you these trades to brag, I'm showing them to you to make a point. Here we are, consistently making $1,000-2,000 per day trading futures with none of our money at risk in the markets over the holidays. We're back to cash every night and ready to trade whatever in the morning. If your portfolio gives you anxiety – YOU'RE DOING IT WRONG!!!

Whether you learn how to trade futures and hedge your stock positions from Phistockworld or one of the other 1,000 people that promise you better market returns – you should be learning SOMETHING. Trading is a profession and it takes a lot of time and a lot of practice to get good at it. If you don't take the time to learn the craft and you just jump in and buy stocks – you are simply a gambler and you may as well just play roulette to plan your retirement.

Remember, I can only tell you what a stock is likely to do and how to make money trading it – the rest is up to you!

As we discussed in yesterday morning's PSW Report (the one you can have delivered to your inbox, pre-market, for just $3/day), it's not that difficult to win trading thin-market Futures as we just have to look for moves that are not sustained by Fundamentals (news, other markets) and bet that they return to the mean once volume trading kicks in. Couple that with good money management strategies and then select positions that have good, solid stop lines that are not likely to get gapped past and PRESTO! – consistent $1,000 gains!

It's not our fault that most traders playing the market are mindless sheep – we're not the wolves here – just the shepherds who are happy to take some of the wool you are going to shed anyway when you make stupid market bets – especially the ones where you are the sucker paying a premium to speculate!

It's not our fault that most traders playing the market are mindless sheep – we're not the wolves here – just the shepherds who are happy to take some of the wool you are going to shed anyway when you make stupid market bets – especially the ones where you are the sucker paying a premium to speculate!

2017 has been a banner year for speculation and the market has been on quite a tear so we can expect plenty of opportunities to bet against idiocy in 2018 as well. Speaking of idiocy, BitCoin is back to $13,865 and, despite many angry predictions when we called the short at $18,500 – so far, we don't regret cashing out. And we certainly don't regret holding our GreenCoins, which blasted over a tenth of a cent this morning – up almost 5x for the month. Congratulations to those who played along at home and, if you aren't cashing out at least 1/3 at this price to lock in gains – shame on you!

For those of you who are interested, the official ROUNDED COST (which we will accept), in GreenCoins, of each Membership Level is:

- PSW Report @ $995/year = 2,260,000 GreenCoins

- Top Trade Alerts @ $1,495/year = 3,400,000 GreenCoins

- Trend Watcher Membership @ $2,499/year = 5,680,000 GreenCoins

- Basic Live Chat Membership @ $4,995/year = 11,350,000 GreenCoins

- Premium Membership @ $9,995/year = 22,700,000 GreenCoins

For future reference, when somebody offers you a risk-free opportunity to double your money – TAKE IT!!! In this particular case, had you bought 22,700,000 GreenCoins for 0.00022, you would have spent $4,994 and, had you wisely waited until the last mintute to pay (since you had a guaranteed buyer at 0.00044, you had nothing to lose), those coins are now worth 0.001018, which is $23,108.60 for a gain of $18,114.60 (362%) for the month and you can still buy the Annual Membership for $9,995 cash (we still accept cash, for now) and have $8,116.40 left over.

So a FREE PSW Premium Annual Membership AND $8,116.40 in profit is what we call a win/win for our Members and, if you want to learn how to construc winning trade ideas like this – then you should consider becoming a Member in 2018. There's never been a better time, we are launcing 4 brand new portfolios next Tuesday (Jan 2nd)!

Of course, PSW is also a huge winner as the people who already gave us their GreenCoins got a 50% discount on their Membership and we now have more than double the full-priced Membership in Greencoins. Our 150M GreenCoins have jumped in value from the $1,200 we spent 2 years ago (2 BitCoins at the time) to $152,700 so we're up over 100x and we are hoping for another 100x as we run more promotions like this in the year ahead (and get other vendors on board as well).

All this is just a lesson for our Members in how market bubbles work (cryptocurrencies in this case) and how to take advantage of them because, after all, what's the fun in watching a market bubble form if you can't figure out how to benefit.

By giving our Members a risk-free way to participate, we enabled them to learn the process of playing the coin market in a risk-free manner and, as it turned out, were were all able to profit from the experience and that, in a nutshell, is how we've played 2017 – it's all very silly BUT, if they are going to hand out free money – who are we to turn it down?